Brazilian financial services platform XP has reported a stellar fourth quarter with a Q4 19 net income reaching R$ 390m (US&75m) while its overall net income totalled R$ 1.09 billion, a 134% increase from the previous year.

XP’s Q4 19 net revenues stand at R$1.69 billion, a 91% jump from the previous year quarter.

The company attributes this massive growth to accelerating increases in total revenues, specifically brokerage and performance fees in retail and issuer services along with ongoing efficiency gains.

According to the firm, all-time low interest rates are driving secular change in Brazilians’ relationship and engagement with investments.

In order to function as a multi-purpose bank, the brokerage firm launched Banco XP in October of last year after the Brazilian Monetary Authority gave authorisation at the end of 2018.

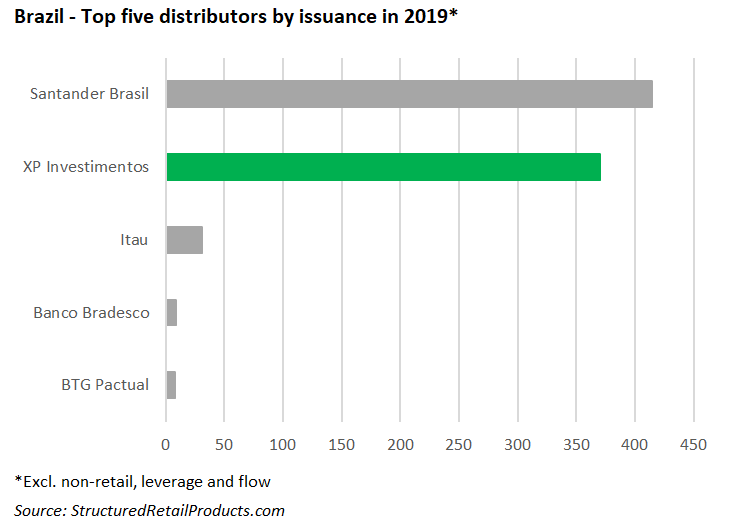

SRP data shows that XP was the second most prolific distributer in Brazil during 2019 having distributed 370 structured products, following Santander Brasil which issued 414 products. Itau placed third with 31 products, Banco Bradesco follows with nine products while BTG Pactual issued eight.

XP has distributed 1,253 live products, all of which are domestically listed. The tranche investments are wrapped as structured operations certificates and fall under the real estate, hybrid, credit, equity and FX rate asset classes. Underlyings include XP, Vale, Uber Technologies, Amazon and Alibaba.

In a bid to expand its range of business offerings, XP announced a brand partnership with Visa in early March, an initiative that not only will help to drive the firm’s debit and credit card services, but aligns with the goal of establishing a full-service platform by adding new financial products for clients over time.

Total assets under custody reached R$409 billion in the final quarter, a soar of 17% from the previous quarter and a whopping growth of 103% from 2018.

XP also boasted a considerable rise in clients that total 1.7 million at the end of 2019, up 91% from 892,000 at the end of the previous year.

Derivative financial instruments stood at R$ 3.23 billion in 2019, up from its 2018 figure of R$ 991 million.

‘We are confident that the combination of our investment and financial digital services with the new cards and solutions to be launched with Visa will enhance even more the experience of our client,’ said XP chief executive officer and founder Guilherme Benchimol.

The outlook for 2020 appears tarnished due to the widespread outbreak of Covid-19 with the firm predicting negative blows to assets under custody as a result of equity exposure, as well as a reduced growth pace in terms of net inflow.

XP also expects a rise in demand for fixed income or structured notes products due to the increase level of risk aversion that the pandemic is sure to bring.

Click here to view XP’s annual report.