The structured products industry has pushed through 2025 with resilience and optimism despite unprecedented global economic uncertainty. SRP and LPA’s comprehensive sentiment survey, reveals an industry not only weathering volatility but often thriving because of it.

Chapter 1, Sentiment, captures the industry’s enduring confidence and agility as it turns uncertainty into opportunity.

Optimism in the face of uncertainty

It will come as no surprise to learn that sentiment in the global structured products market remained high in the face of this year's unprecedented market uncertainty.

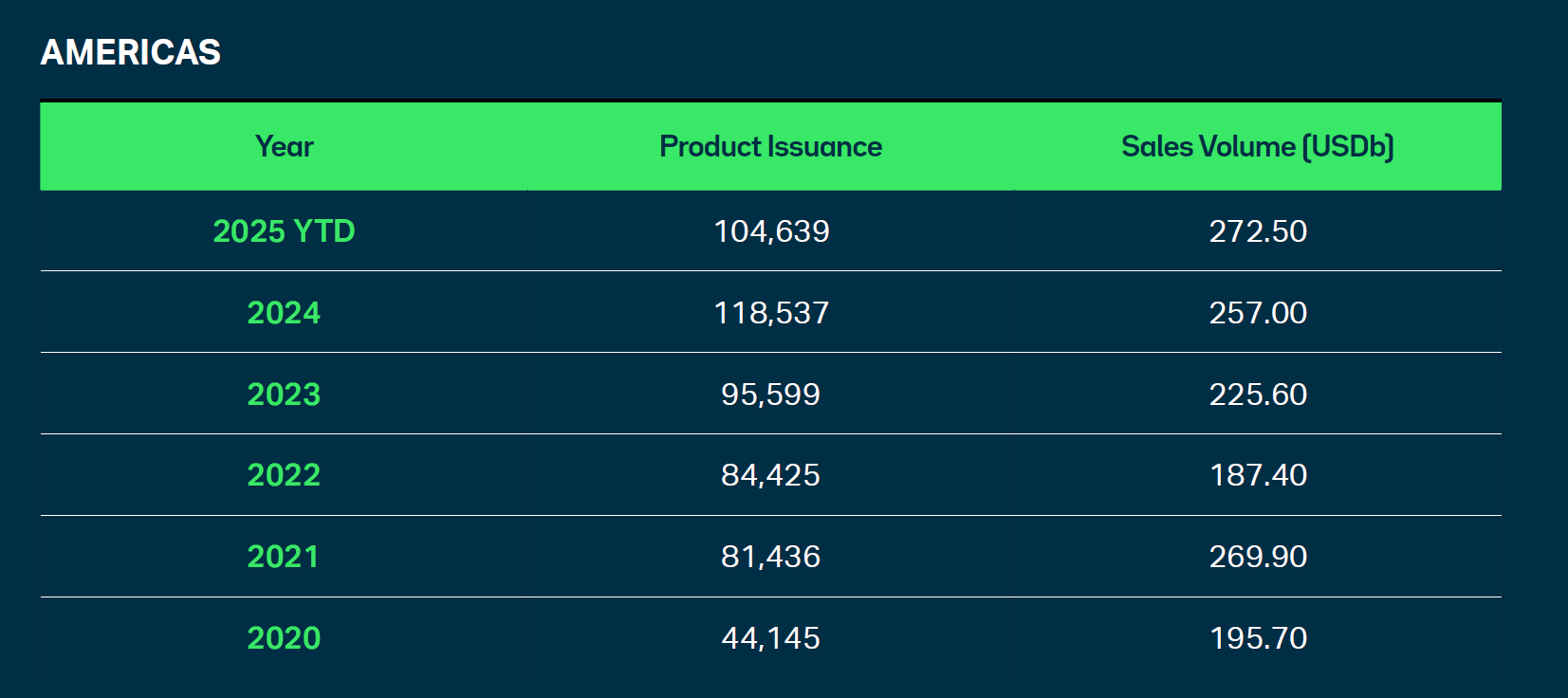

Global issuance and volume have climbed for the past five years. The only region in which annual volume contracted over that period was APAC in 2021-2022 (-13%) and 2022-23 (-7.4%), though the Americas had a flat 2021-2022 (up 0.8% in volume terms). The charts below show the regional differences in fortunes and demonstrate in particular the steady growth pattern of the more mature European markets. (YTD: July 2025)

The snapshots were taken at the beginning of August 2025, making it difficult to project full-year figures with complete accuracy. However, SRP’s current forecasts are for increased issuance and volume year-on-year in 2025. The US and Canada are likely to grow, probably by at least 5-10%, with US volume likely finishing around US$200bn and Mexico also slightly up.

