DBS Bank has launched a partnership between DBS Private Bank and DBS Vickers Securities (Thailand) to double its wealth assets under management in Thailand from SGD4 billion (US$2.9 billion) to SGD8 billion by 2023.

DBS Bank has launched a partnership between DBS Private Bank and DBS Vickers Securities (Thailand), in a move to double its wealth assets under management in Thailand from SGD4 billion (US$2.9 billion) to SGD8 billion by 2023.

The Singaporean bank is targeting Thailand’s growing pool of high-net-worth individuals (HNWIs) who are increasingly looking to diversify their portfolios and access investment opportunities overseas, according to Said Sim S Lim (pictured), group head of wealth management and consumer banking, DBS Bank.

‘We believe the Thai wealth market holds immense potential, having witnessed Thai investors’ growing sophistication and receptiveness to investment ideas, and the Bank of Thailand’s encouraging regulatory stance towards offshore investments,’ said Lim. ‘We’ve served Thai investors for over two decades through our securities business and understand their needs and preferences.’

With our strong Asian expertise and connectivity, leading digital capabilities, and reputation as Asia’s safest and the world’s best – we seek to become a trusted partner by providing customers with seamless access to opportunities and wealth management solutions both within and beyond Thailand’s shores.”

The partnership seeks to provide wealth clients in Thailand with access to a fully integrated onshore and offshore wealth management suite of products. To cater to rising demand, the bank also aims to double its headcount for wealth relationship managers (RMs) in Thailand by 2023.

By combining DBS Vickers Securities (Thailand)’s onshore offering across funds, equities, structured notes and bonds, as well as strong Thai market advisory, with DBS Private Bank’s global wealth expertise, extensive Asian network and full suite of offshore wealth management solutions and platform, the bank seeks to offer a first-in-market ‘one-stop’ shop.

DBS is an active player in the Asia-Pacific structured products market with 251 products worth an estimated US$813.5m sold in 2019, according to SRP data.

Most of the DBS products listed on SRP database were issued in Taiwan (241 products), including some of the best performing autocallable notes in the region (such as 7M USD Knock-in Memory Autocallable Note 078000006422 and 8M GBP Knock-in Memory Autocallable Note 078000006421 as well as range accrual notes like 12M USD Memory Autocallable Range Accrual Note 078000006419). Year to date, the bank has also marketed 11 structures in China with an estimated value of US$188m.

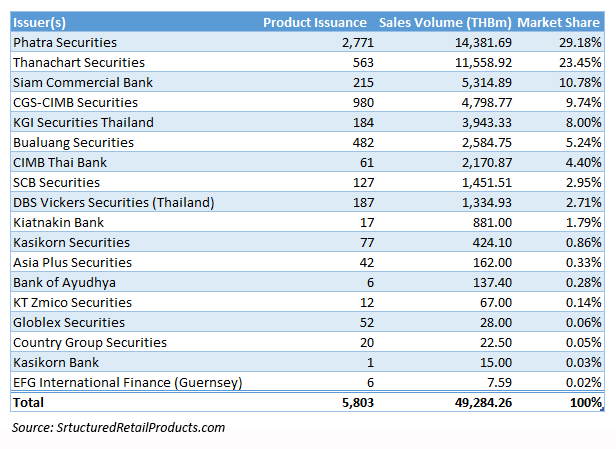

In Thailand, DBS Vickers Securities (Thailand) is also a regular provider of structured products with 187 products marketed so far this year worth an estimated US$42m.

Going forward, the new suite of products will be delivered to clients via their relationship manager, who will serve as a single point of contact. Under the new structure, DBS’ wealth clients in Thailand will be able to access and manage their investments in one place. In contrast, existing market practices require investors to go through separate entities for their investment needs – one for onshore and another for offshore.

Thailand’s wealth population has shown rapid growth over the last few years. The nation’s 122,000 HNWIs recorded in 2017, almost equal the number of HNWIs in Singapore.

According to DBS, much of Thai wealth is held in family-owned businesses, which are key drivers of Thailand’s economy – accounting for more than 80% of the nation’s GDP and over one-third of listed firms on the Stock Exchange of Thailand.

DBS believes that these family businesses will be well-served by the bank’s unique one-bank proposition, which provides access to offerings across wealth management, retail, investment and corporate banking. During the first three months of this year.

DBS has been operating a securities business in Thailand since 1998. Today, DBS Vickers Securities (Thailand) holds a full securities licence and has established its position as a leading securities company in Thailand.