Vontobel Financial Products which houses the bank’s structured products business is ‘winning over new target groups through innovation’, according to the bank’s quarterly results

The Swiss bank has reported an increase its market shares in the first three quarters and also expanded into new segments with the launch of its new pension investments within its Deritrade digital platform which is expected to become an ‘increasingly important topic’ in the short term.

In the first phase, the bank has opened its deritrade platforms to relationship managers from more than 60 banks and 500 external asset managers to access pension solutions and banking services for their clients from a single source.

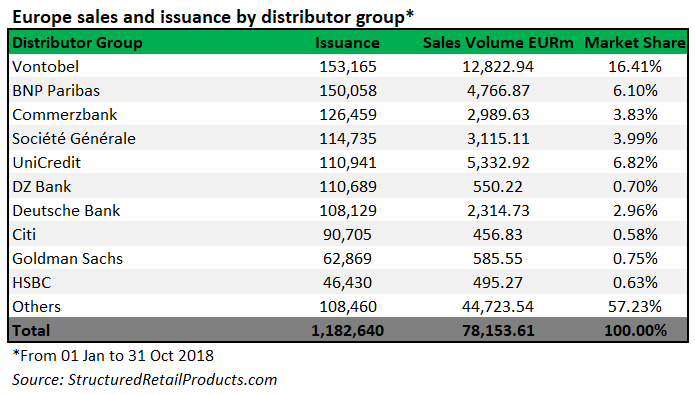

The Swiss bank retains the top position as the most active European issuer in the public distribution segment, excluding leverage and flow products, year to date- with 12,934 products marketed worth €12.1 billion, according to SRP data. The Swiss bank dominated European issuance and sales in the retail market in 2017 with 11,910 products and €11.4bn in sales.

Vontobel reported it remains on track in the third quarter of 2018, despite the fact that clients have been ‘unsettled and cautious due to volatile markets’. The bank predicted in its half-year results that the second half of the year would be comparatively difficult and require a careful approach.

‘This was borne out in the third quarter as investors held back, driving sales lower,’ stated the bank. ‘Overall, however, the first nine months of 2018 yielded solid results in line with Vontobel's expectations, confirming its broad-based growth trajectory.’

Advised client assets reached a new record high of CHF209.4 billion (US$207 billion). This growth was aided substantially by the client assets transferred following the acquisition of the former Notenstein La Roche Privatbank. Vontobel recorded net new money growth within its target range of 4-6% in the first three quarters, with Asset Management posting the strongest growth.

Including the client assets of the former Notenstein La Roche Privatbank, combined Wealth Management had CHF74.2 billion of advised client assets at the end of the third quarter, compared with CHF52.7 billion in the prior year. Former Notenstein La Roche staff have also increased the number of relationship managers serving wealth management clients in the Swiss home market and international focus markets to over 300.

The bank also reported that growth in net new money over the first nine months of 2018, excluding Notenstein La Roche, was within its target range of 4-6. The legal and technical migration of Notenstein La Roche Privatbank was successfully completed on September 30, 2018.

In addition, the acquisition of Lombard Odier's wealth management business with US-based private clients has also bolstered the bank’s growth in North America, while Vontobel Wealth Management is also ‘pressing ahead’ with targeted investments in digital platforms and technologies.

Vontobel Asset Management recorded advised client assets of CHF125.8 billion at the end of the third quarter, up from CHF114.6 billion a year previously. The growth in net new money was above the target range of 4-6%, helped in particular by fixed-income and multi-asset solutions as well as sustainable strategies.

"Our growth in 2018 confirms that clients are satisfied with the breadth and quality of services Vontobel provides. We are aware that our success depends heavily on the markets. The political backdrop in particular is increasingly unsettling the business world and ultimately our clients. Nevertheless,

‘We are maintaining our targets in terms of solid, long-term growth," stated Vontobel CEO Zeno Staub (pictured).

Earlier this week, the Swiss bank reshuffled the senior management of its structured products advisory and distribution, and transaction banking businesses following Georg von Wattenwyl’s decision to take charge of external asset managers business in Asia and family offices globally. From January 1, 2019, Peter Camenzind will take over from Von Wattenwyl as head financial products advisory and distribution.