For Europe, annual rises appear locked in, in France, Germany, Italy and Switzerland.

Increasing notionals and product issuance are also expected in APAC, primarily driven by Hong Kong SAR, China and South Korea. Product issuance in China and Hong Kong SAR almost doubled in 2025 from 2024 figures. Taiwan has seen 25% issuance growth in the last quarter and around 20% year on year-to-date. There are no significant changes in other APAC countries other than Thailand, which has seen a reported 50% decline in issuance.

Anecdotally too, market sentiment appears not to have been unduly rattled by the market and economic challenges around US tariff uncertainty. Structured products’ secular developmental thrust, the ability to create offerings to suit all market circumstances, and the increasingly rapid speed of deployment, instead 'trumped' the market jitters of the second quarter.

Market drivers, industry response

The end of the ultra-low interest rate era allowed for the pricing of principal-protected notes with enticing upside once again. Higher bond yields renewed interest in fixed income-linked notes more broadly. Underlying equity markets post-Covid had been delivering healthy returns.

The US global tariffs announcement at the start of April, however, triggered an immediate equity market sell-off, with volatility measured by the VIX index increasing by 40%, as reported by MSCI1. Derivative market volume surged. On 4 April, US exchanges experienced a record-setting day, with over 100 million equity and index option contracts traded. Both put and call option volumes on US exchanges peaked, reaching unprecedented levels of over 52 million and 48 million trades, respectively.

Unfortunately, we have no estimate of the proportion representing re-hedging by structured product issuers, though SRP market analysis as well as industry commentary suggests a far more sanguine experience than in the 2018 'Volmageddon' rout.2

SRP analysis also shows that only 72 S&P-linked products issued in 2024 or Q1 2025 breached their defensive barriers, while only 196 of 786 S&P-linked autocalls missed eligible autocall dates.

Issuers also responded to the new geopolitical and market reality by adjusting their investment propositions. In the US, for example, J.P. Morgan advised investors to consider investing in equity-linked notes with a downside buffer, enhanced income, "and even still some upside exposure."3 On 11 April, the US investment bank confirmed it had seen "interest" in equity-linked notes, explaining: "Right now, investors can potentially generate coupons of over 10% if equity markets are higher over the next 54 weeks, while potentially maintaining full principal protection down to a barrier 10% below current levels."

