The structured products industry has pushed through 2025 with resilience and optimism despite unprecedented global economic uncertainty. SRP and LPA’s comprehensive sentiment survey, reveals an industry not only weathering volatility but often thriving because of it.

Chapter 2, Innovation Drivers & Recent Evolution, captures the industry’s technology and product innovation shaping the industry.

TECHNOLOGY

As Canadian-American science fiction writer William Gibson famously said, "The future is already here – it's just not evenly distributed." If the innovations of the past five years are instructive, the future for the structured products industry is AI, further ‘platformification’, ever faster speeds of execution, data and its sharing, and end-to-end automation. In other words: technology.

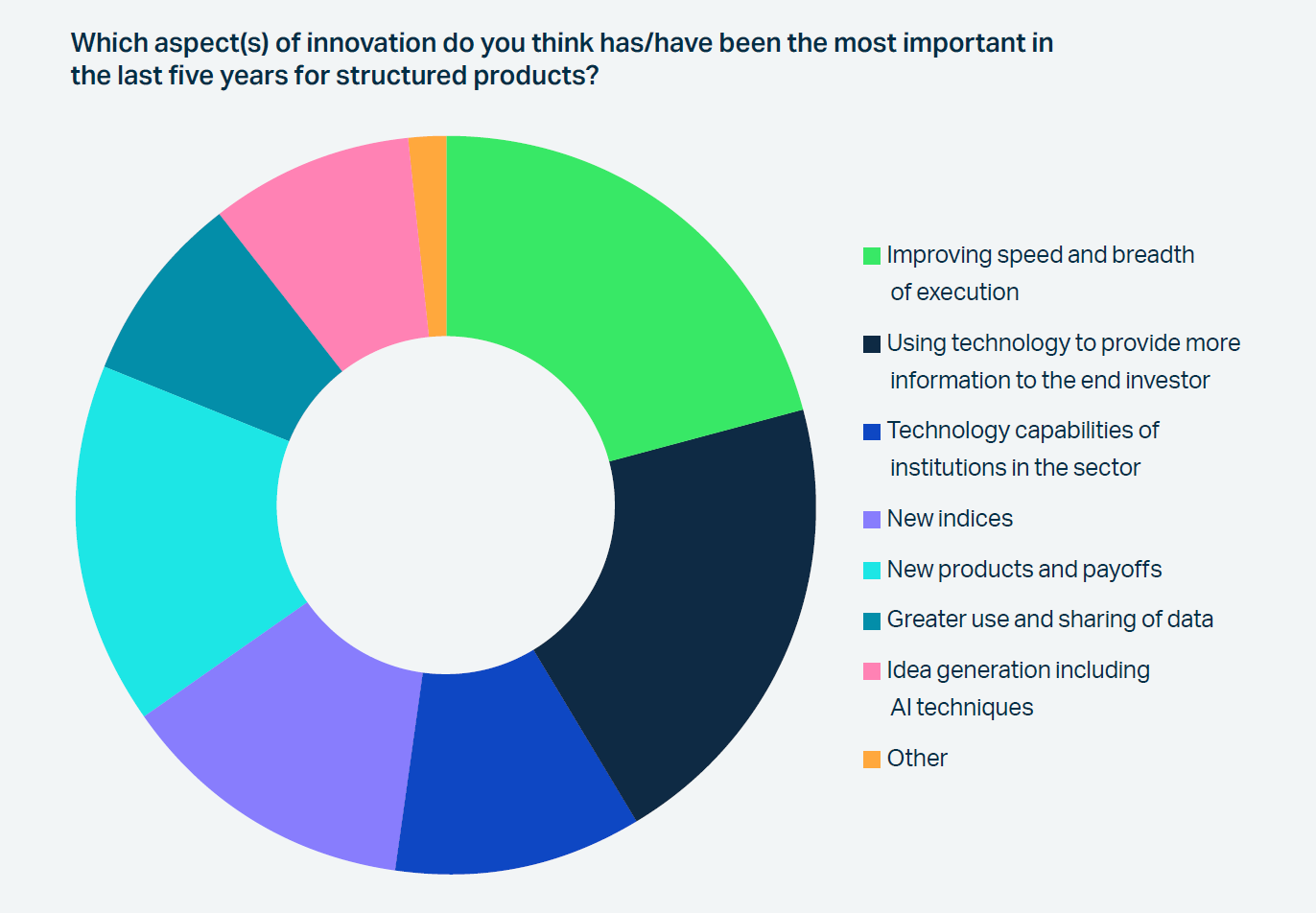

Asked which aspects of innovation they considered the most important of the past five years, a majority of our respondents answered 'technology', or implied it where they didn't say so directly. All told, technology-linked issues were mentioned as innovation drivers more than twice as often as product development.

