The Swiss bank reports higher trading activity in equity derivatives as a result of increased market volatility; chief executive Tidjane Thiam (pictured) warns of headwinds ahead from the ongoing challenging geopolitical environment.

Credit Suisse has posted a group pre-tax income of CHF1.1 billion (US$1.1 billion) in the third quarter of 2019, an increase of 70% on the prior year quarter; group net income, at CHF881m, was up 108% year-on-year.

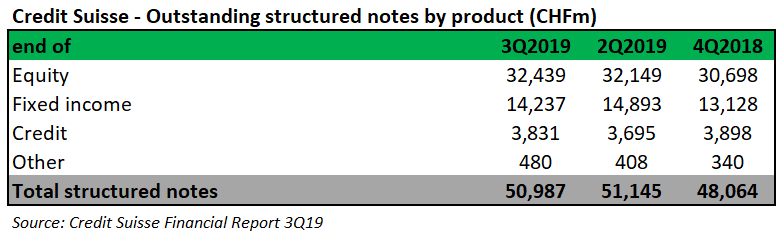

As of the end of 3Q2019, the outstanding long-term debt stood at CHF159.1 billion, which included senior and subordinated instruments. The bank had CHF51 billion of structured notes outstanding at September 30 2019, compared to CHF51.1 billion as of the end of 2Q2019 and CHF48 billion end-December.

Sixty-four percent of the outstanding structured notes were linked to equities (CHF32.4 billion); 28% was tied to fixed income underlyings; 7.5% to credit; and 0.5% to others.

Negative treasury results of CHF276m in Q3 2019 mainly reflected losses of CHF181m with respect to structured notes volatility, primarily relating to interest rate movements, according to the bank.

In the global markets division, net revenues of US$1.43 billion for the quarter increased by 34% compared to the third quarter of 2018, due to a marked increase in trading results, which ‘more than offset’ reduced debt and equity underwriting.

Equities sales and trading revenues of US$424m increased 11% year on year, with higher trading activity in prime services and equity derivatives as a result of ‘increased’ market volatility.

Fixed income sales and trading revenues of US$903m increased 72% year on year, reflecting ‘robust’ revenue growth across most businesses and sustained leading market shares.

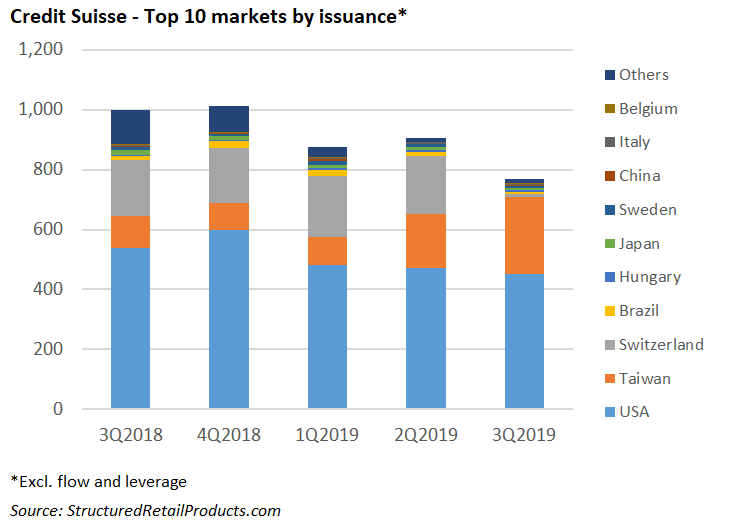

Credit Suisse sold an estimated US$2 billion from 767 issued structured products (excluding leverage and flow) worth an estimated US$2 billion between July 1 and September 30 2019 (Q3 2018: US$3.2 billion from 1,011 products), according to SRP data.

The products were sold across 14 different jurisdictions, of which the US, with sales of US$926.77m from 446 structures, was the biggest market.

In Asia Pacific, where the bank continues to drive further strategic alignment in its Asia trading solutions business, with synergies in structured product capabilities and distribution, increased focus on ultra-high-net-worth clients, and platform initiatives, it launched products in Taiwan (244), Japan (six) and China (five).

Other markets where Credit Suisse was active in the quarter were predominately European and included Switzerland (12 products), Hungary and Sweden (six each), Finland, France and Belgium (three each). The last country was responsible for the best-selling structure in the period, which came in the shape of Global Demography Autocallable 2029 II. The 10-year medium-term note, which is linked to the Stoxx Global Demography Select 50 Index, was distributed via Deutsche Bank Belgium and sold US$25m during the subscription period.

During the quarter, Credit Suisse Asset Management announced its intention to integrate environmental, social and governance (ESG) factors into its investment process, initially with 30 actively managed investment funds representing CHF20 billion of assets, a sum which is expected to grow to more than CHF100 billion of assets under management by 2020.

Click the link to view the Credit Suisse third quarter 2019 results, presentation and financial report.