The structured products industry has pushed through 2025 with resilience and optimism despite unprecedented global economic uncertainty. SRP and LPA’s, reveals an industry not only weathering volatility but often thriving because of it.

Chapter 5, Conclusion - Positioning for Growth - the final chapter touches on how firms are preparing for 2026.

ONE SIZE DOESN'T FIT

This report has outlined the recent experiences of an industry that has pushed through the geopolitical and market turbulence of early 2025 with overwhelming positivity. It is an industry constantly seeking to exploit gaps in its coverage, and that understands the need to compete with other investments and wrappers, and with the technology and product development tasks necessary to achieve that.

As we have seen, it is also an industry facing challenges as it grows. For individual firms, this combination of opportunities and challenges means setting targets for success based on their own strengths and capabilities, then creating a business development strategy to achieve them.

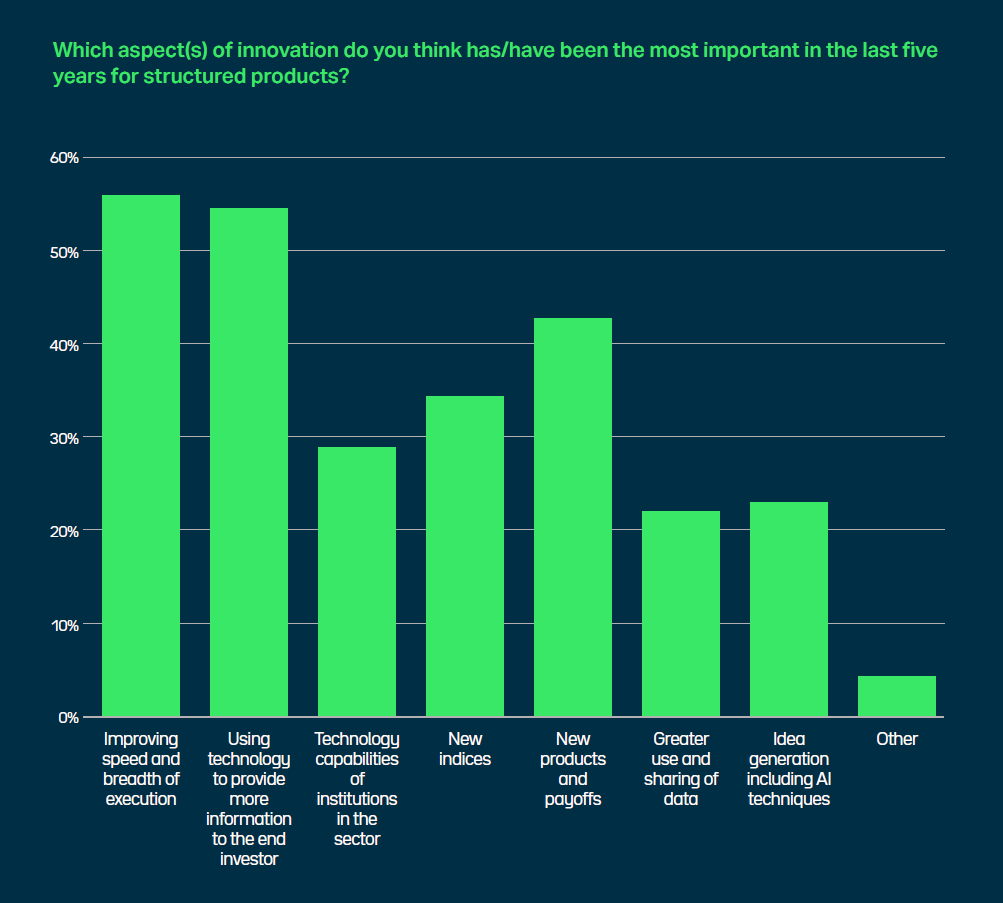

As one would expect, our survey respondents related their developmental tasks to the themes identified in this report, as well as to their USPs, geographies, business segment, customer focus, current size and their perceived progress on the big themes of technological integration, adoption of AI, customisation, speed and so on.

BBVA’s Garcia-Rubiales, for example, says the bank has a "unique value proposition" in the US market, having both competitive pricing and being a safe and diversified credit: “They're already typically pretty full on [the usual] credits… We've become the number one issuer with a couple of US accounts over the past couple years, because they got comfortable with the credit and the pricing is very competitive.”

