The structured products industry has pushed through 2025 with resilience and optimism despite unprecedented global economic uncertainty. SRP and LPA’s, reveals an industry not only weathering volatility but often thriving because of it.

Chapter 4, Challenged and Risk Factors, captures the industry’s macro risks, regulatory changes, distribution hurdles and talent shortages.

GROWING PAINS

Even an industry whose participants are actively pursuing growth opportunities faces challenges as it grows. The structured products market is no exception.

We asked our survey respondents: "What is the biggest challenge you expect to impact the structured product space in the next few years?" Responses to this open-ended question coalesced into several key themes: regulatory overwhelm and fragmentation (around 25% of responses); the pressure of integrating technological developments; addressing a perceived deficit in trust and education; market and economic uncertainty; the tension in product development between sophistication and accessibility; and competition and the stresses it places on industry economics.

The overarching image is of an industry seeking to balance growth and innovation while managing complexity, regulatory scrutiny, and the fundamental challenge of maintaining trust in what many still perceive as opaque financial instruments. Nonetheless, challenges vary by geography and market segment.

As SocGen's Milan observed, the two business segments – flow and customised products – face different pressures. The flow business faces IT and development budget constraints, which are further amplified by the need to integrate new technologies and provide new added value services.

“The flow business faces IT and development constraints, while in the customised products market... [it’s about] distinguishing yourself through early and continuous innovation.”

Elias Milan, Global Head of Structured Products E-Business and Head of Business Management Office for Equity Non-Linear Trading Activities, Société Générale (Paris, France)

REGULATORY DEMANDS

As we noted in the previous section, characterising regulation as a challenge may seem contradictory given that almost half (47.5%) of respondents regulatory changes to have a positive impact on the structured product market's future (35% expected a negative impact, and 17.3% were neutral).

One private banking respondent captured the nuance: "Both [answers] should be correct – transparency helps the end investor, but regulation makes it difficult sometimes for retail investors."

Regulatory impact also manifests in increased compliance costs, constraints on product offerings, and can even push issuers towards riskier alternative products.

The apparent inconsistency was clarified in interview, where participants expressed their own regional and sectoral experiences. Pedro Moura of Schroders noted that in Asia, for example, "Pre-2008, there was a big market of structured funds and then regulation was introduced. Since then, it's been a mixture of regulation and self-regulation that effectively reduced the available market."

Conversely, in Brazil, XP Investments' Bruno Giannecchini emphasised that regulatory permissions had opened structured products to investors initially and later expanded product availability.

Well-intentioned regulatory actions can also have unintended consequences. French regulator the Autorité des marchés financiers’ (AMF) treatment of optimised indices as a product mechanism, for example, has steered issuers of decrement products towards single names they might not otherwise have chosen, replacing index risk with risk concentrated in single names in products with barriers set at -40%, -50%.1

Regulation was also viewed as the primary barrier to expansion into new business lines by 81.8% of respondents. They expressed concern about regulatory uncertainty, diverging environments, compliance costs, and inter-jurisdictional inconsistency. Respondents highlighted fatigue with sheer regulatory volume across jurisdictions, particularly in APAC. The US, meanwhile, was criticised for lacking a retail framework equivalent to MiFID II and there were concerns that Trump might leave the Basel accord.

TECHNOLOGICAL INTEGRATION

While AI and technological advancement represent clear opportunities, their implementation also presents significant challenges, especially since those sections of the business not automated can now create operational 'bottlenecks'.

Respondents worried about integrating and controlling AI systems, including the risk of commodification or, as one private banker put it, "convergence due to broad AI use."

One market participant asked, rhetorically, whether there is anything to stop a "bank from wiping out their wealth management division and allowing a large language model to allocate the portfolio instead.2

Other concerns include the complexity of integrating the various technologies across the value chain and between enterprises, the burden of continued manual work, and the operational strain arising from managing pricing speed and product lifecycles.

One banker in the Spanish state outlined the challenge: "As structured products become more customised and cross-asset, ensuring accurate trade capture, lifecycle event processing, and timely settlement, while adapting to evolving regulations like EMIR Refit3 or T+1 settlement cycles, will stretch existing systems and teams."