Technology to improve speed and breadth of execution, and technology to provide more information to end investors were each mentioned by just over half of respondents (56.2% and 54.7%) as having driven innovation in the last five years, while 29.1% stressed the technology capabilities of individual firms.

Interview respondents stressed end-to-end automation, lifecycle management, accurate online pricing, multi-issuer platforms, technology integration, AI, and data gathering, use and delivery.

Technology has emerged as an especially critical innovation driver in the flow segment of the market. Here, as executives such as Société Générale’s Elias Milan pointed out: "IT and digitalisation play a major role, primarily because they significantly reduce operational costs and enhance scalability."

The pressure for speed can also be extreme in this section of the market. Anouch Wilhelms, the executive director spearheading the development of German retail flow business at Leonteq, expressed the urgency: "Currently, time to market is up to 10 minutes and even that is too long!"

What may be ‘too long’ now nonetheless represents a dramatic transformation since the financial crisis of 2008. Nikolaus Barth, head of Equity & Brokerage Sales for Central & Northern Europe at HypoVereinsbank (UniCredit, Germany), noted that it took more than five days to issue a product when he joined UniCredit 15 years ago. Now it takes "about five minutes" from typing the idea into the system to full public offer.

Barth is among the just over 11% of survey respondents taking ‘a few minutes’ to launch a product.

Volume growth has forced the pace of change. Arta Finance’s Linker, describing his firm as 'very tech-first', reported:

"We did more trades in January 2025 alone than we did in the entire period of October 2023 through December 2024... With the right kind of trades we can go from client request to auction to awarding the trade fully booked with less than five minutes of total human work."

Bear in mind, however, that current delivery speed is heavily linked to market segment, product innovation and firm-level factors, so that despite speed being important to over half of respondents, the majority still take a few days or a few weeks (25.7% each), or a few months (23.5%) to issue a product.

