UK financial adviser firm Lowes Financial Management (LFM) has released a 10-year research on UK structured products proving that they have delivered gains and matched investor expectations.

The Review of the Decade compiles extensive research into the significant positive steps the UK structured products industry has made over the past decade.

“The results lay bare the extent to which those who dismissed the sector were wrong,” said Ian Lowes (pictured), managing director at LFM. “They deserve consideration [as] an investment style that has a demonstrable and enviable track record.”

According to the research, a total of 4,444 structured products were sold between January 2010 and December 2019 in the UK market via the country’s preferred wrapper, the structured product plan, of which 1,628 remained in force at 31 December 2019.

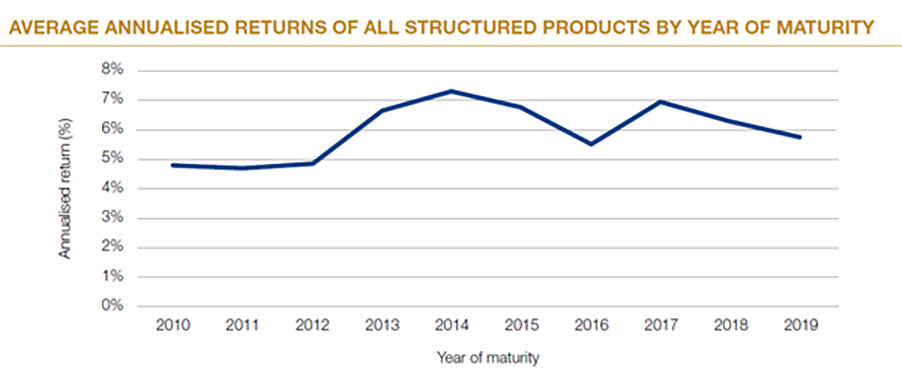

Over the last 10 years, 3,895 structured products matured within the entire UK retail sector, delivering an average annualised return of 6.98% whereas structured deposits returned 3.64%.

The analysis shows that just 60 (1.54%) of the maturing structured products returned a loss; while 70.06% of maturing structured products were linked solely to the FTSE 100 index.

Source: Lowes Financial Management

Capital-protected investment-based plans have been phased out throughout the decade, to the extent that since 2015 only one fully protected plan has been issued in the retail market. This suggests “it is unlikely that this construct will reappear any time soon”.

Across the entire sector - encompassing all the various profiles and styles in the market, including deposits – maturing products during the past decade returned an average annualised return of 6.27%. The average investment duration was three years and nine months.

“It’s worth noting that at the point of committing to an investment, investors would have to have been prepared to hold the structured product for typically up to six years, though the majority of products that had an early maturity feature did not go full term,” said Lowes.

The research also shows that capital-at-risk structures have dominated with capital-at-risk plans accounting for 81% of the plans issued in the decade’s ultimate year – 26% more than in the opening year.

From an underlying perspective, the UK domestic FTSE 100 index (67% market share) was the most featured underlying asset in the UK market throughout the decade; and appeared in index baskets alongside the Eurostoxx 50 index (10% market share) and the S&P 500 index (nine percent market share) as part of ‘dual index’ plans, or within plans with more than one underlying.

Share price-linked plans remained marginal during the period analysed and made up four percent of plans issued. However, 81.29% of these plans were issued in the first five years – just three share-linked plans were issued after 2015.

Regarding the lack of adoption of structured products among advisors, Lowes told SRP that the UK retail sector has evolved to offer some of the most attractive investments advisers and investors could access and those that neglected to embrace it over the last decade missed out.

“Having spent my life and career in investments, I've seen and heard it all and as such, respect natural scepticism,” said Lowes. “But I am at a loss to understand why all independent financial advisers haven't embraced structured products.”

Direct to consumer technology-based solutions could help expand adoption and generate a lot more interest.

“It might not be until then that the majority of advisers realise what the sector has to offer – by which time their clients might be embracing the sector on a self-directed basis,” said Lowes.

Click in the link to read LFM’s full report.