The oldest independent institution in the Netherlands has collected more than €4 million in commissions on structured products despite lower issuance levels

Van Lanschot Kempen has reported a net result of €80.3m for 2018, down from €94.9m the previous year. Assets under management stood at €67 billion at year-end while gains on structured products were lower than last year, due to a lower volume issued, according to the bank.

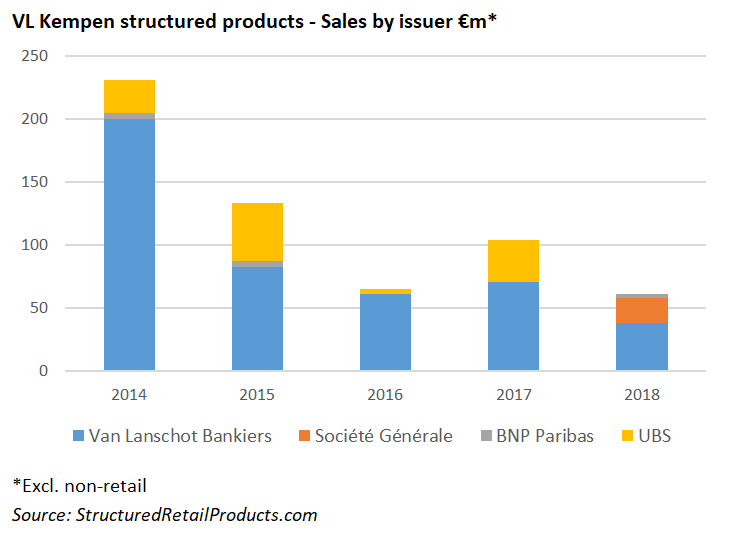

Kempen distributed eight public offers with estimated sales of approximately of €60m in the Netherlands in 2018, compared to 13 structured products worth €100m in 2017, according to SRP data. Last year's products included six products issued on the paper of parent company Van Lanschot Bankiers and one product each was issued via BNP Paribas and Société Générale, respectively.

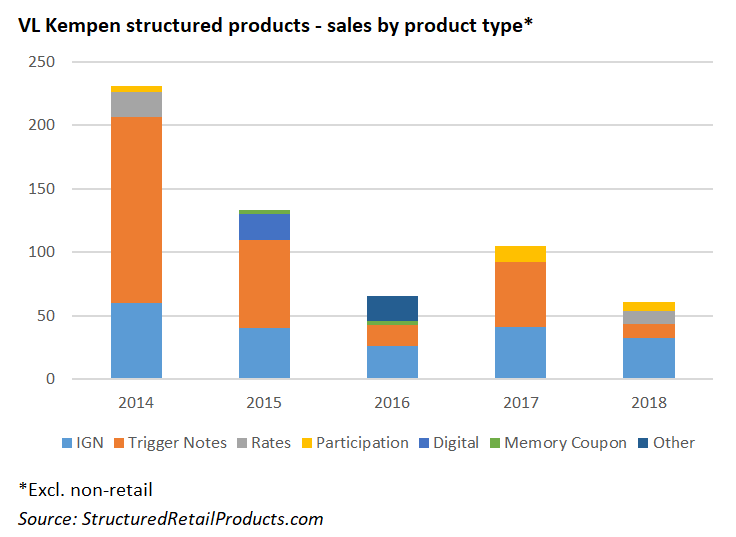

The Eurostoxx 50 index was used as the underlying index in four products, including the VL Trigger Note Eurozone 18-23, while the local AEX-Index was used in two structures. Single products were linked to the Stoxx Europe Small 200 index and the constant maturity swap rate.

Four of the products had an autocallable feature, and provided soft protection only; three products protected minimum 90% of capital; and one product was fully protected.

Financial liabilities at fair value through profit or loss, which include non-structured debt instruments such as floating-rate notes and fixed-rate notes, and structured debt instruments such as index guarantee notes (IGNs) and trigger notes, stood at €940m at December 31 2018, down from €971m at December 31 2017.

At the end of 2018, the bank’s funding ratio had increased 5.7 percentage points to 106.2% (year-end 2017: 100.5%) in the wake of a decline in loans and advances to clients (-6%) and in savings and deposits (-1%). In June 2018, a senior unsecured bond was redeemed and in December 2018 a residential mortgage-backed security (RMBS) was redeemed. Overall issued debt securities fell by €0.9 billion in 2018 and the bank no longer has RMBS and benchmark unsecured debt issuances placed with investors.

The merchant banking division, which includes the structured products team, reported a strong increase in commission income in 2018 at €58m (2017: €41.7m). Seven percent of the total commission, or €4.1m, could be attributed to structured products.

Commissions in the securities division, at €238.5m, were up €4.2m thanks to AUM net inflows and the acquisition of UBS’ wealth management activities in the Netherlands, with management fees up by €6.7m and transaction fees down by €3.3m. In addition to providing structured products services to Van Lanschot Private Banking, the division was able to do more business in the OTC market, closing 143 deals in 2018 (2017: 194) worth €181m in new notional (2017: €294m).

‘We have had a reasonably good year in terms of our performance and our ability to pursue our goals with respect to wealth management,’ said Karl Guha (pictured), chairman of the statutory board, commenting on the results. ‘Like most financial institutions operating in our space, we felt the impact of market volatility, particularly towards the end of 2018, on our earnings.’

Click the link to view the full Van Lanschot annual report, performance report and presentation.