Integration, the new imperative

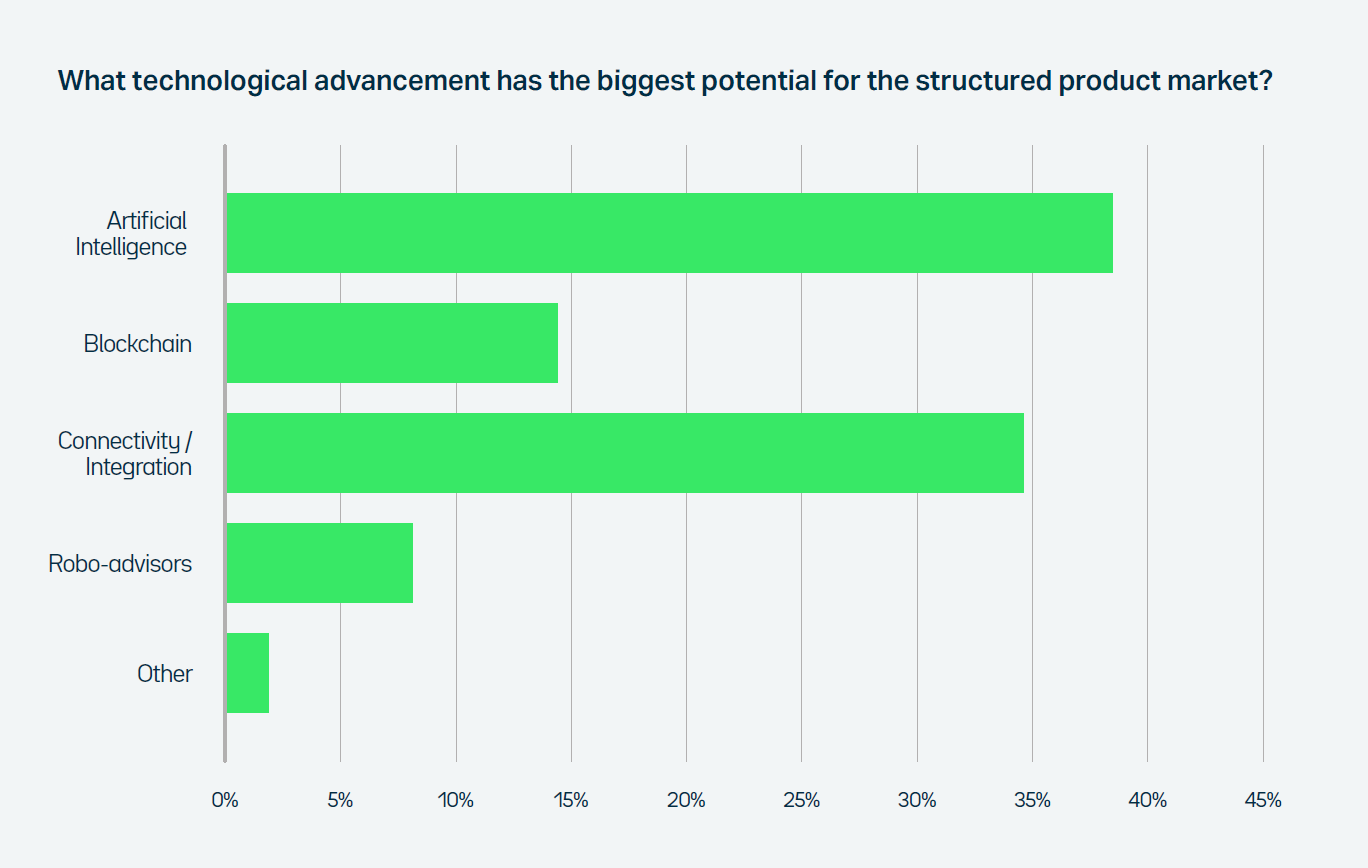

Over a third (35.5%) of respondents identified connectivity/integration as the technological advancement with the biggest future potential.

As UniCredit’s Barth explained: "Issuing a product is nice, and it's good to have this product ready in five minutes. But it's much more important that in the entire value chain, you are integrated digitally." This integration enables order flow providers to buy products through integrated, "systems, data hubs... to meet regulatory requirements" and "send documents to the right connection, smoothly and in a regulatory compliant way."

One Singapore-based banker emphasised this sense of holism: "The technology involved end to end... There are more and more platforms automating different parts and making the whole process more structured and systematic and faster. Any part not automated could be the bottleneck."

Multi-issuer platforms have also emerged as a key development. Victoria Garcia-Rubiales, BBVA’s Head of Investment Solutions Sales for the US and LatAm, noted that they "help clients access prices from different issuers in a more automated way and also manage the post trade... [helping] increase the volume that can be done."

Regional divides

But technology adoption varies significantly by region. Garcia-Rubiales observed, "Asia is leap years ahead of the US. Europe is kind of in the middle... and the US is slowly moving in that direction."

Arta’s Linker confirmed this disparity: "In Asia...most of the trades are entirely automated, end-to-end. Our API faces their API, or we click a button on one of their websites." By contrast, some US dealers "don't have client-facing e-mail pricers at all."

This fragmentation has pricing implications. Linker reported instances where, "We'll get the same structure quoted by the US, London or Paris, and Asia desks and we'll get three completely different prices."

AI: the revolution begins

Almost two fifths (39.4%) of respondents identified AI as the single most important future technology, though the structured products industry is still in the relatively early stages of AI integration.

Current applications are often modest and practical, in marketing and sales training, for example. Deniz Saygili, who works in complex index management for index provider Solactive, expressed a typical use case – to "distil information in some large language model quickly and efficiently," from lengthy public documents.

However, expectations for transformative change are substantial. Bruno Giannecchini, Head of Structuring for Retail Products at XP Investimentos (Brazil's biggest player in structured notes with about 30% of the market), admitted: "We still don't know the full potential of AI coming to this market."

UniCredit’s Barth, however, revealed they are "already starting to use AI" for data-driven issuance, analysing data to identify the right underlying assets in mass market products.