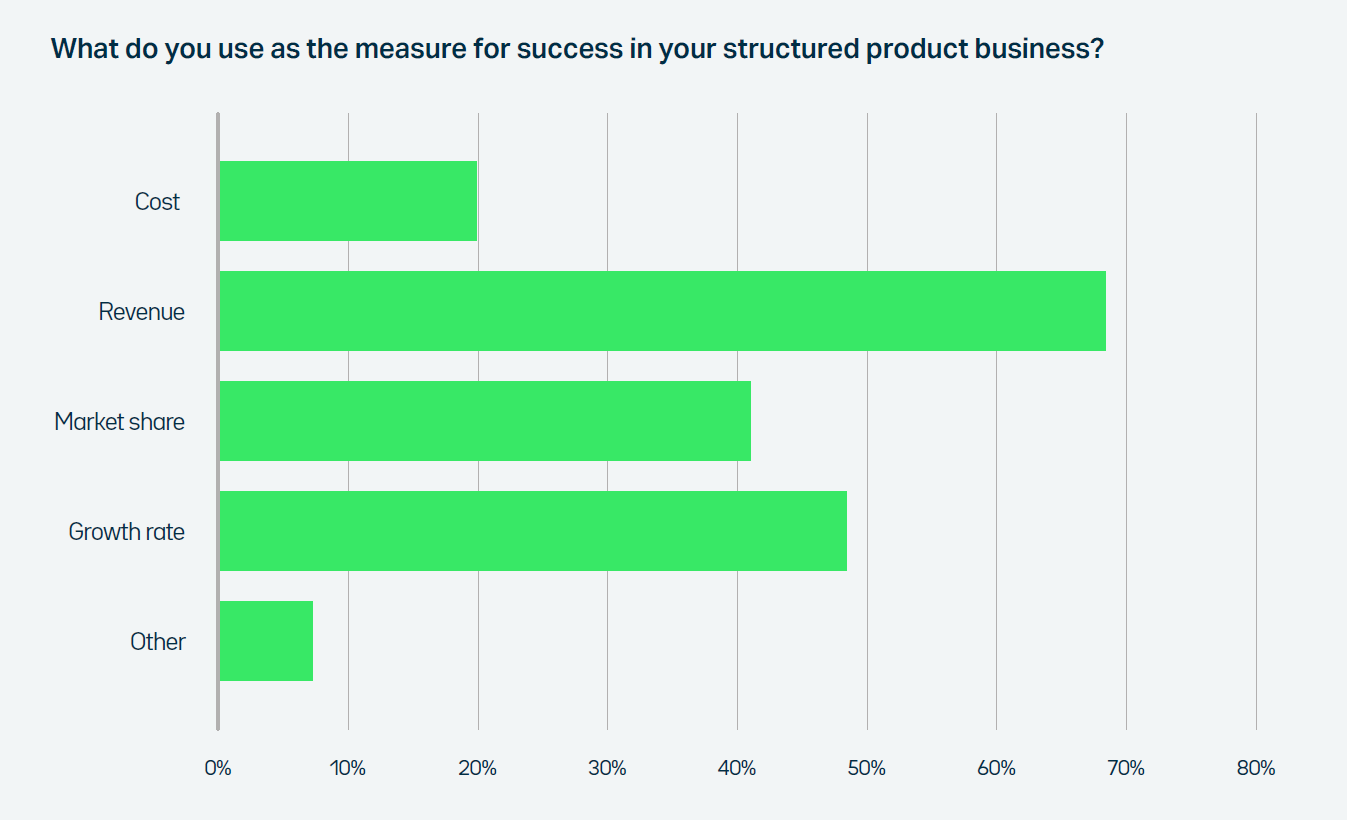

Survey respondents were allowed to indicate more than one way of characterising their success metrics, but there was still a clear hierarchy of responses. Most (68.8%) were focused on revenue, followed by growth rate (48.7%), market share (41.3%) and cost (20.1%).

Among the ‘other’ responses to that question were the more qualitative factors upon which those financial metrics might rely – such as speed, customer satisfaction, product performance, IT (again) – as well as profitability. One North American distributer, who highlighted both gaining new users and “growing usage within the existing user base,” explained that meant, “taking the team doing US$100k a year and helping them get to US$5m per year.”

“It is an industry constantly seeking to exploit gaps in its coverage, and that understands the need to compete with other investments and wrappers.”

