Swiss trade-body reports Q1 2019 turnover almost level year-on-year with capital protected products showing the highest increase.

Turnover of structured products in Switzerland reached CHF91 billion (US$90.1 billion) in the first quarter of 2019, down one percent compared to the same period last year, according to the latest figures from the Swiss Structured Products Association (SSPA).

Capital protection products made up 18% of total turnover in Q1 2019, representing an increase of nominal turnover of 32% compared to Q1 2018.

The nominal turnover of participation products increased by 19% to CHF16 billion, while despite a slight decrease compared to Q1 2018, yield enhancement products accounted for approximately half of total turnover in the first quarter of 2019 (46%). Leverage products constituted the second-largest product group with 19% of total turnover, despite a 20% decrease in nominal turnover compared to Q1 2018.

Fifty-two percent of total turnover in the first quarter came from equity products; the turnover share of FX products declined by one percent compared to Q1 2018 and reached 26% while the share of fixed income products rose to 16% (last year: 12%).

Turnover on the primary market grew by 4% to CHF53 billion compared to prior-year quarter. By contrast, turnover on the secondary market declined from CHF41 billion in Q1 2018 to CHF38 billion in Q1 2019. The US dollar is again the predominant currency in Q1 2019 with a share of 40%, followed by euro (32%) and the Swiss franc (15%).

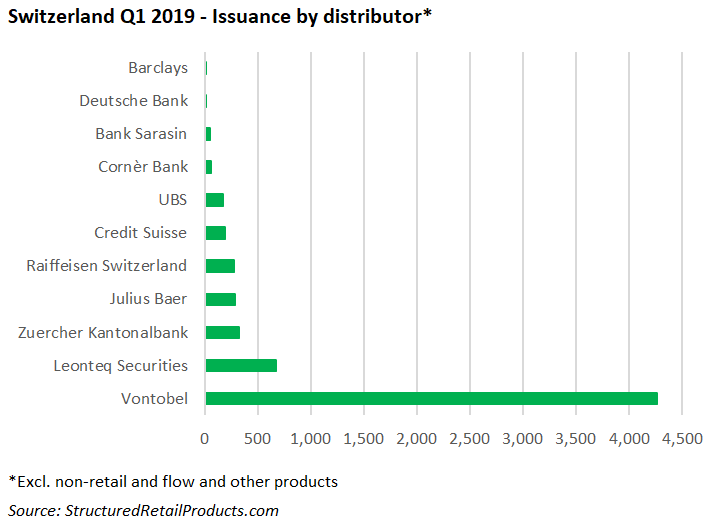

There were 6,295 structured products (excluding non-retail, flow and others) with strike dates in the first quarter of 2019, according to the SRP Switzerland database (Q1 2018: 5,280 products). Of these, 5,364 products are still live while 931 structures – predominately reverse convertibles and dual currency certificates – have since matured.

Vontobel, with 4,260 products (almost 70% of the total issuance), was by far the most active distributor, followed by Leonteq (671 products) and Zuercher Kantonalbank (320).

‘After a comparatively strong first quarter in 2018, we are pleased that the only slightly lower turnover in the first three months of this year confirm the continued consistent demand for structured products,’ said Georg von Wattenwyl (pictured), SSPA chairman, commenting on the results. ‘Although the turbulence of the fourth quarter has partly unsettled investors, they value attractive and innovative investment opportunities in the portfolio context.’

The figures, which include exchange listed as well as unlisted products created in or for Switzerland that are sold nationally as well as internationally, are provided by SSPA members Barclays Capital, Banque Cantonale Vaudoise, Commerzbank, Credit Suisse, Goldman Sachs, Julius Baer, Leonteq, Notenstein La Roche, Raiffeisen, UBS, Vontobel as well as Zurich Cantonal Bank. These represent the largest part of the Swiss market.

Click the link to view the full SSPA structured products value creation report for Q1 2019.