Revenues in both fixed income and equities trading dropped drastically year-on-year in the fourth quarter ending in March as Nomura’s wholesale business posted a pretax loss of JPY13 billion (US$116 million).

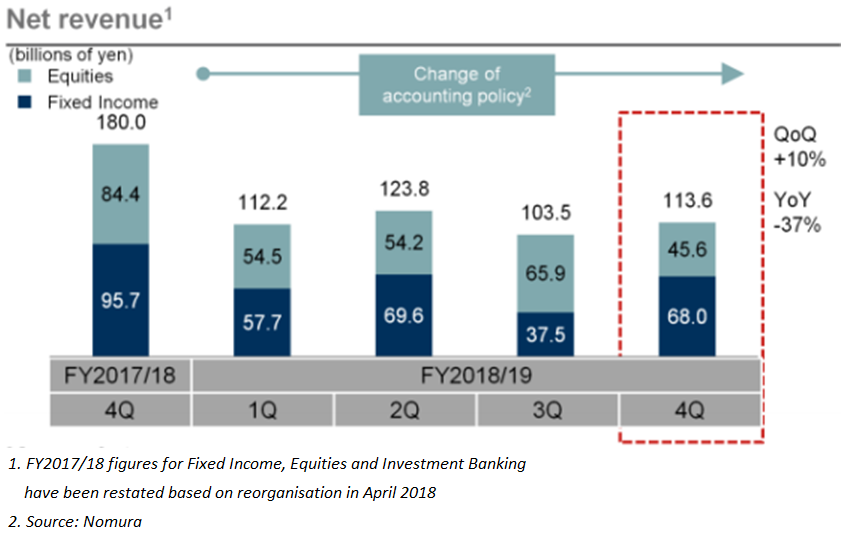

Nomura posted a 46% drop in revenue from equities trading to JPY45.6 billion in the fourth quarter from the same period a year earlier due to subdued volatility levels. The Japanese investment bank said ‘lower market volumes and low volatility for most part of the quarter impacted cash equities and derivatives.’

The bank’s revenue from fixed income trading also plunged 29% year-on-year to JPY68 billion. From a quarter earlier though, the revenue rose over 80% because of the bond market rally earlier this year that was boosted by the US Federal Reserve’s dovish pivot.

The overall revenue of global markets business was down 37% in Q4 from a year ago to JPY113.6 billion, while the bank reported its first annual net loss in a decade of JPY100.4 billion.

The bleak results came after Nomura announced a restructuring plan that includes cutting US$1 billion in costs from its wholesale business. The bank explained that it is facing ‘challenges’ in the wholesale business due to declining fixed income revenue. It attributed the drop to factors like ‘margin compression’ prompted by automation and ‘shift from active investment to passive.’

Nomura also booked a JPY81 billion goodwill impairment charge from its wholesale segment in the previous quarter ending in December.

The Japanese bank was the issuer of only five products in the first quarter of this year targeted at institutional investors globally, according to SRP data. The products are all income generating and have a tenor of less than six years. The bank sold a combined US$38.7 million with the structures, which included the callable compounding coupon notes, a 20-year income product linked to the appreciation of the US dollar relative to the Korean won.

The year ended March 2019 was challenging, with net revenue of JPY1.1 trillion, down 25% year-on-year, and loss before income taxes was JPY37.7 billion, said Takumi Kitamura (pictured), chief financial officer, commenting on the results. ‘Last quarter trading revenue dropped due to uncertain market conditions, but this quarter all products posted stronger results, particularly rates and credit,’ said Kitamura.

Nomura released its financial results for full year ending in March 2019 on April 25. Click the link to view the full presentation, the financial summary, and the Q&A.