UniCredit's Barth explained that technological advances can bring changes to industry infrastructure that then present their own challenges. The different rules and connectivity requirements that come with the proliferation of multi-trading facilities (MTFs) are placing a strain on his business, he said: "There are many exchanges in Germany that we have to deal with from a regulatory perspective... And the number is still increasing. Some banks are thinking about founding their own MTFs."

EDUCTATING FOR TRUST

The challenges around relationships with the end investor were largely expressed educationally, particularly given structured products' perceived complexity versus other investments. One middle-European commentator highlighted "the fight against the ETF industry" and the related "challenge of explaining structured products in simple terms."

In Switzerland, Payoff.ch's Serge Nussbaumer said that because of this,

"We're struggling to increase assets under management. It's US 250 billion... about 3% of all deposits or portfolios on average, and we can't manage to increase that to 4% or 5%."

The educational challenge is global, though, spanning from China to the US. Mariana Investments’ Steven Graham noted of the UK market: "Our belief is that the market is still too narrow and by that, I mean the number of advisors who utilise these products or are willing to discuss their feasibility in client portfolios."

Some called for education as a route to greater transparency, particularly regarding what they saw as problematic products. One French asset manager urged, "Increase end-investors’ awareness and more regulatory control, as we view structured products as a way for (a lot of) intermediaries to make (a lot of) money at the expense of end-investors."

Around 8% of respondents highlighted product issues as their greatest challenge. Concerns centred on over-complexity, potential poor performance, and ensuring, as one middle-European academic put it, "fair, transparent, and competitively priced products." A European investment consultant similarly called for, "maintaining discipline in the offering, avoiding potential reputational damage from taking risks in underlyings and payoffs to boost sales." Providers naturally fear bad press, including that instigated by other investment segments, as has happened in the past.

Decrement indices were singled out as being particularly problematic. One North American manufacturer warned of the need to educate investors on "increasingly complex products, especially underlyings like dividend decrement indices." But some thought the problem ran deeper than education. A north European asset manager said they feared the "potential risks derived from more structured underlyings (e.g. decrement underlyings)”. Or, as a British manufacturer bluntly stated, "Proprietary underlyings with decrement will explode badly."

Some interviewees highlighted potential poor performance from other product types. In Brazil, said XP Investimentos' Giannecchini, "The next big challenge we have is relevant credit events in the market and how the market is going to behave."

MARKET AND ECONOMIC UNCERTAINTY

Market and geopolitical instability loomed large in future concerns. Here, respondents mentioned a cocktail of interest rate changes, geopolitical uncertainty (and the rise of nationalism and populism), the effect of protectionism, as well as market volatility in general and a bear market in particular.

As one participant noted, "If rates go down, all fixed income products will have trouble finding reinvestment."

In Brazil, by contrast, high local rates have enabled issuers like XP to focus on capital-protected structures or structures with a guaranteed fixed coupon. But, said head of retail structuring Bruno Giannecchini, that’s not an easy sell: "For instance, if you have a callable product that doesn't autocall, the opportunity cost associated [with that] is quite relevant now. This is the kind of challenge we have with participation and call products shrinking in the last two to three years, and this is what has been driving the good performance of credit linked products as well." For Giannecchini, the solution lies at least partly in payoff development.

Mariana Capital's Graham said investors also fear future market moves: "Markets have continued to rise for quite a prolonged period. There is still concern about what that geopolitical future might look like and how that might affect portfolios."

Specific worries included the trade disruptions spawned by the current US administration, and political instability constraining US-domiciled investments

COMPETITIVE PRESSURES

This external economic and geopolitical context impinges on internal issues such as increased competition and thus margin compression, and pricing pressures across the ecosystem.

One European service provider highlighted likely "pricing and margin pressures as the interest environment cools." Another interviewee, who preferred to remain anonymous, explained: "We are all suffering from margin compression, because there's more players involved throughout the product chain. There's more fees getting layered in, making it difficult to include your fee plus all these other fees and still make the product competitive."

