Belgian investors were lured back by market opportunities in Q4 2022.

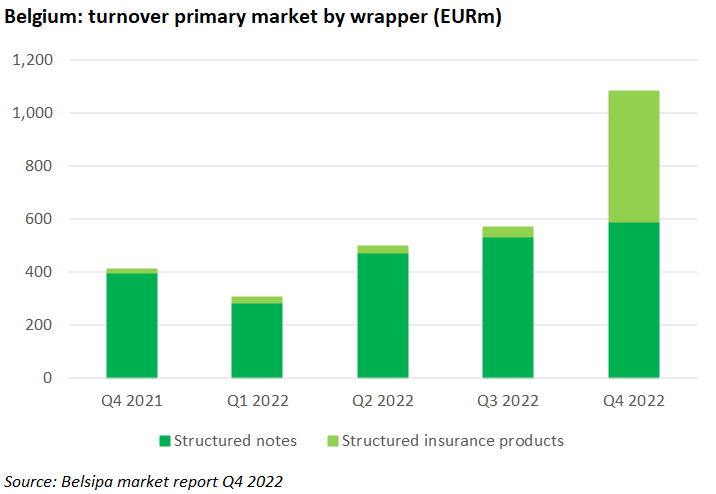

Structured products sold €1.1 billion (US$1.2 billion) on the primary market in Belgium during the fourth quarter of 2022, a 1.6-fold increase year-on-year (YoY) and up 90% from Q3, according to the latest figures released by the Belgian Structured Investment Products Association (Belsipa).

Some €590m of all primary market sales was invested in structured notes with the remaining €500m invested in unit-linked insurance products (Class 23).

The latter category included KBC-Life MI Global Selection 100-1, which was the best-selling product in the quarter, according to SRP data. The five-year capital protected product, which participates 100% in a basket of 30 global large-cap companies, sold €295m during its subscription period.

Structured funds, which had sold €234m in FY2021, were not issued at all in 2022.

The volume-adjusted share of capital-protected products as part of the primary market turnover rose by 70% on an annual basis and by two percent quarterly.

‘As interest rates allow us to offer attractive combinations of annual coupons and capital protection, both investors and issuers/distributors are returning to [the structured products] asset class,’ said Belsipa chair Florence Devleeschauwer (pictured).

Sales in the secondary market, which includes products sold back to the issuing bank before maturity, were up 29% between quarters, but still significantly lower (38%) than the year before.

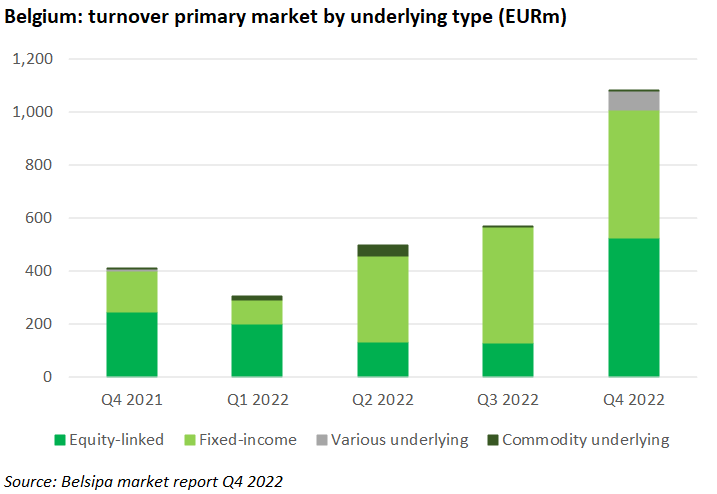

The primary market turnover of equity-linked products, at €523m, increased by 113% YoY and by 309% quarter-on-quarter (QoQ). It was boosted by two basket-linked structures from KBC that gathered combined sales of €495m while Belfius collected €22m from a note on the Stoxx Europe Health Care index.

Products linked to fixed-income underlyings sold €483m during the quarter – up 215% YoY and 11% QoQ. Their best-seller was the Fixed to Floating CMS Linked Coupon Note 2028, which offered a coupon of 3.75% pa during the first three years of investment. The following years the coupon is equal to two times the spread between the 30-year EUR constant maturity swap (CMS) rate and the five-year EUR CMS rate, subject to a minimum of two percent pa and a maximum of five percent pa. It was issued on the paper of Société Générale and sold €150m.

Filip Gils, vice chairman of Belsipa added: ‘The balanced risk and return structure of our asset class is a very useful optimisation for many portfolios, in today's equity and bond markets, which are currently subject to many external factors. Especially regarding the stock market, our products are ideal for building tailor-made protection against volatility.’

The banks affiliated to Belsipa launched 90 new products between October and December (Q3 2022: 117). The total number of product launches in 2022 was 40% higher than in 2021.

As of 31 December 2022, the outstanding volume in structured products stood at €20.3 billion, an increase of one percent, or €123m compared to end-September.

At the end of Q4, a total of 2,050 structured products were live on the Belgian market. Compared to the previous quarter, with a total of 2,090 products, this represents a two percent increase. Fifty-six percent of the live products had an equity-linked underlying while 67% of all products are capital protected.

Belsipa was founded in 2013 and has Belfius, BNP Paribas Fortis, ING Belgium, Goldman Sachs, KBC, Société Générale, Crédit Suisse and Morgan Stanley as full members. Those banks aside, Crelan, Bank Nagelmackers, AG Insurance and Deutsche Bank also provided data to the report, which covers approximately 95% of the Belgian market.

Click the link to read the Q4 2022 Belsipa market report on retail structured products.