ABN Amro started the preparations for the introduction of €Str while ING Group’s commitment to sustainable and green financing achieved ‘good’ commercial results in the second quarter of 2019.

ABN Amro reported a net profit of €693m in the second quarter, reflecting ‘higher net interest income, continued solid operational performance, and moderate impairments,’ said Kees van Dijkhuizen (pictured), CEO, commenting on the bank’s results.

Although ABN Amro no longer rolls out structured products from its own issuance programme, since it closed its equity derivatives desk in 2014, the bank still has a number of interest linked products outstanding, including five structures tied to the constant maturity swap rate in The Netherlands.

Issued debt securities, at €75 billion, grew by €1.1 billion compared to March 31 2019. Short-term funding declined by €0.7 billion, while long-term funding increased by €1.8 billion. Compared to year-end 2018 issued debt securities came down by €5.8 billion as the need for wholesale funding declined, according to the bank.

ABN Amro is preparing for the introduction of the euro short-term rate (€Str), the replacement of the euro overnight index average (Eonia) and the reform of the Euribor.

These preparations include amending contracts were necessary to ensure a ‘smooth transition’ in case current benchmark rates cease to exist, according to the bank.

Interbank offered rates (Ibors), which are used by market participants as a reference for interest rate payments for cash products and derivatives and for valuation of derivatives instruments, can be found within ABN Amro in a wide range of products such as over-the-counter (OTC) derivatives, securitised products, loans, deposits, and floating rate notes, etc.

ING posted a 2Q2019 net result of €1.4 billion.

Debt securities in issue stood at €118 billion at June 30 2019, down from €120.6 billion the prior quarter, and also a decrease compared to €119.7 billion at year-end 2018.

In wholesale banking, the underlying result before tax stood at €553m, down from €675m one year ago. The decrease mainly reflected lower income in financial markets – the business responsible for the distribution of structured notes and OTC derivatives to the bank’s own retail and private banking clients – for which the market conditions in the second quarter ‘remained challenging’.

The bank issued 1,113 sprinter certificates in The Netherlands during 2Q2019, according to SRP data. The majority of the bank’s leverage products (621) were linked to a single share, of which Arcelor Mittal (47 products), ASML (35), Bayer (30), and ASMI (29) were the most frequently used. A further 365 sprinters were linked to a single index, including the AEX (169), Dax (87), and S&P 500 (29).

In Belgium the bank sold two memory coupon notes, one floating rate note, and one switch rate note, for a combined volume of €115m, while in Poland three structured deposits were distributed via ING Bank Slaski in the quarter.

Total underlying income in wholesale banking was €1.3 billion, six percent lower than in the same quarter last year, predominately due to lower revenues in financial markets and treasury & other, according to the bank.

ING conducted 26 sustainable bond transactions and 12 sustainable loan transactions during the second quarter. The former included 20 green bonds, one social bond and five sustainable bonds. Among them was a €750m green bond for Vodafone whose proceeds will go towards energy efficiency, renewable energy and green buildings.

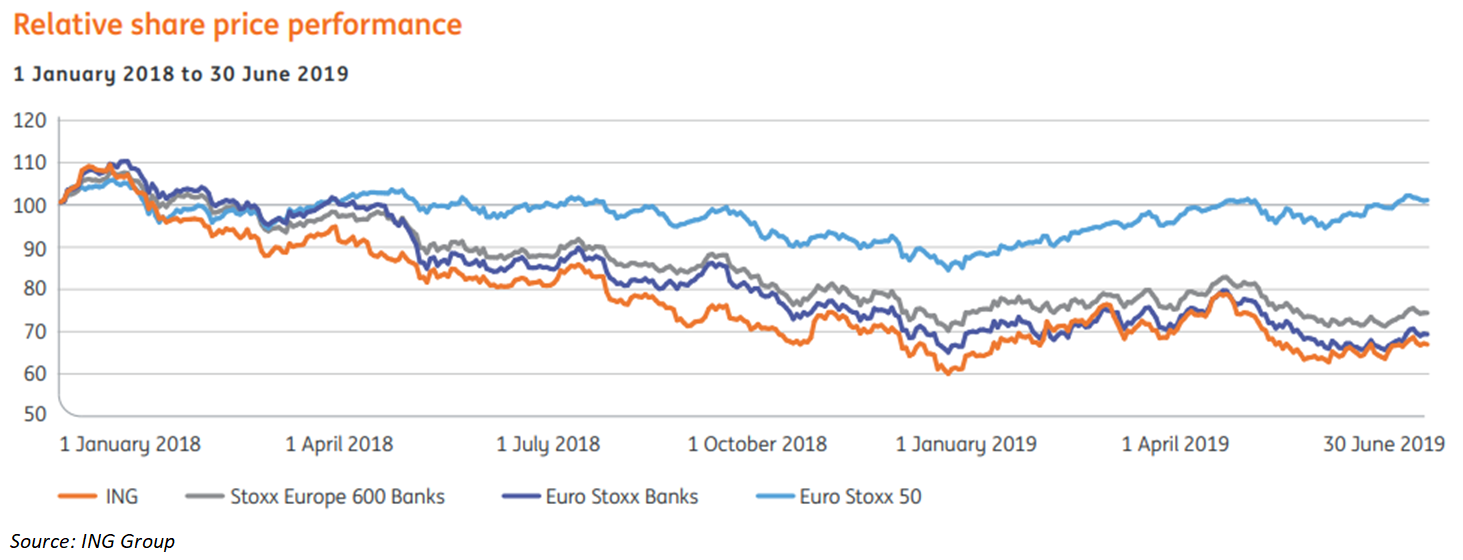

‘Higher volumes and resilient lending margins supported earnings despite the ongoing low interest rate environment,’ said Ralph Hamers (pictured right), CEO of ING Group. ‘Looking ahead, we expect that persistently low interest rates will put pressure on net interest income.’

Click the link the read the full second quarter 2019 report for ABN Amro and ING Group.