The US bank has seen its net income taken a hit in Q2, falling to US$3.5 billion from US$4 billion in the first quarter of 2020 and US$7.3 billion in Q2 19.

Total revenues have also declined four percent to US$22.3 billion from Q2 19 and two percent in the first quarter of 2020.

The bank attributes the tumble in income to ongoing efforts led by chief financial officer, Paul Donofrio (pictured), to curb the damage caused by the Covid-19 pandemic.

According to Donofrio, Bank of America has added US$4 billion to credit reserves to reflect the current economic outlook and processed more than 16 million economic impact payments year-to-date totalling more than US$26 billion for both clients and non-clients.

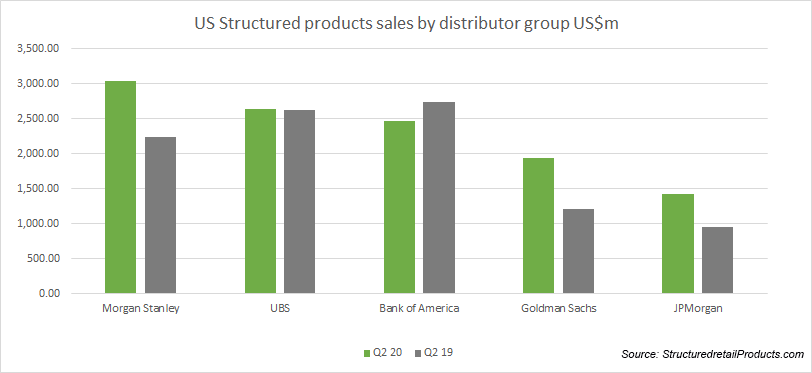

SRP data shows that BofA is the third most prolific distributor group in the US market for the second quarter with an issuance of 108 valued at US$2.47 billion. Morgan Stanley dominates the market in first place with UBS trailing behind in second.

Bank of America was the biggest player in the market in terms of distributor group sales in the second quarter of 2020 with a higher issuance of 157 structured products at a sales volume of US$2.73 billion.

Its sales volume in Q1 20 totalled US$3.57 billion with 156 products, reflecting a booming period for the bank before the markets crashed.

The bank has distributed 1,354 live products that are listed in the US, Japan, the Netherlands, Italy, and Germany. The majority of the investments are listed as registered notes (unlisted), warrants, exchange-traded notes, and CDs.

Prominent underlyings include the S&P500, Eurostoxx 50, Russell 2000, DJ Industrial Average Index, Nikkei 225, and the FTSE100. Most of the investments are classified under the equity (single index), equity (share basket) and equity (index basket) asset classes.

By business

Consumer banking suffered significant declines in revenues of US$7.9 billion, a 19% decrease from Q2 19 while provision for credit losses grew by US$3.0 billion.

Global wealth and investment management reported losses of 10% in revenue from the second quarter of 2019 (US$4.4 billion from US$4.9 billion). The decrease is attributed to lower net interest income and transactional revenue which more than offset the benefits of deposit, loan and AUM growth.

The Global markets division was able to boost its second quarter net income by 81% to US$1.9 billion from Q2 19 with both fixed income revenues skyrocketing by 50% and equities income soaring by seven percent, though the latter was offset by a weaker performance in revenues.

Total risk-weighted assets decreased to US$1.5 billion from US$1.56 billion in the first quarter of 2020 while remaining steady from its Q2 19 value.

Click here to view the second quarter earnings.