The bank is the leading issuer of structured products in the third quarter of 2019 in the US, despite ‘weaker’ client activity in equity derivatives.

JP Morgan reported a net income of US$9.1 billion and earnings per share of US$2.68 in the third quarter of 2019. In the corporate and investment bank (CIB), net income was US$2.8 billion, up seven percent from the prior year quarter with net revenue, at US$9.3 billion, up six percent.

Equity markets revenue was US$1.5 billion, down five percent against ‘a very strong’ third quarter last year, with the performance of equity derivatives ‘challenged’ by lower client activity and unfavourable market conditions, according to chief financial officer Jennifer Piepszak.

‘In equity derivatives, it was a combination of weaker client activity and some losses on inventory, but it wasn't meaningful,’ said Piepszak, adding that those losses were ‘certainly not meaningful in the grand scheme of things, but they were part of the equity derivative story’.

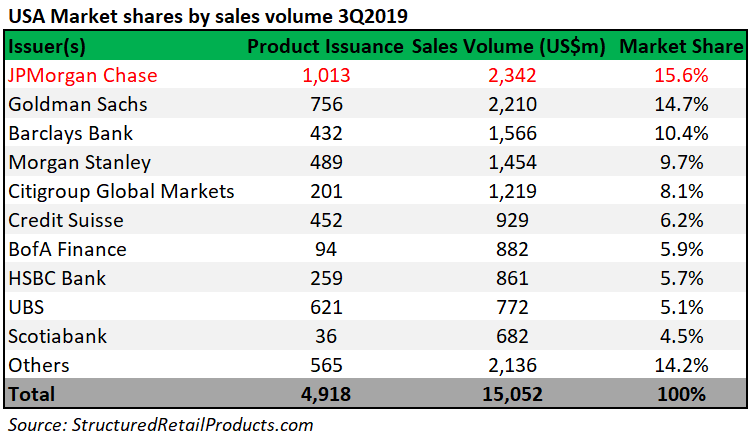

JP Morgan was the most active issuer of structured products in the United States, with a 16% share of the market, ahead of Goldman Sachs (14.7%) and Barclays (10.4%), according to SRP data.

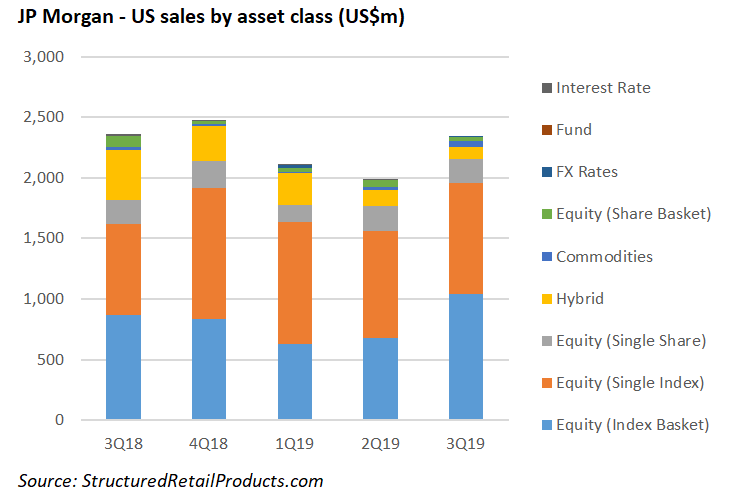

The bank collected US$2.3 billion from 1,013 structured products during the quarter, down from US$2.4 billion (818 products) registered in the comparable quarter last year, but an increase from US$1.9 billion (906 products) in 2Q2019.

Equity-linked products dominated JP Morgan’s issuance in the third quarter, with more than US$1 billion accumulated from 435 structures tied to an index basket. Three hundred and fifty products worth US912m were linked to a single index, including the bank’s proprietary JP Morgan Balanced Value Dividends and JP Morgan ETF Efficiente DS 5 indices, which were seen in 21 and 19 products, respectively. A further 94 structures with combined sales of US$206m were linked to a single share of which Amazon (13 products), Nvidia (10) and Netflix (five), were the most in demand.

JP Morgan’s products were distributed via, among others, First Trust Portfolios, GS Private Banking, Incapital, Raymond James and UBS. The Trigger Performance Leveraged Upside Securities (48132G641), the bank’s best-selling structure of the quarter, was distributed via Morgan Stanley Wealth Management. The three-year unlisted registered note, which offers 200% of the rise in the Russell 200 Index, collected US$28.8m during its subscription period.

Net income in asset & wealth management was US$668m, down eight percent, while net revenue was flat at US$3.6 billion, with the impact of higher average market levels as well as deposit and loan growth, offset by deposit margin compression.

Assets under management (AUM) stood at US$2.2 trillion at the end of September, up eight percent, driven by inflows into both long-term and liquidity products and the impact of higher market levels, according to the bank.

Click the link to read the JP Morgan third quarter results, presentation and earnings transcript.