International regulators have been calling for alternative risk-free rates to replace interbank offered rates (Ibors). Such a transition is particularly urgent in the jurisdictions where the relevant Ibor will likely be discontinued.

The reform of interest rates benchmarks also affects structured products with more than 2,000 live products linked to the London interbank offered rate (Libor) – which is set to be discontinued at the end of 2021 – the Euro interbank offered rate (Euribor), or the constant maturity swap (CMS), a reference index which is supported by Libor or Euribor.

It would be increasingly uncomfortable to enter new businesses that reference Libor and mature after 2021, according to Edward Schooling Latter (pictured), director of markets and wholesale policy at the FCA, speaking at a Linklaters seminar on the future of global interest rate reform in London on July 4.

“There have been no public Libor-linked bonds since January this year,” said Schooling Latter, adding that seeking alternative products is going to be the hardest in the bond market, with the derivatives market already having alternatives in place.

“The FCA will be looking if books of outstanding maturing products after 2021 are managed down,” he said.

Every change can have consequences for structured products and there is a risk that products will be adjusted, or reimbursed early, in the event of changes to the benchmark indexes or their replacement by alternative reference rates.

According to Mark Brown, derivatives partner at Linklaters, a number of issuers in the structured product space have adapted to the benchmark supplement.

“Certain structured product programmes have fallbacks built in to provide the possibility of early termination [when Libor is phased out],” he said.

No one anticipated that the Ibors would permanently disappear, said Rick Sandilands, senior counsel Europe, International Swaps and Derivatives Association (Isda).

“We have to have something in place [by end 2021] otherwise we end up with severe market disruption,” said Sandilands.

Doug Laurie, director and wholesale lending programme lead for strategic initiatives including benchmark reform and Brexit, Barclays, said he believes that most people still see the Libor transition as a 2020 problem, with too little being done right now. “I don’t expect the momentum to pick up until after this year. Infrastructure to support new products is vital,” he said. “Then there is education, making sure all our clients are aware of this and making contingency plans.”

A big focus needs to be on new products, agreed Serge Gwynne, partner, corporate and institutional banking practice, Oliver Wyman. “Without new products you cannot transition away from Libor.”

However, according to Wyman, “many corporates still like Libor and don’t want to move away from it”.

“They don’t like the costs associated with [moving away from Libor] either,” he said.

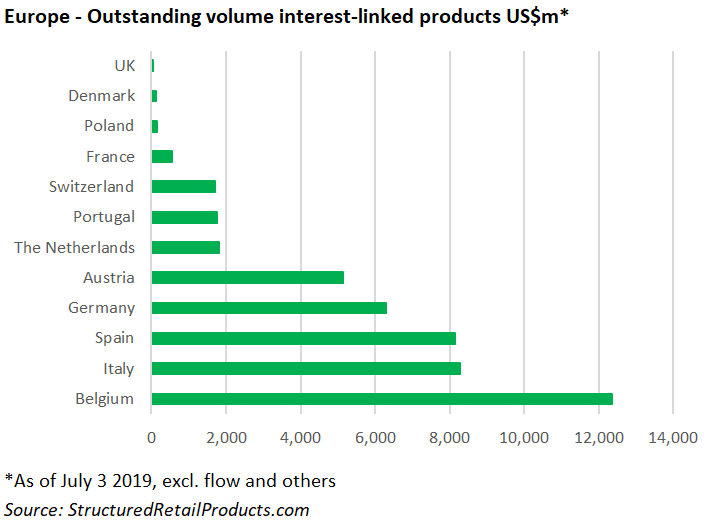

The outstanding volume in Europe for the 2,000 plus structured products linked to Libor, Euribor or CMS rate is almost US$50 billion, according to SRP data. The Belgian market, with US$12.5 billion from 455 products, is the main provider of interest-linked products in Europe, followed by Italy (US$8.3 billion from 94 products) and Spain (US$8.1 billion from 50 products).