The Swiss bank reports significantly higher structured derivatives revenues boosted by large tickets in Switzerland and Brazil

Credit Suisse’s net income attributable to shareholders stood at CHF749m (US$734m) in the first quarter of 2019, the highest quarterly profit since 3Q2015, according to the bank first quarter results.

Equity sales and trading revenues in the global markets (GM) division, at CHF540m, increased 10% year-on-year. Equity derivatives revenues increased compared to the same period of 2018, reflecting significantly higher structured derivatives revenues due to increased client activity. Equity sales and trading revenues increased 52%, mainly due to a seasonal increase in client activity and more favourable market conditions, compared to the fourth quarter of 2018.

The bank’s international trading solutions (ITS) franchise, a collaboration between GM, Swiss Universal Bank and international wealth management, increased its net revenues by 23% year-on-year.

Landmark transactions in ITS included SMI Income Maximizer certificate, a flow structured product which was distributed among private banking clients in Switzerland and collected sales of US$175m. The open-ended certificate tracks the CS Swiss Equity Enhanced Call Writing Index and is available in two tranches: one with a minimum denomination of CHF500k (CH0373575833) and one with a denomination of CHF1k (CH0373575841). In Brazil, an exclusive structured note issued in partnership with a leading asset manager accumulated sales of US$650m, according to the bank.

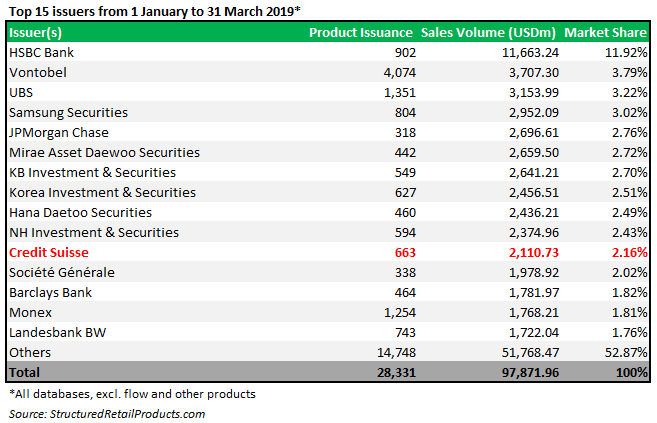

Credit Suisse was the issuing company behind more than 650 structured products (excluding flow and others) in the first quarter of 2019, according to SRP data. The structures sold a combined US$2.1 billion, more than 50% of which was accumulated by 408 notes sold by the bank in the US market (US$1.1 billion).

Almost all of Credit Suisse’s products in the US were tied to equities – predominately index baskets (205 products) and single indices (121 products) – with a wide range of parties, including, among others, Incapital, Morgan Stanley, Raymond James, UBS and Wells Fargo, taking care of the distribution.

In Taiwan, Credit Suisse was the issuing party behind 90 products (US$304m) which were available from 14 different distributors including Cathay Securities, Citibank, E Sun Bank, EnTie Bank, and Standard Chartered.

Seventy-five products (US$150m) were sold in the bank’s domestic market Switzerland while CS was also active in Germany, Japan, Sweden and the UK during the quarter.

Private banking net revenues of CHF1 billion decreased slightly compared to 1Q2018. Transaction- and performance-based revenues of CHF354m increased 14%, primarily driven by higher revenues from ITS, higher corporate advisory fees related to integrated solutions and higher levels of structured product issuances.

Quarter-on-quarter, transaction- and performance-based revenues increased 55%, reflecting higher client activity with higher levels of structured product issuances and higher revenues from ITS, according to the bank.

In Asia Pacific, net revenues increased 69% q-o-q, reflecting higher fixed income and equity sales and trading revenues. Fixed income sales and trading revenues increased significantly, mainly driven by higher revenues from credit products, structured products, foreign exchange and developed market rates products, mainly because an improved trading performance and higher client activity. Equity sales and trading revenues increased 17%, mainly due to higher revenues from equity derivatives.

‘In a challenging quarter, which was the first after the end of our three-year restructuring, we achieved our fifth consecutive quarter of positive income with net income of CHF749 million, up 8% year-on-year,’ said Tidjane Thiam (pictured), chief executive officer, commenting on the bank’s results.

Click the link to read the full Credit Suisse first quarter 2019 financial results, earnings release, and the presentation.