Lior Abehassera, an equity derivatives investment banker turned fintech entrepreneur, who works on multi-asset solutions at alternatives-oriented independent investment boutique Lynceus Partners, envisions a future where clients interact with AI-powered pricing systems: "Tomorrow, investors will use a chat box online and ask, 'I'm looking for a coupon of X% p.a. in GBP; my appetite for risk is Y over Z years, and I'm bullish on US financials and semiconductors. What product ideas do you suggest?’ The AI financial engineering agent will then think for a few seconds, check pricings directly with issuers' online pricers and revert with some proposals in writing, but also generate in your favourite language some marketing materials such as factsheets, full regulatory-friendly brochures, and bespoke explanatory videos. The ultimate SRP killer app!" he said.

Data as competitive advantage

Data is an increasingly valuable USP for index providers and product issuers alike. Data-driven issuance is ‘huge’, as Solactive’s Saygili noted.

Here too, AI is making its mark, with providers starting to offer products on indices with built-in AI features that anticipate market moves from market data or even market sentiments inferred from social media.

Early days for the blockchain

Despite Société Générale becoming the first issuer to launch a public blockchain-enabled product four years ago,1 adoption and future expectations remain limited. Only 14.8% of respondents viewed blockchain as the most important future technology.

Nonetheless, some participants see significant potential. Schroders’ Moura said he finds tokenisation "particularly interesting," explaining it could "impact traditional investment ideas... that were only available to more complex and institutional investors and allow [them] to open up and change the rules of the game."

PRODUCT INNOVATION

Geography matters

Nearly 43% of respondents highlighted new products and payoffs as two of the most important innovations of the past five years, with new indices mentioned by 34.5%.

However, attitudes to product innovation vary markedly by geography and market segment, reflecting different levels of market maturity and client preferences.

In some markets the ‘innovation’ is a return to simpler offerings. Schroders’ Moura noted of his APAC beat:

"This is a bit of a departure from ten years ago... when you had Himalayas, Condors or Rainbows; we're now seeing demand for simpler and more transparent structures."

Linker also reflected on APAC’s preference for established structures: "Demand leans very heavily towards one, two, three, maybe four structures. You see FCNs [fixed coupon notes] or ELNs [equity-linked notes] really dominating." Customisation tends to happen within these familiar formats: "The interest comes from the client saying, 'I want it on this exact asset with these exact strike dates, but I still just want an FCN like everyone else'," he said.

The European market tends to focus more on efficiency, time to market and cost, while in the US markets there is more of an emphasis on product customisation, intellectual property and research, at least for sections of the market.

Linker illustrated: "We can say, 'Here is some wacky structure that half the issuers are going to pass on because they don't like it when they look at it'. But the ones who are able to price it see some compelling market opportunity."

Flow vs. custom

In flow markets, product innovation is trumped by speed of execution, reflecting fundamental differences in business model: volume and efficiency, versus innovation as differentiator.

As Leonteq’s Wilhelms stated bluntly of the German flow market, "Innovation is not the most important one anymore: today, standard payouts on 10 to 15 important underlyings represent a big proportion of the market... I think the last big innovation in Germany dates back from 2009."

By contrast, Arta’s Linker noted that customisation in the US market often centres around a new structure, and at sizes as small as US$750k for a first iteration. The source of that customised demand is, "partially mediated by advisors, or by us, who need to identify what that problem is."

Underlyings

The 34.5% of respondents highlighting new indices as important innovations reflect the recognition, particularly in sections of the market, that the choice of underlying drives differentiation.

But here too, the line between technology and product innovation is increasingly blurred. Barth revealed:

"Especially in the mass market, we are using technology to find the right underlying. We analyse a lot of data and try to be ahead of the curve. Data-driven issuance is huge for us."

Index providers are responding in kind, increasingly focusing on intellectual property and proprietary data, so that there are now over three million indices globally.2 Benchmarks have mushroomed over the last two decades, driven by the emergence of ETFs and the general increase in passive investing amid fee pressures and concerns about active manager performance.

In structured products, index customisation can answer pricing challenges as well as specific investor interests and goals. For example, the rise of decrement indices has provided new opportunities for product innovation, even in markets heavily focused on a single benchmark, offering ways to pass on the benefits of pricing environments to investors through synthetic index construction, as Mariana Investments’ Graham noted.3 Graham has also worked with advisors on other synthetic alternatives to FTSE, including synthetic equally-weighted FTSE indices.

