The bank has paid A$690,000 (US$494,000) in compensation to customers who were mis-sold complicated investments, mainly structured products. The UK bank has also halted providing all personal financial advice.

The redress payouts come as Australia’s financial regulator concludes its almost three-year review on HSBC’s structured products sales between 2009 and 2013. HSBC reviewed all of its advice on structured products and lodged a breach notification with the regulator, reporting potential deficiencies in the advice provided to approximately 464 of the 557 clients reviewed.

The amount covers compensation for its non-compliant structured product advice cases that accounted for about one-fifth of 510 advice files reviewed. The bank was also found to have provided inappropriate advice on other complex investments such as superannuation and annuities. The frequency of falling short of regulatory standards, however, was much lower for such products.

In relation to the products sold, the Australian Securities and Investments Commission (Asic) previously said that ‘the scope of advice was restricted to a single HSBC structured product,’ and ‘there was insufficient evidence that the advice was appropriate for the clients’ circumstances or needs’.

Asic has accepted an enforceable undertaking from the bank to review and compensate its clients in 2016. The financial watchdog accepts the pledge as an alternative to civil or administrative action against a breach of a legislation it administers.

The enforceable undertaking came after the regulator’s monitoring of sales of structured products, for which results were first released in a May 2013 report. In the review almost six years ago, Asic warned 10 banks that they were misleading investors on the capital protection feature of a structured product and providing inaccurate information.

As a result of the regulator’s decision, HSBC stopped offering structured products to retail clients in March 2013. As the investigation was carried out HSBC was ordered to develop and implement a remediation plan to ensure that affected clients were reviewed and remediated in an ‘efficient, honest and fair manner’; and appoint an independent expert to report to Asic on the adequacy of HSBC's review and remediation program.

Ernst & Young assessed HSBC’s review under the enforceable undertaking. The consultancy firm determined that the bank had ‘materially delivered on its requirements’. It added that the bank posed no ongoing financial advice risk as it ceased providing all personal financial advice to customers in March last year.

The enforceable undertaking requires the bank to appoint an independent expert, which in this case, was Ernst & Young.

The Australian watchdog has already forced 10 Australian financial firms including Westpac Banking Corp, Sentry Financial Services, Meritum Financial Group, MASU Financial Management, Madison Financial Group, HSBC Bank Australia, Genesys Wealth Advisers, FSS Advisory, Count Financial and Consultum Financial Adviser to undertake corrective action to address shortcomings around advice on complex structured investment products.

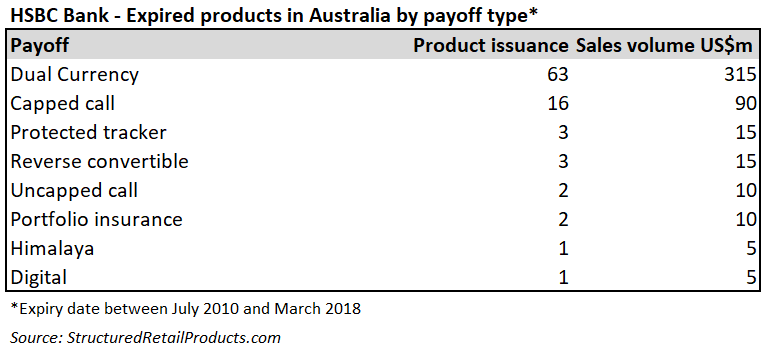

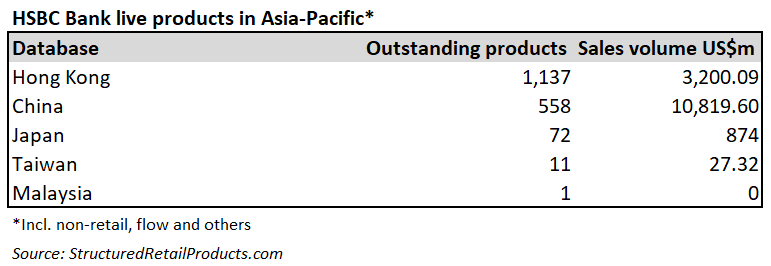

According to SRP data, among the institutions reviewed by the Australian regulator have distributed more than 1,000 structured products in and outside of Australia since 2001. A total of 751 structured products are live in Australia with their sales volume totalling US$1.6 billion, according to SRP data.

An Asic spokesperson said: “We are pleased to have provided ASIC and the independent expert with assurance that we have effectively addressed the issues covered by the undertaking.”