The UK bank reported a 21% increase to £8.6 billion (US$11.2 billion) in net income during the second quarter of 2020 in its corporate and investment banking (CIB) division, compared to the same period a year prior.

However, profit before tax has suffered a 12% drop in Q2 20 to £1.52 billion reflecting a £1.11 billion decrease in consumer, cards, and payments. The bank’s corporate and investment bank division saw its income boosted by 35% to £6.98 billion, driven by a 73% increase in markets activities. This reflects higher client engagement, spread widening and higher levels of volatility.

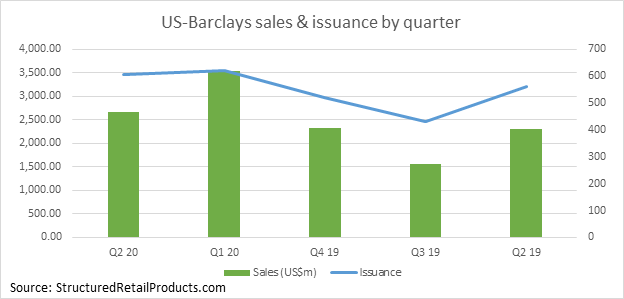

Barclays has retained its position as the most prolific issuer in the US market in terms of sales, having issued 607 structured products for US$2.67 billion. The bank’s sales volume and issuance have decreased from its Q1 20 figure of 623 products valued at $3.54 billion.

Citigroup Global Markets trails behind in second place though its issuance is a higher figure of 660 products with a sales volume of US$1.94 billion. Morgan Stanley Finance stands at third place with 664 products sold for US$1.79 billion.

In Q2 19, Barclays was also the top issuer with 563 products and a sales volume of US$2.3 billion.

Barclays Bank has issued a total of 5,244 live products according to SRP data. The majority of the products are listed across the US, UK, and Japan. Some wrappers include registered notes (unlisted), exchange-traded notes, pensions and medium-term notes. Underlying assets classes include equity (single index, index basket, share basket, single share), interest rate and hybrid with a number of underlyings including the S&P500, Russell 2000, DJ Industrial Average Index, Eurostoxx 50, and Nasdaq 100, leading the bank’s issuance.

Business lines

The UK bank reported a significant increase in credit impairment charges to £2.67 billion from £510m in the second quarter of 2019. Total operating expenses fell seven percent to £4.57 billion due to overall cost efficiencies and discipline in the current environment.

Derivatives and financial instruments liabilities climbed to £308 billion from £79.1 billion in Q2 19. This can be attributed to a decrease in major interest rate curves and increased trading volumes.

Risk-weighted assets (RWAs) grew to £190 billion in the second quarter from £158 billion at the end of Q4 19.

The second quarter impairment charge has been reduced to £1.62 billion from £2.12 billion in Q1 20. Both UK and US macroeconomic variables have been revised since the first quarter and new forecasts include a longer recovery period and unemployment rate.

The bank’s international income also increased by three percent to £4 billion, driven by a strong performance it corporate and investment bank income.

Respective RWAs have dropped to £231.2 billion due to reduced client activity quarter over quarter as well as lower consumer, cards, and payments balances.

‘Our CIB is taking a leading role helping clients to access capital markets to raise equity and debt, underwriting c.£620bn of new issuance in the quarter,’ said James Staley, group chief executive officer (pictured).

Click here to view the second quarter results.