A North American index provider respondent warned of the far-reaching impact this global competition will have: "[The] increase in competition globally naturally decreases fees associated on the broker side. Banks’ profit margins will be impacted and they may focus on alternative products, therefore making the market for these products less liquid."

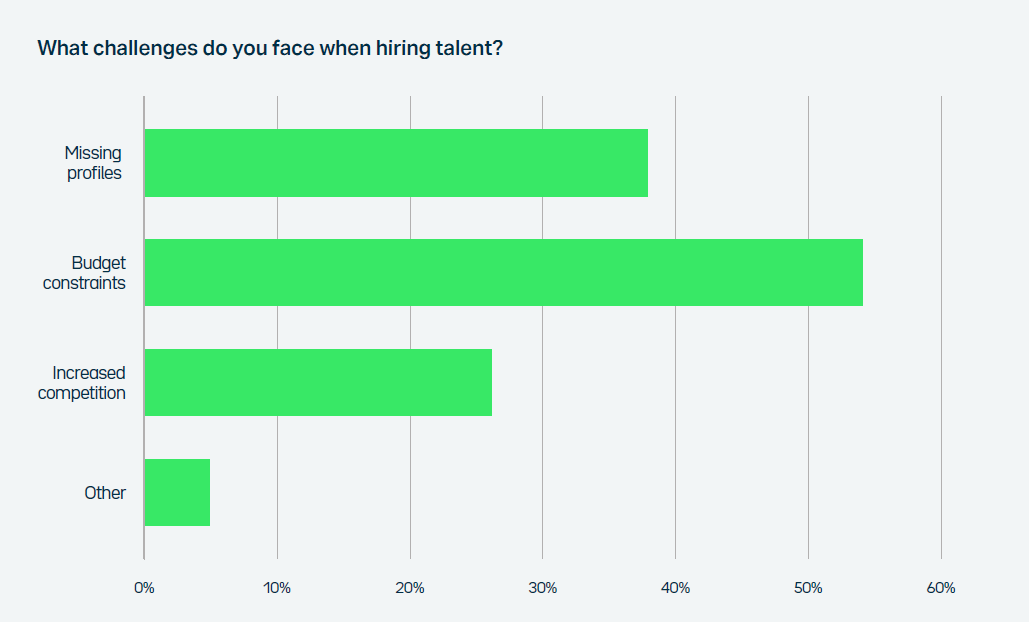

On hiring challenges, over half of respondents (54.2%) highlighted budgetary constraints, while a surprisingly high 38% cited missing applicant profiles and 26.3% noted increased competition for talent. Some mentioned structured products, "might be boring for talented individuals" and noted a "lack of interest" in the sector.

In conclusion, the challenges highlighted in this section are a mix of operational headwinds and structural barriers to industry expansion in particular sectors. However, our qualitative data reveals survey participants’ concerns as largely ‘high-quality’ problems arising from success and growth rather than the threat of market decline.