Optimism of the will

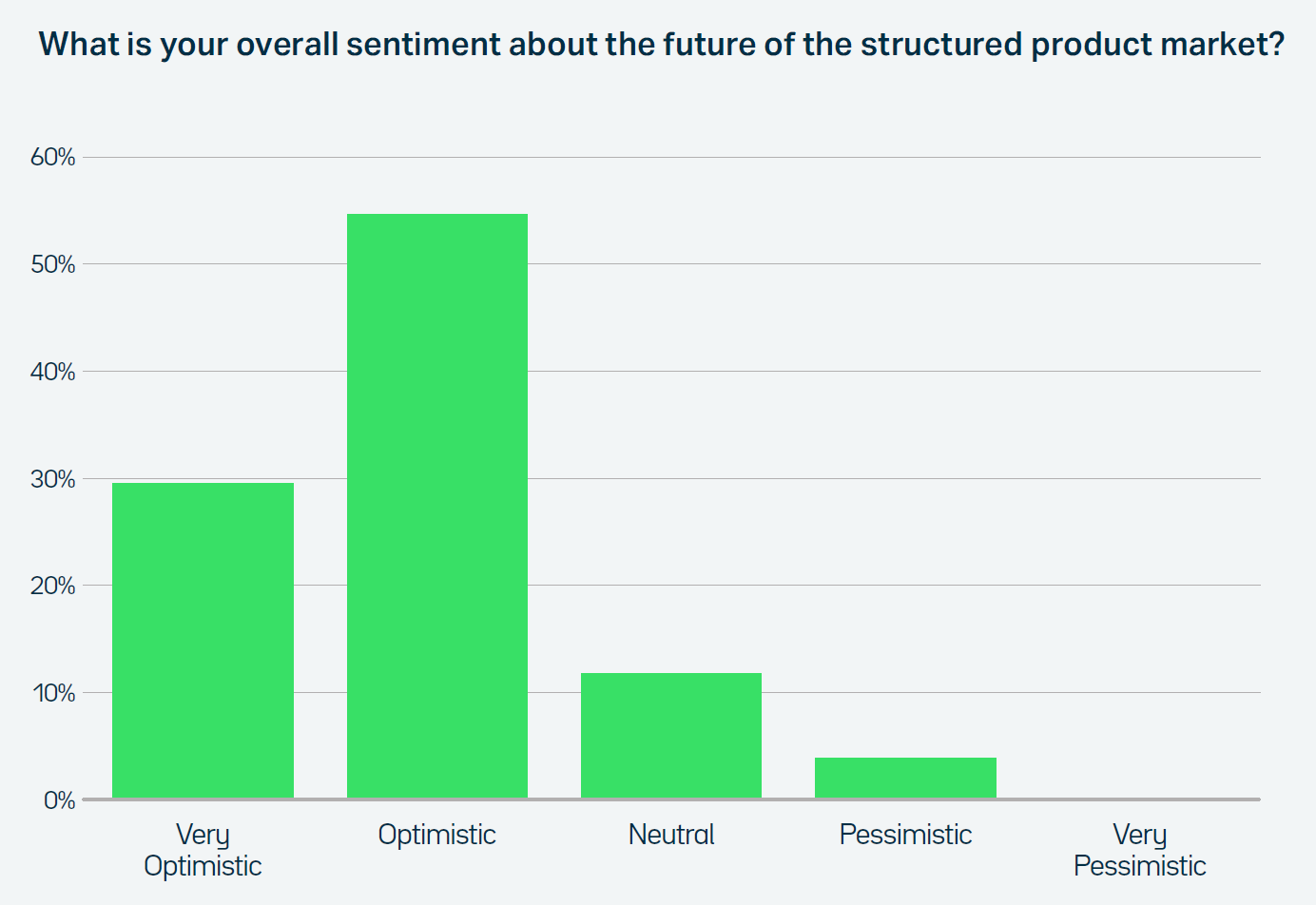

The sentiment section of the SRP survey reflects this adaptability. When asked 'What is your overall sentiment about the future of the structured product market?' 55% of respondents considered themselves 'optimistic', while 30% are 'very optimistic'. No respondents ticked the 'very pessimistic' box, while only 4% of respondents registered as 'pessimistic' and 12% as neutral.

This was reflected in our interviews, where only one market participant expressed a neutral outlook, and the rest expressed varying degrees of enthusiasm.

Elias Milan, Paris-based Global Head of Structured Products E-Business and Head of Business Management Office for Equity Non-Linear Trading Activities oversees global digitalisation of structured products at Société Générale. Milan broke down the opportunities by region, suggesting that "In Europe's mature markets, such as France, growth segments include a rising appetite from direct retail clients for equity-linked and capital-protected products.”

The US, which has grown significantly since 2021, he characterised as having "substantial potential for further expansion," while in Asia he said he sees “prominent opportunities in China, and structured products to continue to attract investors in Japan."

Market dynamics

The US equity market – and the global equity indices dominated by that market – has been characterised by optimism giving way to caution, giving way to optimism again, creating a start-stop rotation effect. Returns for the S&P 500 came in at 10.5% for the second quarter, with early April losses erased just a month later, in dollar terms.

In its third quarter equity market outlook, analysts at Blackrock noted that while tariff negotiations – and equity market volatility – continue, markets have likely "anticipated, realised and digested the greatest pains on this front, as the outer bounds of negotiation have been set."4 'Liberation Day' worries have not yet led to a global trade war. "Other US policy priorities, such as corporate tax reform and deregulation in industries such as tech and financials, could be positive catalysts for US stocks should the Trump administration and investors focus their attention here," said the firm.

