When I first started to become familiar with the South African market, one of my first questions was: why so much investment in foreign currencies? As a Portuguese national who grew up in the eurozone and lives in the UK, how could you understand the risks of investors living in an emerging market? I certainly couldn’t.

The truth is that currencies in developing markets, like the South African Rand, are more affected by pressures compared with those in developed markets. A rapid depreciation can be the result of several factors, from the US interest rates and debt environment, to local economy issues or political events, but always with one result: diminished purchasing power, as imports become more expensive.

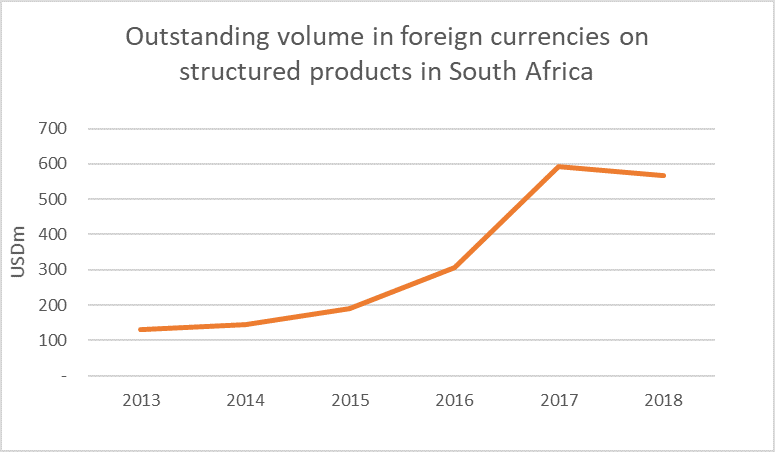

As such, the structured product market came up with an easy solution: issuing the products in foreign currencies. Since 2013, the market has seen a 200% growth in the total outstanding notional in foreign currencies structured products, alongside a depreciation of the South African Rand, which enabled investors to preserve their capital. Allied with capital preservation in foreign currencies, the average annualised return of 7.3% of all products matured since 2013, gave South African investors a fulfilment of capital preservation that they couldn’t on other investment products.

Source: StructuredRetailProducts.com

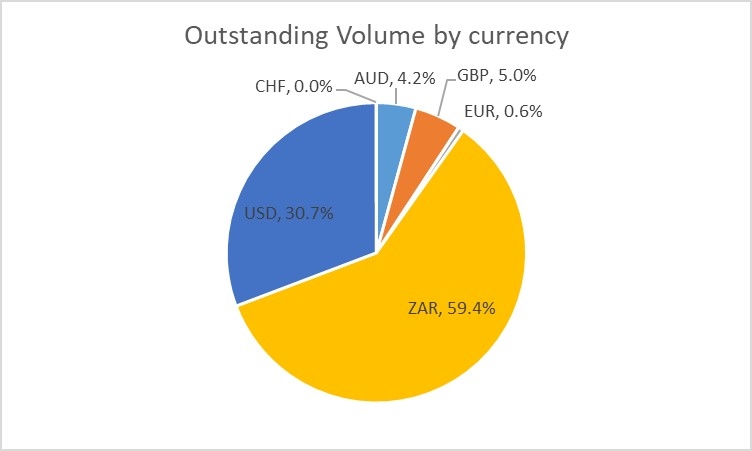

Nevertheless, although the risk of depreciation of the South African rand has decreased, investors added other currency risks to their portfolio. According to the current outstanding volume by currency issued, USD represents almost 31% of total products held by investors, followed by the British pound sterling with 5% and the Australian dollar with 4.2%.

With Brexit looming, the US trade war and the constrains of an economy heavily dependent on commodities, such as Australia, South African investors need to take a view on the domestic currency. Has the South African Rand hit the bottom or will it continue to depreciate?

Source: StructuredRetailProducts.com