The German bank started the transfer of the markets and commodities division sold to Société Générale in 2018 but this isn't expected to complete this year.

Discontinued operations, which include the income and expenses of the equity markets & commodities (EMC) division sold to Société Générale, posted a result after tax of €12m.

Major parts of the discontinued operation were already transferred to Société Générale by June 30 2019 or will be transferred before the end of 2019, including the complete transfer of the asset management business.

Parts of the development and issuing of structured financial products business have also already been transferred, with the opportunities and risks arising from the associated assets and liabilities initially being transferred ‘synthetically’ to Société Générale through the conclusion of corresponding derivative transactions.

However, due to the ‘scope of the transactions and the employees to be transferred’ as well as the ‘complexity of the individual transfer processes,' it will not be possible to complete all the transfers in 2019 or by 30 June 2020, according to the bank.

The legal transfer of the relevant assets and liabilities, which also requires their derecognition from the balance sheet, will only take place at later stages in the transaction from 2019 onwards and is expected to be completed in 2021. The economic transfer to the purchaser will be largely completed within a year. Only legal transfers will then still follow.

Commerzbank posted a net profit of €391m in the first half of 2019. It said that in spite of an ‘extremely challenging environment,' it managed to increase net interest income though operating profit for the first six months was €542m, compared with €659m in the prior-year period.

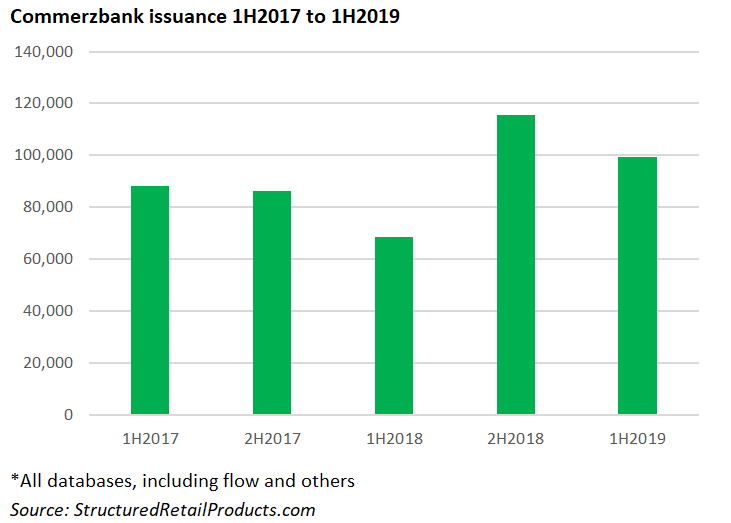

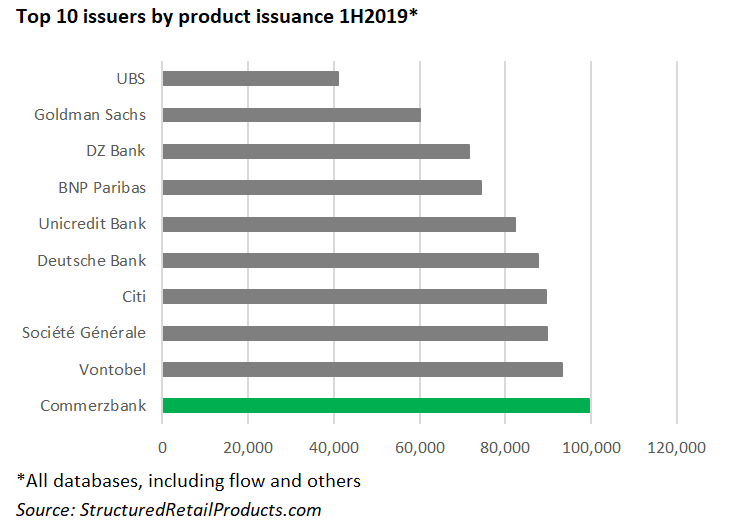

The bank was the most active manufacturer of structured products in 1H2019, issuing just under 100,000 structured products between January 1 and June 30 2019, up 45% from the 68,465 products launched in the same period last year, according to SRP data.

The vast majority were listed flow and leverage certificates which can be traded in Stuttgart and Frankfurt and at the Euronext Amsterdam and Paris exchanges.

Financial assets held for trading were €47.7 billion at the reporting date, up €5.2 billion on the figure at year-end 2018. While positive fair values of interest rate derivatives rose by €3.8 billion, positive fair values of currency and equity derivatives fell by €0.8 billion overall. Securitised debt instruments increased by €2 billion.

Liabilities held for trading which comprises derivatives that do not qualify for hedge accounting, own issues in the trading book and delivery commitments arising from short sales of securities included €42m of certificates and other issued bonds as of June 30 2019, down 14.4% from €49m end-December 2018.

The Commerzbank share gained 9.3% compared to a rise of just 1.3% for the Eurostoxx Banks index with the above-average performance attributable both to talks with Deutsche Bank about a possible merger and to general takeover speculation.

Commerzbank raised a total of €5.9 billion in long-term funding on the capital market in the first half of 2019. The average term of all issues made during the reporting period was over eight years. In the unsecured area, the bank issued two preferred senior benchmark bonds with a total volume of €2.25 billion and terms of five years and seven years respectively in 1H2019.

‘We were able to further strengthen our common equity ratio as business continued to grow,’ said Stephan Engels (pictured), chief financial officer. ‘At the beginning of July, we also optimised our capital structure and further strengthened our total capital by issuing our first AT 1 bond which was significantly oversubscribed.’

Click the link to read the full second quarter 2019 results, presentation, and interim report.