Canadian financial institutions Bank of Montreal (BMO), Royal Bank of Canada (RBC) and Canadian Imperial Bank of Commerce (CIBC) have announced underwhelming results for the second of quarter of 2020.

Containment measures that were implemented to curb the damage brought on by the Covid-19 pandemic resulted in the country’s GDP contracting by 10% in the first calendar quarter of 2020. Economic output is expected to decline by a further 40% in the second calendar quarter.

The Bank of Canada cut its policy rate to 0.25% in March from 1.75% to maintain economic stability. Nonetheless, the outlook appears bleak with GDP being expected to remain lower than 2019 levels through the remainder of the current year.

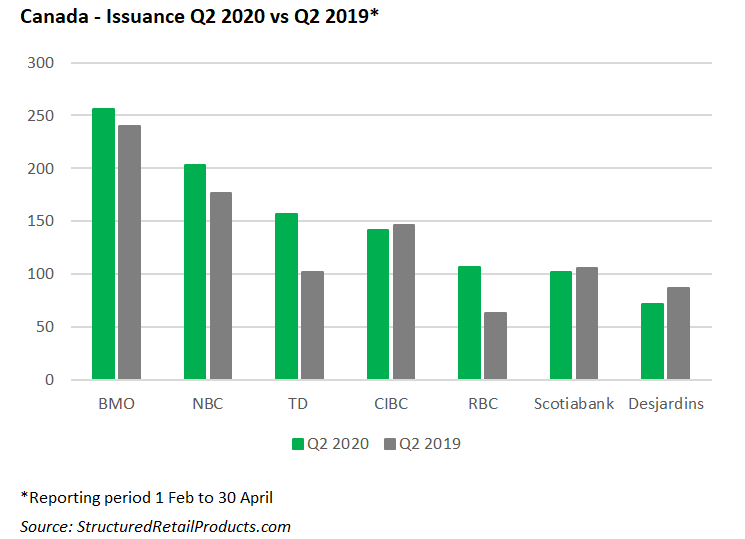

BMO and CIBC have seen their issuance of structured products reduced by 16% and four percent, respectively, while RBC’s issuance has experienced a 19% increase year-on-year (120 products in 2019/ 143 products in 2020), SRP data shows.

BMO announced that its net income fell by more than 50% to CAD689m (US$504m) from CAD1.497 billion in Q2 19 and CAD1.592 billion in Q1 20. The quarter-to-quarter losses were primarily driven by the impact of higher provisions for credit losses and lower revenue, which was partially offset by lower expenses.

SRP data shows that BMO continues to dominate the Canadian market, having issued 256 structured products compared with 240 in Q2 19.

BMO has 3,403 live products listed in Canada and the US and are wrapped as registered notes (unlisted), principal-protected notes (PPNs), notes, guaranteed investment certificates (GICs) and exchange-traded notes. The products differ in length from under a year to over six years and fall under a range of asset classes, some of which include hybrid, real estate, credit and commodities. Some underlyings include VanEck Vectors Gold Miners ETF, BCE, BMO Canadian High Dividend Covered Call ETF, Citigroup and DJ Industrial Average Index.

Reported revenue for the second quarter totalled CAD5.264 billion compared with CAD6.213 billion in Q2 19. BMO wealth management revenue fell due to lower insurance revenue, BMO capital markets revenue decreased as a result of lower trading revenue while the bank’s P&C business revenue increased because of growth in loan and deposit balances. The latter was offset by lower margins, including the impact of a lower rate environment.

Derivative financial instruments increased by CAD22.3 billion, reflecting in a rise in value of client-driven trading derivatives in BMO capital markets, increased volatility in equity markets, and lower interest rates as well as oil prices.

RBC’s net income for the second quarter tumbled by 54% YoY totalling CAD1.48 billion from CAD1.749 billion in Q2 19.

Compared to the last quarter, net income was down by CAD2.03 billion with lower results in personal & commercial banking, capital markets and wealth management.

RBC’s structured products issuance soared in the second quarter of 2020 reaching 107 from 64 the same quarter a year prior. The bank has 30 live products listed as institutional investments and are wrapped as notes and warrants.

The products differ in length from under a year to over six years and fall under the interest rate, fund and equity (single share, single index and index basket) asset classes. Underlyings include the S&P500, Eurostoxx 50, Nikkei 225 and FTSE100.

Total revenue for the second quarter stands at CAD10.33 billion as of 30 April 2020, a drop from the bank’s Q1 20 figure of CAD12.836 and Q2 19 figure of CAD11.5 billion.

Provision for credit losses shot up valuing CAD2.83 billion from CAD419 million in Q1 20 and CAD426 million in Q2 19.

Derivative financial instruments jumped to CAD50 billion from CAD402 million in the second quarter of 2019. Total RWAs also soared to CAD558.4 billion from CAD523 billion in Q1 20 and CAD510.5 billion in Q2 19.

CIBC announced a 71% plummet in its reported net income of CAD392 million from CAD 1.35 billion in the second quarter of 2019.

The bank’s Canadian personal and business banking segment suffered a loss in net income of 64% from Q2 19 at CAD203 million while the Canadian commercial banking and wealth management segment took a hit of 37% at CAD206 million.

CIBC’s structured product issuance appears not to have wavered significantly with its Q2 20 figure standing at 142, a slight decrease from 147 in Q2 19. The bank has 2,270 live products listed domestically and the US as well as institutional investments and are wrapped as notes, registered notes (unlisted), PPNs and GICs.

The products feature different investment horizons from under a year to over six years and fall under the interest rate, fund, hybrid, commodities and equity (single share, single index, share basket and index basket) asset classes. Underlyings include Wells Fargo, Bank of Montreal, Bank of Nova Scotia and CIBC Monthly Income Fund.

US commercial banking and wealth management’s net income tumbled by a whopping 89% to total CAD18 million while capital markets reported earnings of CAD137 million, a 52% decrease reflected in a higher provision for credit losses (CAD1.41 billion compared with CAD261 million in Q1 20).

RWAs stand at CAD261.8 billion in the second quarter, a rise from the bank’s Q1 20 figure of CAD252.1 billion and Q2 19 figure of CAD234.8 billion.

Derivative financial instruments total CAD41.2 billion, a jump from CAD25.11 billion in October 2019.

Click the link to read the full second quarter 2020 report for BMO, RBC and CIBC.

Photograph: Sebastiaan Stam /Unsplash