Rather than reacting to each data point in isolation, investors appear to be increasingly focused on the broader trajectory of macroeconomic and policy developments, according to Blackrock: "Our gauge of investor risk tolerance revealed a rebound beginning in May, eventually returning to levels seen in February. This resurgence in sentiment may reflect growing confidence in the evolving policy environment ― potentially laying the groundwork for continued investor enthusiasm."

That said, the possibility of 21st century mercantilist policies creating serious economic downsides that impact equities remains present for many investors, suggesting continuous demand for partially defensive structures.

Benoît Bélanger, Managing Director and Head of Structured Products at Desjardins Investments in Canada, told SRP the short-term stock market falls linked to US tariff uncertainty served as a useful reminder to investors that there is downside risk in equities.

"What happened earlier this year, with the increased volatility related to what was happening in the US, that did create some awareness of what could happen in bad times in the market, because everything was positive before that," he said. "When this happened, people were looking for more protection. People who were investing without any protection started to value the protection that structured notes can bring to their portfolios."

"I think what we're seeing is that the products are working as they were designed to, and a lot of that uncertainty that was in the market around March, April time bled out,"

added Christopher Loudon, Head of Structured Product Origination at advisor Raymond James in New York.

Rates and regions

Equity market ups and downs aside, the fundamental generational shift on the rates side – or, rather, the return to the pre-global financial crisis normal – is obviously a primary driver for the structured notes industry. "This has made a huge difference compared to a year ago," said Desjardins’ Bélanger. "There has been a significant shift from fixed-rate certificates of deposit to market-linked certificates of deposit in our own network. This is something that is positive for us."

Steven Graham, a Partner at London-based Mariana Investments, a UK provider of structured products, added: "From a pricing perspective, we've enjoyed a period of relatively high interest rates, which we haven't always seen. I think that has opened the door to cash-equivalent products – structured capital-protected products and deposit products."

Those higher interest rates now look likely to fall in the US, while rates in continental Europe have already fallen substantially from their post-Covid peak.

In Asia, meanwhile, the industry is poised to benefit from investors' habitual 'risk-on' appetites and the region's burgeoning wealth: "Asia-Pacific is a region of significant wealth in the retail and private banking space, and it's a region with risk appetite, so we expect to continue seeing increased demand. As such, I would expect positive issuance in the future," said Pedro Moura, Head of Asia Client Solutions at Schroders in Singapore.

"Due to ongoing uncertainty, people are less willing to take fully delta-one views, and I think the ability that derivatives offer them to change the range of outcomes is something which is appreciated."

Customisation and evolution

The ability of structured product providers to quickly respond to changes in outlook has become an important element of market development. For example, product providers were able to respond quickly and efficiently to this year's rotation away from richly priced US equities into better-value European stocks on the back of a belief that the era of US exceptionalism has ended.

There is also a trend of better serving individual as opposed to macro-level sentiment. Take, for example, Arta Finance. The digital wealth management platform dual-headquartered in Singapore and the San Francisco Bay Area aims to democratise access to sophisticated investment strategies traditionally available to ultra-high-net-worth individuals. Matt Linker, Arta's Head of Derivatives (including structured products), said more personalised approaches are becoming more popular.

"The overarching theme is increasing demand for customisation, for tweaks on an individual client level compared to the historical model which is much more a one-size-fits-all, off-the-rack approach," he said.

Linker added that in Asia there has long been demand for equity-linked notes, fixed coupon notes, and other types of standardised structures, but with personalised, stipulated pricing factors. "The banks and issuers have been pretty good about supporting that as long as you colour within their lines," he said. "But as soon as anyone tries to do something a little bit out of what they're used to, then it's very hard for them to support it because the flow is built so heavily around, for example, five different structures with 10 different dials you can tweak. Anything outside of those structures and dials, it's next to impossible."

In the US, by contrast, Linker is now seeing more customisation at the structure level. "Instead of, 'I want an autocall with this barrier or that barrier,' which is a little bit more the Asia style, in the US, it's more, 'I want a unique feature because I have a unique problem and I am using a structured product to solve that unique problem in my portfolio'."

The result is that instead of clients putting US$500,000 into one note, "they will put US$50,000 into 10."

This customisation, as well as the need for speed and the technological change that enables it, will be explored more fully in the following section on the past and future drivers of innovation.

Want more insights? Access the full report here.