The Canadian bank was the fourth most active issuer in Canada over the previous quarter with more than 150 products launched.

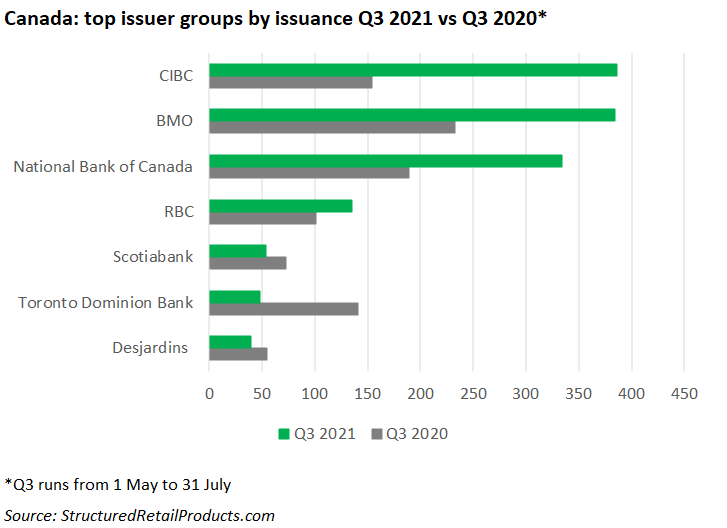

The Royal Bank of Canada (RBC) issued a total of 159 structured products in the Canadian market during the third quarter, representing a 57% increase from the same period in 2020 where figures stood at 101 products. The bank’s issuance, however, could not match that of the top three issuers in the market which averaged more than 300 products.

RBC’s issuance stagnated throughout 2020 and eventually dropped to 98 products in the second quarter (February-April) of 2021 before bouncing back in the following quarter.

Dominant underlyings in Q3 21 consist of the banking sector such as CIBC (32 products), Toronto Dominion Bank (26 products), Bank of Nova Scotia (23 products), and National Bank of Canada with 19 products.

RBC has also boosted its issuance of note wrappers by 68% from Q3 20 with sales reaching US$217.6m in Q3 21 (126 products), compared with US$130m across 68 products.

Guaranteed investment certificate issuance has increased by 11% over the past year totalling US$90m (33 products) in the current quarter, compared with US$81m spanning over the same number of products.

ETF focus

The bank put the focus on exchange-traded funds (ETFs) during the quarter (May-July) which saw eight structured products tied this wrapper , worth an estimated US$22m - no such structures were issued in the same period of 2020, SRP data shows.

The emergence of RBC’s structured products linked to ETF assets began during the bank’s first quarter of 2021 ranging from November 2020 and January 2021. The two products issued by the bank raised almost US$8m which then grew to US$19m in the second quarter (February-April 2021), on the back of seven products.

During Q3 21, the best-selling structure tied to an ETF was the RBC Phoenix Autocallable Securities (CAD), Series 273P.

Selling for almost CAD6m (US$4.7m), the income note tracks the VanEck Vectors Gold Miners ETF and Energy Select Sector SPDR Fund. The product will pay a fixed coupon of 9.1% pa. if the underlying is above 65% of its initial level at any observation date.

Sales for RBC’s hybrid issuance was also at its highest in Q3 21 with 14 products valued at US$18.5m after fluctuating in size throughout the year and hitting a record low in Q1 21 with just 12 products worth US$7.5m.

Most of the products issued by RBC in Q3 21 were linked to single equity indices, which is in line with the bank’s issuance in 3 20, although both issuance and sales in Q3 21 were significantly higher at US$157.5m (78 products), compared to US$85m (34 products).

Business lines

The bank led by Dave McKay (pictured) has reported a net income of CAD4.3 billion for the quarter ended July 31, 2021, up $1.1 billion or 34% from the previous year.

RBC’s results included releases of provisions on performing loans of CAD638m mainly driven by the macroeconomic outlook as compared to provisions of CAD280m taken in the prior year due to the impact of the Covid-19 pandemic.

Earnings in personal & commercial banking, capital markets and wealth management were up by 55%, 19%, and 31%, respectively from last year, largely due to the favourable impact of lower provisions.

The bank’s insurance division recorded a net income of CAD234m, an increase of 8% from a year ago, primarily driven by the new longevity reinsurance contracts, lower claims costs, and the impact of actuarial adjustments.

Click to view the bank’s earnings release.