The Swiss exchange adds to cryptocurrency offering; Goldman Sachs Asset Management launches five thematic ETFs that focus on technologies driving transformations in the global economy; Blackrock expands range of sustainable investing; DWS Group expands ESG ETF suite

The Six Swiss exchange has listed its first Ethereum (ETH) based exchange-traded product (ETP). The new Amun Ethereum ETP offers investors the chance of investing in the second most valuable digital asset according to market capitalisation.

AETH tracks the performance of Ethereum and the issuer, Amun, will hold the underlying crypto asset in cold storage equal to 100% of the value of the notes at all times. All digital assets held by Amun are under institutional grade security with several safety measures including multiple private keys, whitelisting and audit trails.

AETH is the second crypto based ETP being offered by Six. The exchange recently listed the Amun Bitcoin ETP with Amun also handling the cold storage of the Bitcoin that backs the ETP. Both ETPs have a 2.5% management fee. Late last year, the exchange said it would list five crypto based ETPs tracking the price of Bitcoin, Ethereum, XRP, Bitcoin Cash and Litecoin. The same five digital assets also make up the Amun Crypto Basket Index (HODL5), which comprises BTC – 49.39%; ETH – 16.58%; BCH – 2.96%; LTC – 3.87%; and XRP – 27.2%.

Goldman Sachs rolls out suite of ETFs tracking innovation

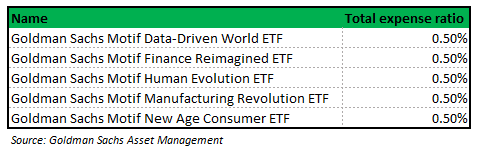

Goldman Sachs Asset Management has launched five thematic exchange-traded funds (ETFs) focusing on technologies that are transforming the global economy. The ETFs track indices created by Motif – a data driven indices and strategies provider. All funds are listed on the NYSE Arca and have a management fee of 50 basis points.

‘Technology is impacting every aspect of our daily lives,’ said Mike Crinieri, global head of ETF strategy at Goldman Sachs Asset Management. ‘It has grown from a single sector to a key driver of every sector.’

Blackrock adds six ESG trackers to LSE

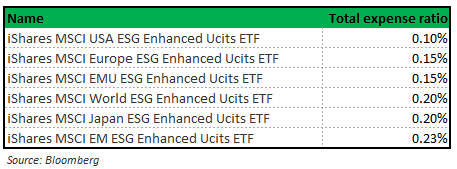

Blackrock joins Vanguard in pursuing sustainability investing strategies. The world’s largest asset manager has rolled out six new ESG ETFs. The funds track MSCI’s single-country and regional indices that re-weight securities to maximise ESG scores by screening out companies with exposure to controversial and nuclear weapons, tobacco, thermal coal and oil sands and those in violation of the United Nations Global Compact principles. The compact encourages businesses to adopt sustainable and socially responsible policies. The expense ratio of the funds ranges from 10 basis points to 23 basis points. The ETFs are listed on the London Stock Exchange.

DWS Group partners with Finnish pension plan

DWS Group has partnered up with Ilmarinen to expand its ESG ETF suite. The Xtrackers MSCI USA ESG Leaders Equity ETF captures the performance of large- and mid-cap US companies with high ESG performance relative to their sector peers. The fund has an expense ratio of 10 basis points and trades on the NYSE Arca.

Ilmarinen – Finland’s largest pension insurance company – underscored that sustainability considerations have been an integral part of its investment strategy for almost two decades. ‘Taking material and relevant ESG data into account helps us achieve our goal of investing pension assets so that the return also secures the pensions of the future generations,’ said Anna Hyrske, head of responsible investments at Ilmarinen.

The ETF launch is the latest addition to the Xtrackers suite of ESG ETFs that includes the Xtrackers MSCI ACWI ex US ESG Leaders Equity ETF and the Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF.