The Canadian economy experienced a slowdown towards the end of 2019 with a mere growth of 0.3% in the fourth quarter, a drop from the previous calendar quarter’s 1.3%. Recent indicators suggest global growth stagnation is reflected in transitory factors such as labour and transportation disruptions. This should be offset with a moderate rebound in terms of GDP growth in the first calendar quarter

From a structured products perspective, the Canadian market saw a deceleration in 2019 with just over 4,000 products marketed worth an estimated CAD13.7 billion (US$10.3 billion) compared to 4,361 products worth CAD18.3 billion sold in 2018.

The Canadian Imperial Bank of Commerce (CIBC) reigned in the new decade with a high performance during the first quarter of 2020 achieving a net income of CAD1.21 billion, a 3% year-over-year variance from its Q1 19 value of CAD1.18 billion.

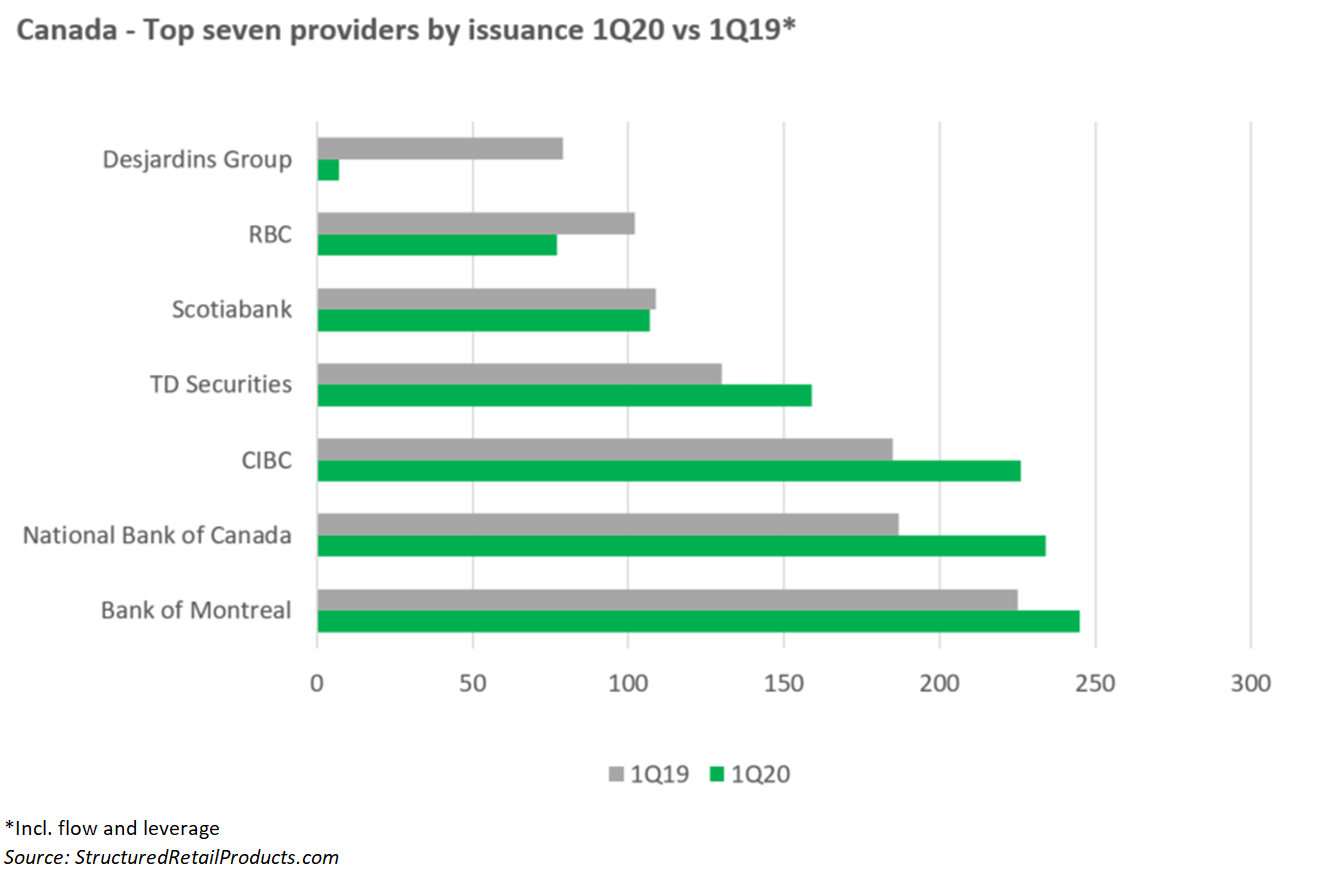

Out of the top seven structured product providers for Q1 20 in Canada, CIBC ranks third after BMO and NBC, SRP data shows. The bank has issued 226 products compared with 185 in the same quarter of 2019.

The bank currently has 2,364 live products listed in Canada and the US and differ in length from short-term to long-term. Underlyings include WTI Crude Oil, Yamana Gold, Western Digital, US Bancorp and UnitedHealth. The tranche investments are wrapped as registered notes, PPNs, notes and GICs.

The bank’s global markets revenue were also up by CAD120m, a jump that the bank attributes to higher revenue from its interest rate trading business, global markets financing activities and equity derivatives trading business.

Derivative instruments saw a minimal increase of 1% or CAD0.3 billion driven by higher equity, commodity and interest rate derivatives valuation. It was partially offset by the drop in foreign exchange derivatives valuation.

The banks risk-weighted assets totalled CAD252 billion, a climb from its Q4 19 value of CAD239.9 billion.

‘We delivered a strong first quarter in 2020 as we executed on our client-focused strategy and continued to diversify our earnings growth,’ said president and chief executive officer, Victor Dodig (pictured).

TD Securities

Placing fourth as a structured products provider in Q1 20, TD Securities issued 159 products, sliding up from fifth place with 109 products in the same quarter of 2019.

The bank reported an impressive first quarter with a net income of CAD2.99 billion, a rise of 24% in comparison to its Q1 19 value CAD2.41 billion.

SRP data shows that the bank has 2,002 live tranche products listed in both the US and Canada that are wrapped as registered notes, PPNs, GICs and notes. Underlyings range from Visa, ViacomCBS and Bank of China, to Citigroup, Chevron and Facebook. They fall under hybrid, credit equity and real estate asset classes and range in maturity from under a year to over six years.

TD’s derivatives total CAD45 billion, down from its fourth quarter figure of CAD50 billion. The decrease reflects lower mark-to-market values on forward options.

Net interest income also increased to CAD6.3 billion as of 31 January 2020, a number that has been steadily on the incline since the bank’s earliest reported figure of CAD5.4 billion in second quarter of 2018.

The bank’s RWAs stand at CAD 476 million, a climb of about 4.4% from its fourth quarter value of CAD456 million in 2019.

‘Our strong performance demonstrates the advantages of our strategy and proven business model, as we continued to acquire new customers and engage with them in more innovative and personalised ways,’ said chief executive officer and group president, Bharat Masrani.

Scotiabank

Ranking fifth in terms of Q1 20 product issuance is Scotiabank which issued 107 structured products compared with its higher Q1 19 value of 130.

Scotiabank has commenced 2020 on a strong note with a Q1 20 net income of CAD2.33 billion compared with its Q1 19 figure of CAD2.25 billion.

The bank has 1,936 live tranche investment products listed both domestically and in the US. Underlyings include Wells Fargo, Verizon, US Bancorp, Unilever, Walmart and Vodafone. The products fall within the real estate, interest rate, hybrid and commodities asset classes and vary in tenor from three to more than six years.

Net interest income (NII) for the first quarter also saw an increase reaching CAD4.4 billion, up from its 4Q19 and 1Q19 figures of CAD4.34 billion and CAD4.27 billion respectively.

Risk-weighted assets stand at CAD420.7 billion as of 31 January 2020, a decrease from the previous quarter (CAD421.2 billion).

Total derivative notional amounts were CAD6.13 trillion in Q1 20 up from CAD5.9 trillion in the previous quarter.

‘We are pleased with our balanced performance this quarter having delivered solid results across all our businesses and our asset quality remains strong,’ said president and chief executive officer, Brian Porter.

Royal Bank of Canada (RBC)

The Royal Bank of Canada (RBC) placed sixth in terms of product issuance having issued 77 products in the first quarter of 2020, a drop from its value of 102 products in Q1 19.

RBC championed the first quarter with a net income soar of CAD3.5 billion in the first quarter of 2020, a jump of 11% in the same period the previous year and 9% from the final quarter of 2019.

The bank has 34 live tranche investments listed as institutional as well as one product being issued in Ireland. The products are linked multiple indices such as the Nikkei 225, S&P 500, ING, FTSE 100 and Eurostoxx 50. Asset classes consist of interest rate, fund and equity (single share, single index, share basket and index basket)

The products are wrapped as pensions, warrants, notes, medium-term notes, ARFs and AMRFs ranging in tenor from three to over six years.

Net interest income (NII) also increased to CAD7.62 billion in Q1 20, from its initial Q4 19 and Q1 19 figures of CAD6.3 billion and CAD6.74 billion respectively.

The bank’s risk-weighted assets total CAD523.7 billion as of 31 January 2020, a climb from its Q1 19 value of CAD508.5 billion.

‘We had a strong start to the year with earnings growth of 11% year-over-year,’ said chief executive officer, Dave McKay. ‘Against the uncertain macroeconomic backdrop, we remain focused on prudently managing our risks, leveraging our scale and competitive position, and balancing our investments in technology and talent for long-term, sustainable growth,’ he said.

Desjardins

As the lone bank that has just released its fourth quarter earnings and has yet to report on its first quarter of 2020, Desjardins ranks last in terms of product issuance with a mere seven products, plummeting from its Q1 19 figure of 79.

Desjardins’ products strike every even month of the year which may be the underlying cause of such a drastic decline in issuance.

Desjardins has 1,145 live tranche investment products that are all wrapped as GICs and are all domestically listed. They belong to interest rate, hybrid, equity and commodity asset classes and are linked to multiple underlyings that include Unilever, Aetna, 3M Company and BlackRock.

Desjardins ended 2019 with a notable total income of CAD 20.79 billion, a surge from its 2018 income, CAD 17.31 billion.

Net interest income for the final quarter reached CAD 1.42 billion representing a steady incline from the previous quarter with a figure of CAD1.37 billion.

As of 31 December 2019, derivative financial instruments total CAD4.28 billion. The bank’s derivative financial instruments include interest rate, foreign exchange, other financial derivative and option contracts.

The groups RWAs at the end of 2019 stand at CAD113.86 billion which signals a drop from its 2018 figure of CAD129.47 billion.

‘Desjardins’ higher surplus earnings, increasing membership, growing member dividends and strong capital base are all evidence of its strength, resilience and growth potential,’ said president and CEO Guy Cormier.