The Italian bank’s profit for the first six months of 2019 was boosted by sales of structured products for retail investors, ‘in particular certificates’, with volumes doubling from the comparable six-month period.

Banca IMI has posted a consolidated profit of €710m in the first half of 2019, representing an increase of 64% on the €433m recorded in the comparable six-month period, and in respect of the €803m for the entire 2018 period.

Growth in half-year 2019 was driven, among others, by good performances in proprietary securities investments and in the structuring of investment products for the retail segment, ‘in particular certificates,' according to the bank

Placements of equity-linked certificates in the private banking segment in Italy amounted to €1.2 billion, evenly divided between capital protected and conditionally capital-protected products. The demand for investment products from the non-captive networks focused on capital-protected products ‘based on the uncertain market closing at the end of 2018’.

The Banca dei Territori division, which comprises of the Intesa Sanpaolo, Banca 5, and Mediocredito Italian networks, recorded certificate sales for €2.8 billion, with volumes more than doubling on the comparable six-month period, in particular in the ‘digital’ and ‘equity protection performance’, payoff categories. Turnover for the instrument was high, with €1.3 billion in net repurchases from the secondary market, according to the bank.

Networks also confirmed their interest in the distribution of protected insurance products and funds. In this regard, the subscriptions for over one billion stand out, for the two Epsilon Difesa 100 February 2026 and Epsilon Difesa 100 March 2026 funds, for which Banca IMI provided synthetic instruments with exposure to the equity profile.

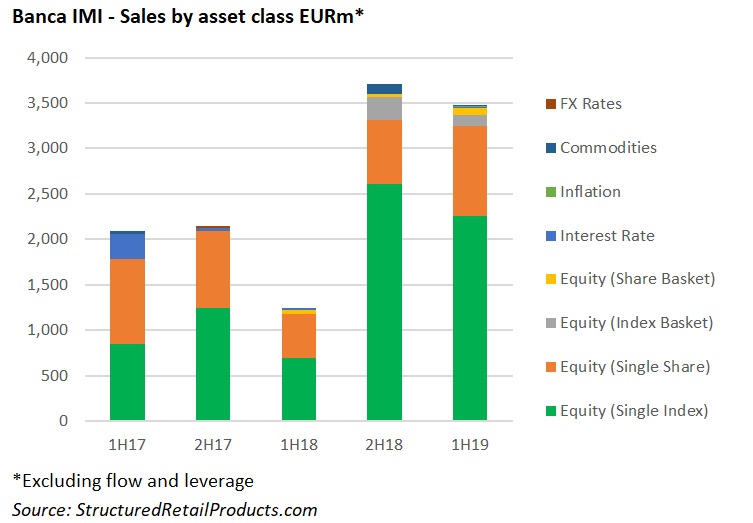

Banca IMI issued 55 structured products (excluding flow and leverage) worth €3.5 billion during 1H2019, a 178% increase by sales volume from €1.2m that was accumulated by 31 structures in the same period last year, according to SRP data.

More than 65% of the total sales volume, at €2.3 billion, came from 25 products linked to a single equity index, while sales linked to a single stock were also in demand during the period (€1billion from 19 products).

The best-selling product for the semester was a standard long certificate on the Eurostoxx Select Dividend 30, which collected €337.2m during its subscription period. The seven-year, fully protected securities offer annual income depending on the performance of the index and are available via the Intesa Sanpaolo distribution channel.

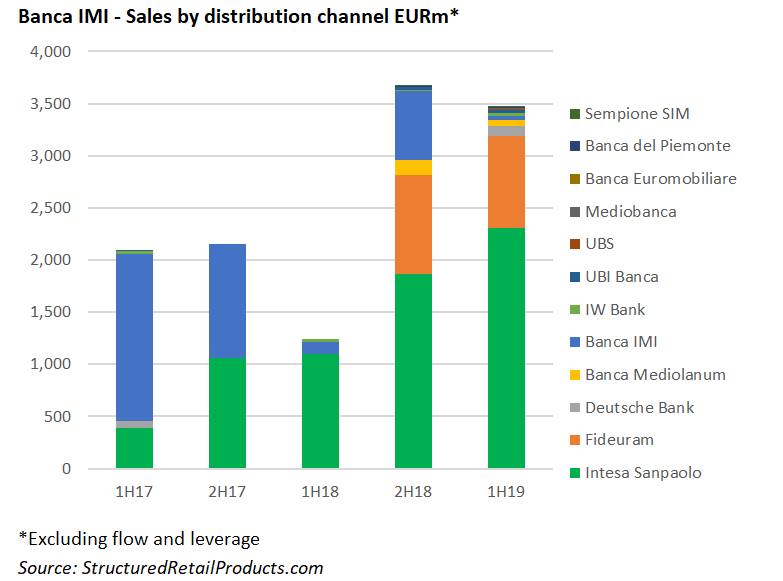

Of the 13 different channels used for distribution between January 1 and June 30 2019, Intesa Sanpaolo was by far the most active, with 35 products worth €3.2 billion distributed in the period, including 15 products with combined sales of €886m that were available via Fideuram, Intesa Sanpaolo’s private banking network. Other distributors used during half-year 2019 included Banca del Piemonte, Banca Euromobilaire, Deutsche Bank, IW Bank, and UBS.

According to the bank, a general drop in the total volumes of listed derivatives traded was recorded in the first half of the year, ‘even with around 19 million contracts brokered’, reflecting the broader slowdown observed on the main reference markets: Idem (-18.2%), ICE (-16.1%) and Eurex (-1.2%).

At €411m, net interest income was up by 43.7% on the comparative half-year, once again driven by the expansion of assets, with investments in debt securities exceeding €50 billion, from the €27 billion at June 30 2018 and €33 billion at December 31 2018.

Click the link to read the full Banca IMI interim financial report.