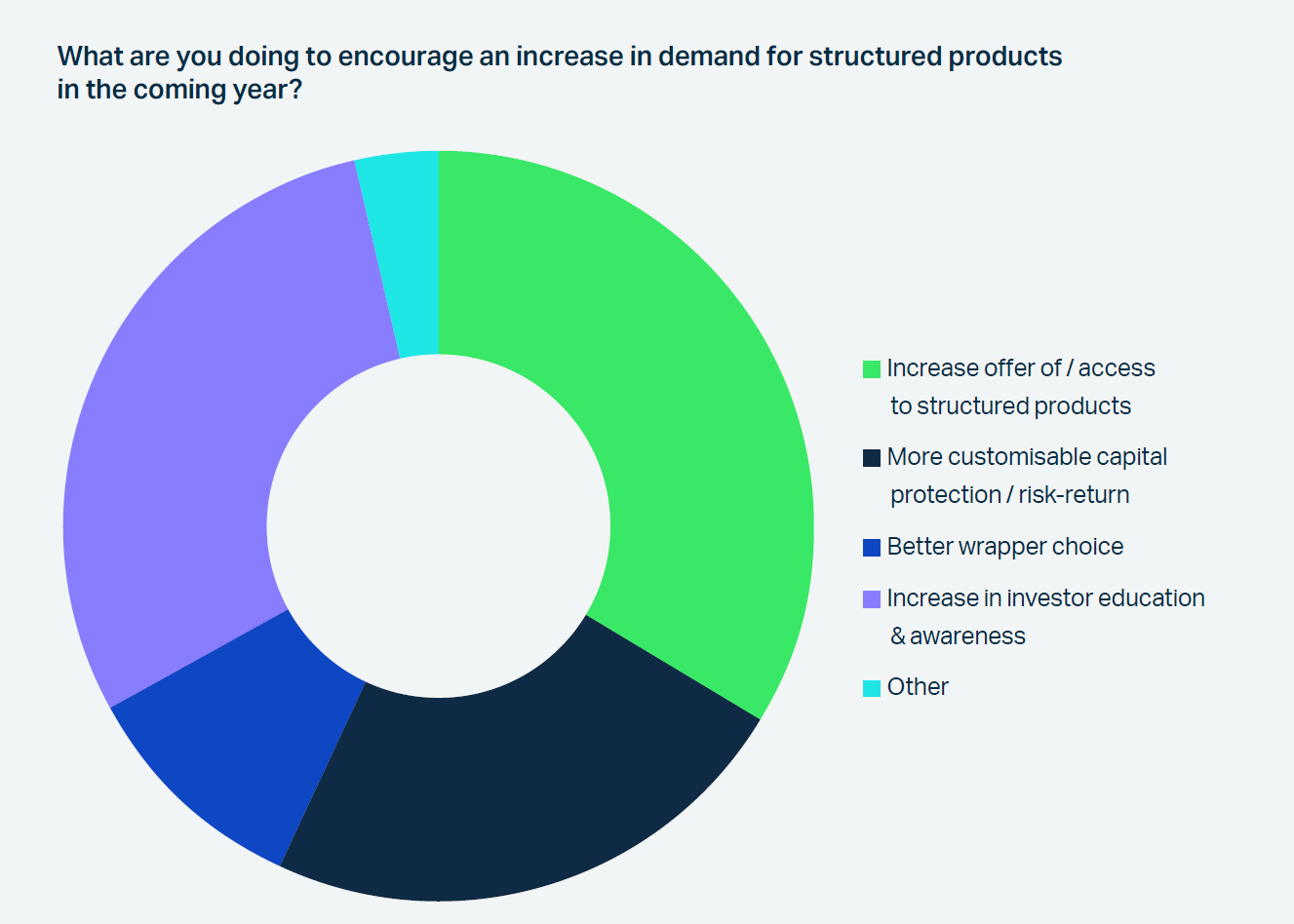

When asked what firms are planning to do to stimulate demand for structured products in the coming year, again with more than one choice allowed, 70% of respondents said they are increasing their offer of, and access to, structured products. 61% of respondents said they are increasing investor education and awareness as a way to increase demand.

Education is a critical element of business development for intermediary, or retail-oriented players in particular. One North American distributor told us how they work with the thousands-strong network of affiliated advisors, of which around two-thirds have their Financial Advisor Series 7 qualification and are the target market for structured notes and market-linked CDs.

They said: “They're already familiar with the concept of downside protection while maintaining upside participation within an annuity chassis. But here, we're talking about structured notes and market-linked certificates of deposit. How do we educate our advisors on that? How do they position these types of solutions along with their existing structured annuities business?" They concluded: “The most important thing is really to educate our advisors and help them capture dollars that right now they were not able to capture through annuities."

In a more general bid to educate the public, another European commentator mentioned in the commentary that they are planning working on media and with ‘finfluencers’.