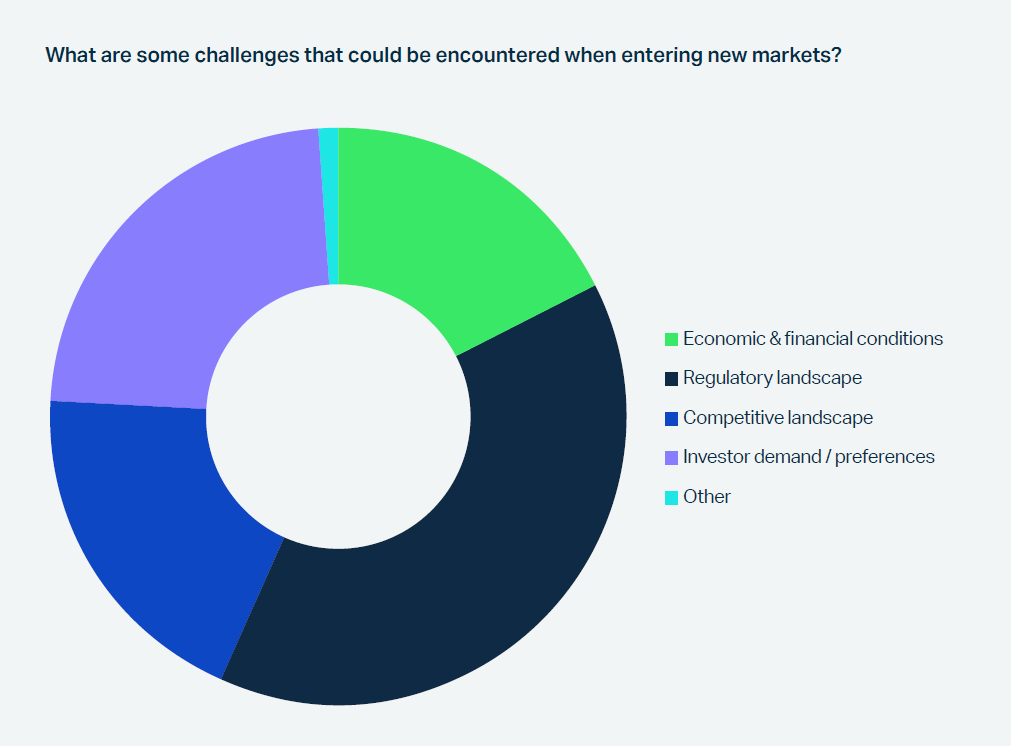

As Arta Finance’s Linker put it: "I see enormous opportunity in expanding into new markets, and naturally I’d love to capitalise on that as we grow the business – there are still major markets where we don’t yet have a presence. However, each is nuanced, and breaking in takes a huge amount of work given current policies, regulatory requirements, and diligence processes. We haven’t yet seen the right solutions to make that easier, but solving that challenge would unlock enormous growth potential."

As Linker makes clear, industry firms require in-house expertise and external solutions to navigate these sophisticated challenges. The next section will reveal how they are positioning themselves for growth.

DECREMENT DETRIMENTAL?

The structured products industry faces mounting concern over decrement indices, particularly single-name point-decrement products, which multiple interviewees warned could trigger widespread investor losses and erode trust.

Several interviewees highlighted decrement products as a looming industry risk, though understandably did not want to go on the record at this point with their concerns.

As well as the general lack of product understanding among investors, single name products and point-based decrements in general were considered particularly problematic.

Single name products rose in popularity in France after its regulator, AMF, introduced restrictions on optimised indices. Their idiosyncratic, concentrated risk is often not immediately apparent to investors, and compounded on the downside by the use of points-based rather than percentage-based decrements. There are already single name products whose mark-to-market performance is way below barriers, though losses won't materialise until maturity.

One market participant, who wanted to remain anonymous, thus described decrement indices as, "a huge time bomb," particularly in France where they originated. They warned, "I'm really afraid of the second wave implication of whenever it is going to explode," predicting global industry consequences as the rash of 10-12 year products matures.

Product complexity compounds investor confusion, especially about the difference between percentage- and points-based decrements.

Points-based decrement indices work by subtracting a fixed number of points from the underlying index value at regular intervals, simulating the effect of dividend payments or other costs, creating a synthetic "dividend yield". Unlike fixed percentage decrements, the impact of a fixed point decrement varies depending on the index's overall level, with a larger impact on a falling index and a smaller impact on a rising index.

When downturns hit, investors believing they have "50% barrier protection" may discover their decrement-adjusted exposure leaves them below protection levels, resulting in significant losses on long-term commitments.

Demand persists, however, and the counter view is that decrement products are a way of, “passing on efficiencies on the trading side” to end clients, as Mariana Capital’s Steven Graham explained.

US distributor Raymond James’ Christopher Loudon agreed, suggesting:

“The way the market's evolving is that everything's going to be linked to the S&P and US markets, but people are going to get smarter about it. A two or three or 4% decrement takes a lot of risk off for the sell side. They can price things tighter. Terms improve.”

Others reported continued investor interest, suggesting the industry’s challenge here lies not just in product structure but in the gap between complex mechanics and investor understanding.