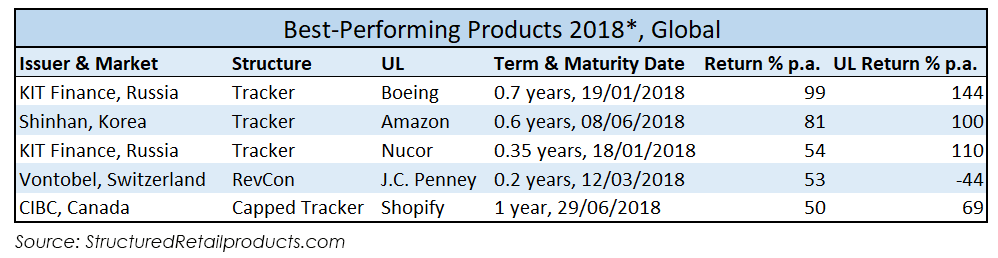

Investors in structured products globally have enjoyed annualised gross returns equal to 4.98% per annum (pa) in the 11 months to the end of November, 2018, SRP data* shows.

Going by payoffs, the Enhanced Tracker, which provides return proportional to the performance of the underlying, but at a greater rate than 1:1, is the best-performing of the mainstream structures, with 8.2% pa average return. Coming in second is the Knock Out, with 6.85%. However, none of the five best-performing not-flow products in the 11 months to the end of November were autocalls, and only one was an enhanced tracker (the fifth- placed one at that).

Another thing in common between the five best products is that they were all based on single stocks and were all short-termed. Significantly, all of the trackers underperformed their underlying, while the reverse convertible significantly outperformed it.

*For products maturing/knocking out between January 1 and November 30, 2018, gross returns only, including estimates

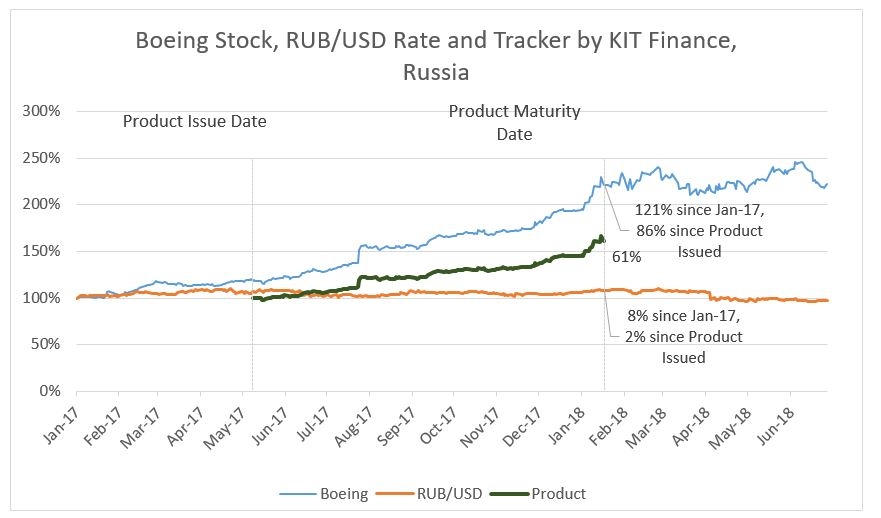

The best-performing product for 2018 according to SRP estimates is a Boeing-linked tracker by KIT Finance in Russia. Upon issuance, the product promised a return equal to 71% of the upside generated by the stock over the term of the investment, as well as full capital protection.

Upon maturity that occurred on January 19 after a term of about eight months, the stock had appreciated 86.47% hence the product generated a total capital return for investors of 61.39%, for an annualised return of 98.94%. Unsurprisingly, the product had some fortuitous entry and exit points with regard to the underlying stock, with Boeing’s stock having recently started rising above a historic plateau close to the strike date, and entering another, slightly more volatile plateau after the maturity date.

Notably, the product, and its return, is denominated in Russian rubles. While the Russian currency has experienced big swings in recent years, from issuance to maturity, the rate had actually gone up by 2%, meaning that the investment returns in dollar terms is actually about 63%.

Source: Yahoo Finance

While the underlying well outperformed the product in terms of gross returns, the product also featured full capital protection – meaning that this year the mantle of best-performing product goes to a fully protected structure for the first time in at least three years.

Coming in at second is a South Korean tracker product distributed by Shinhan. The product offered returns equal to the performance of Amazon (meaning there was no protection at all), which stood at a gross 47.5% at maturity, some seven months after issuance.

Notably, this product is one of only four simple trackers made available to the retail market in Korea since the beginning of 2017, with the other three featuring exposure to commodities and tenors of five years or more. Furthermore, upon issuance, the Shinhan Amazon tracker had collected only about KRW 70m (US$62,000) in sales, ranking in the single-digit percentiles in Korea for 2017.

The third-best-performing product for 2018 again comes from Russia, and KIT Finance. Unsurprisingly, it also features a single stock, Nucor this time, and has a short term, with lower, but unlimited participation in the upside of the underlying. The US steelmaker registered just over 29% increase in its stock price over the four months from the issuance of the KIT product to its maturity.

While the participation rate of just 55% pared returns for KIT investors, like the other KIR product in this ranking, and unlike all three of the other products, the Nucor tracker also featured full capital protection. Meanwhile, much like the Boeing tracker, the RUB/USD rate during the term of this product also rose, albeit only by 1%.

Moving onto Western Europe, the fourth-best-performing product for 2018 comes from Switzerland, and it is the only non-tracker structure to make the list this year. The Vontobel-issued reverse convertible features an extremely high annual coupon rate, short term and a relatively deep contingent capital protection barrier, making for a potent formula that generated a number of extremely high-performing products for Vontobel this year. The best of these was linked to the stock of J.C. Penney, paid a fixed 8.05% over the two-month term of the product, and returned full capital as the underlying stock was above the barrier of 65% of the initial level at all times. In all, SRP estimates that the product returned an annualised 52.58% per annum.

Notably, over the same period, the underlying stock had depreciated by 10%, which would amount to a -44% comparable annualised return from the underlying, making this product the only one in the top five to outperform its underlying.

Finally, the Americas also make the list, courtesy of a Canadian capped tracker linked to the stock of Shopify. The product features enhanced participation at 200%, but also a cap at 25% appreciation, for a total cap on the return at 50%. The stock of Shopify easily beat the cap, climbing 69% over the one-year term of the product. Notably, the year-on-year growth of the underlying stock on the strike date was 285%.

*The data in this article is up-to-date as of writing on December, 11, 2018.