CUSTOM SOLUTIONS

Almost 50% of respondents said they are working on more customisable capital protection and risk-return offerings, including one index provider who said they are working on both time to market and developing their white-label customisation service.

Variants on creating or offering ‘highly customised indices exposed to particular themes’ also arose several times in the comments accompanying the question. Currently, these are US tech and AI, defence, and a rotation away from the US and towards local equities, among others. Respondents naturally also highlighted themes relevant to their own markets – “indices containing ETFs” in the US for example – and stressed the need to respond quickly to changing market sentiment.

Product development too is a highly market dependent topic. In relatively new markets such as Brazil, said XP’s Bruno Giannecchini, "There is still significant potential for us to enhance the value we deliver through payoffs. This involves not only understanding whether each new payoff makes sense for each client, but also clearly explaining the rationale behind introducing new ones. Our goal is not to overwhelm clients with complexity but to offer them a glimpse of how a touch of sophistication can translate into substantial benefits".

Just over a fifth of respondents (21%) said they are looking at offering better wrapper choice. Several providers to the US adviser market for example, are looking at SMAs, which, as one interviewee put it, are a more "model-friendly"13 solution that “could potentially help us take the business from a few hundred million dollars a year to multiple billions of dollars a year." The provider started in the structured solution space with structured annuities (fixed indexed annuities, registered index-linked annuities, RILAs) then moved to offer buffered ETFs, buffered UITs and then structured notes and market-linked CDs.

TECHNOLOGICAL QUESTIONS

As well as the items outlined above, respondents mentioned in their commentary the familiar technology questions of improving end-to-end and business-to-business automation, creating better pricing tools, and improving time to market, including by the use of AI:

"In the short term we are being more effective in the way that we are creating our documentation. We are trying to improve our time to market," said Desjardins’ Bélanger.

Arta Finance’s Matt Linker highlighted the "incredible amount of behind-the-scenes technological support that enables us to be very fast," as he outlined the company’s massive uptick in trades from January this year onwards. "We can go from client request to auction to awarding the trade fully booked with less than five minutes of total human work," he said.

For UniCredit’s Nikolaus Barth, as we mentioned in Section 1, integration is no longer an intra-firm issue, but a matter of “ensuring we are embedded in the entire value chain. We need to learn the kind of technology our distributors, or our order flow providers use. We need to have a smooth order flow and system to buy our products. It's all about connection.”

Some unanswered tech questions remain. While an average 30% of our respondents’ business now goes through multi-issuance platforms, the development of platform business is not complete, either in terms of penetration (as BBVA’s Garcia-Rubiales noted, they still pose problems for some issuers) or integration into the value chain. A North American financial services provider asked how pricing platforms can be integrated with the platforms advisers use daily: “How do we integrate the [platform providers] Simons, Lumas or Halos of this world to the different providers of unified managed accounts [UMAs] or advisor PM [portfolio manager] types of programmes?”

Other providers, as we noted in the Opportunities section above, were focused on new geographies and market segments, penetration of a particular customer segment. The range is too broad to repeat here, but US advisers, RIAs, stand out among the repeat mentions, while SMEs were also suggested as an untapped market.

CONCLUDING REMARKS

This survey and analysis have hopefully provided a comprehensive overview of the current condition of the global structured product market. It shows that even though the market is in many ways mature, it still has much potential to grow and change – in terms of geography and client segments, and also the barely imagined changes that technological advances will allow.

The coming years will bring new challenges as well. Many industrialised countries are heavily debt and deficit laden. Inflation is an ongoing concern. Interest rates can quickly be forced back up just as investors price in monetary easing. Geopolitics is playing a larger role in investment decision making.

Portfolio solutions that provide clearly defined risk parameters will matter more than ever. The payoff innovations of the past, now standardised and mainstream, and able to be priced rapidly using the latest technology, will play a crucial role in many investors’ portfolios, as they are deployed to manage this new era of uncertainty. One US adviser is looking ahead already: “Once Trump leaves office, we will see an explosion of customised products to fit the client’s specific needs,” they said.

Future surveys will show this evolution in progress. The integration of artificial intelligence, increasingly tailored solutions, the emergence of new distribution channels, will all play their role in this changing industry.

END NOTE: POSITIONING FOR GROWTH

We couldn’t end this report without including a message to those working on developing their careers. Around a quarter of our survey respondents said they were facing increased competition from other business sectors as they try to attract the best candidates to their firms. But make sure you’re visible. Almost 40% of hirers cited ‘missing profiles’ as a barrier to hiring.