Its global markets and global wealth units reported a drop in figures in spite of the bank launching in March the highest selling structured product in the US market

Bank of America has reported net income of US$7.3 billion in its first quarter of 2019, a 6% rise year-on-year but on par with the level seen at the end of 2018. The boost in earnings came primarily as a result of a 25% rise in profits in its consumer banking segment, which reached US$3.2 billion, and a 14% rise in its global wealth & investment management business (US$1 billion).

Total net revenue was also stable in Q1, US$23 billion, again driven by consumer banking figures.

Revenue in the bank’s global markets unit was down 13% during the quarter, however, at US$4.2 billion, because of a drop in sales and trading revenue and lower investment banking fees. According to the bank, FICC revenue of $2.4 billion was 8% lower from Q1 in 2018, due to lower client activity across most businesses while equities revenue of $1.2 billion decreased 22% from a record year-ago quarter that benefited from higher client volumes and a strong performance in derivatives on elevated market volatility.

The situation was similar in its global wealth unit, where sales dropped 1%.

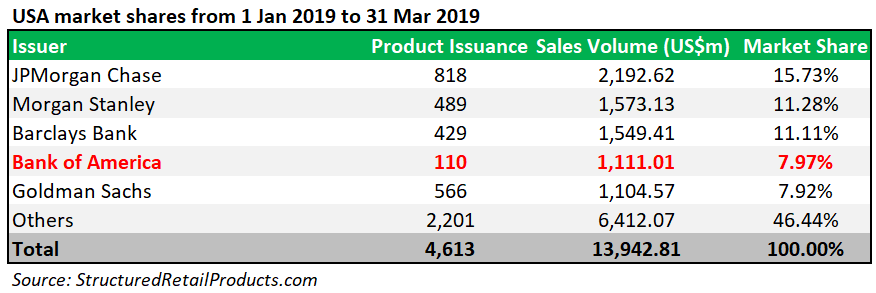

The Charlotte, NC-headquartered firm is the fourth largest bank in the US, with an 8% market share, according to SRP data, behind JPMorgan Chase (15.7%), Morgan Stanley (11.3%) and Barclays (11.1%).

It sold 110 structured products, all of them structured notes, during the quarter ended March 31 2019, amounting to sales of roughly US$1.1 billion.

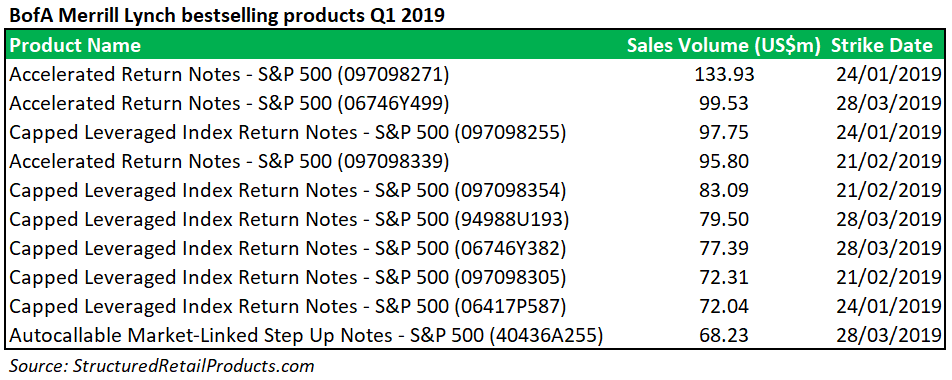

Its best-selling products were Accelerated Return Notes linked with the S&P500 as an underlying, bringing in approximately one-third of its total structured product sales. One of these products, a collaboration between Merrill Lynch and Barclays, has become the highest selling structured product in the US market in March. The 14-month Accelerated Return Notes 06746Y499 sold US$99.5m at inception.

Its best-performing product was a Trigger Phoenix Autocall Optimization Security, linked to General Electric as an underlying, and distributed by UBS Financial Services. This had a performance of 30.74% pa.

Just over half of the products issued during the quarter were linked to the S&P500, followed by the Russell 2000 index (26) and the Eurostoxx 50 (16), SRP data shows.

Click the link to view the full Bank of America first quarter 2019 results.