Products, wrappers and portfolios

Significant innovation is occurring at the wrapper and portfolio level, creating a potential paradigm shift in how structured products reach end investors.

We discussed the early stages of tokenisation, the digital representation of asset ownership, in the technology section above, but it could equally have been included here, as possibly the biggest product innovation of the last century.

Less trailblazing, but also significant, are the individual developments of separately managed accounts (SMAs), actively-managed certificates (AMCs), and fund structures.

Separately managed accounts

Christopher Loudon is responsible for cross-asset origination of structured notes at St. Petersburg, Florida-headquartered wealth manager Raymond James. He manages a team with over US$7bn in annual sales. Loudon believes SMAs will "drive the broader market" in the US, making "the business a lot more efficient for advisors." Separately managed accounts are increasingly targeted toward wealthier investors with six-figure plus portfolios, offering the potential to scale structured product adoption significantly.

One North American financial services distributer said they are building SMAs specifically for the 80% of advisors who historically focused on insurance and, "like the story of structured products, but not the hands-on approach required to manage a structured note book."

This ambition has scale: "We're trying to be more innovative at the programme level... exploring the SMA route and how can we incorporate an SMA into a UMA type of account, which is where most of our AUM is sitting right now."

They continued: "Once we can get the SMA right, it could potentially help us take the business from a few hundred million a year to multiple billions of dollars a year."

Funds and ETFs

The emergence of structured ETFs and other funds represents another path to innovation, albeit with a mixed reception so far.

Our North American distributor said: "I think the industry as a whole is really trying to innovate at the wrapper level and that's really where you see buffered ETFs, buffered UITs and maybe some structured mutual funds coming to market."

However, they expressed some scepticism about mutual fund approaches: "When it comes to mutual funds buying shares that are linked to the performance of a pool of structured products you tend to move away from the actual nature of structured products... It has never really taken off." They cited UK provider Atlantic House’s defined returns fund as an example: "It has a few billion dollars in AUM, but it's not a US$50 billion fund. And I don't think it will ever be."4

Desjardins’ Bélanger, who is responsible for guaranteed investment contracts (GICs) and structured notes offered in the broker-dealer network, observed:

"We are not seeing any new issuers but instead new players using structured funds with structured product exposure. This is something that has been added in the past couple of years... We also saw Calamos in the US which just launched an ETF on structured products."

ETFs are also on the radar of Tom Karlsson, Portfolio Manager and Partner at Patron Investments in London. Karlsson's Luxembourg-based Alternative Investment Fund uses S&P and Eurostoxx options to enhance returns and sometimes protect the downside, benchmarked to the MSCI All Country World Index. As a former structured product sales executive, he is considering partnerships with providers like Leonteq to wrap his strategy: "We're maybe looking at AMCs or ETFs. It would be easy to manage with [our current] process," and a potentially quicker path to scale, he said.

Education matters

Education is also emerging as a critical innovation driver that transcends geographic boundaries. While not suggested by the survey as a crucial innovation of the past five years, some interviewees highlighted its importance. BBVA’s Garcia-Rubiales said,

"I think education is changing the landscape, and that is what will really help the industry grow."

She highlighted the role of platforms and wholesalers: "Firms like iCapital... do a really good job of educating through their wholesalers."

The need for education reflects the industry's recognition that product sophistication must be matched by client understanding: in a world of complex-seeming products, the ability to communicate value propositions clearly can be a profitable differentiator.

Looking ahead The convergence of AI, blockchain, enhanced data capabilities, and improved integration suggests the structured products industry stands at an inflection point. While regional variations in adoption persist, the drive toward faster execution, greater automation, and enhanced client experience appears universal.

Technology is increasingly becoming a table stake rather than competitive advantage. The challenge ahead lies less in adopting individual technologies than in achieving seamless integration across the entire value chain – from initial idea generation through to end investor experience. Ultimately, this also includes addressing the gap in retail technology adoption, where despite advances in institutional systems, end investor engagement remains inconsistent.

Schroders’ Moura highlighted a generational divide: "There are investors willing to make investment decisions themselves... but there's a 'generational gap' in the adoption of digital platforms or robo-advice."

And Mariana’s Graham brought a discussion focused very much on technology back to the human again. In the UK IFA market at least, he said, "It's almost a prerequisite that people have a named contact they can call... People like to deal with people still."