German investment bank Deutsche Bank has seen its issuance and sales of structured products more than halving year on year. However, it plans to increase the volume of its ESG financing along with a portfolio of sustainable investments under management to at least €200 billion in total by 2025.

The strategy is part of the firm’s ongoing efforts to establish itself as a leader in sustainable finance as well as the economy and clients’ shift towards climate targets.

The German bank reported a one percent increase in group revenues to €6.3 billion with core bank net income up by six percent to €6.4 billion and investment banking net revenues soaring by 46% in its Q2 20 earnings report.

However, negative market values from derivative financial instruments stand at €355.7 billion, a 12% increase from the fourth quarter of 2019 (€316.5 billion).

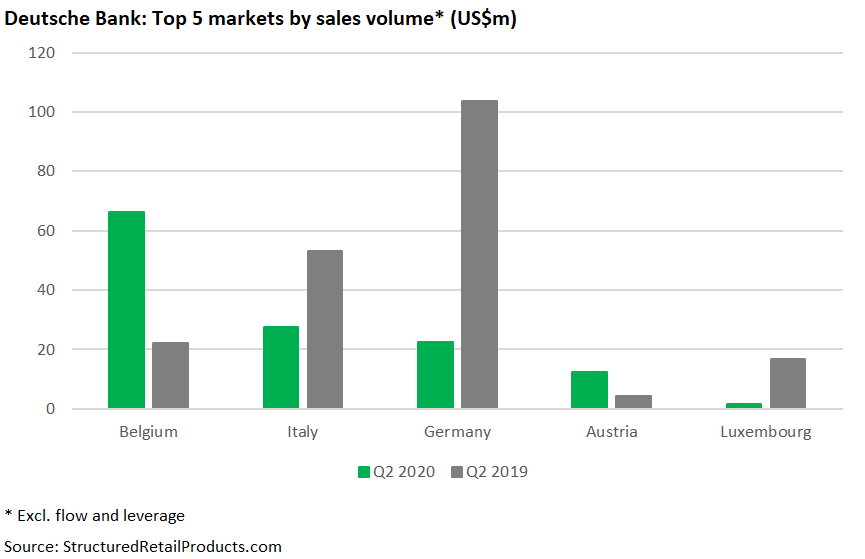

SRP data shows that in the European market, Deutsche Bank issued 7,235 structured products in the second quarter at a sales volume of US$156.8m. This is a significant fall from its Q2 19 figure of 42,276 products valued at US$458.9m. In the first quarter of 2020, the bank issued 8,578 products for US$238.6m.

Deutsche Bank has 183 live products worth a combined $1.7 billion in the US market that are wrapped as registered (unlisted) and unregistered notes, exchange-traded notes and notes. The products range in tenor from under one year to over six years while some underlyings include the Eurostoxx 50, Russell 2000, Constant Maturity Swap Rate, and S&P500. However, the German bank is no longer active in the US market and has not issued products in the US since 2019, when it issued four products worth US$17.4m. This compares to 94 products /US$617m issued in 2018, and 198 products/US$1.08 billion in 2017.

Divisional breakdown

The bank raked in pre-tax profits of €158m compared with a pre-tax loss of €946m in the second quarter of 2019 while noninterest expenses were lowered by 23% year-on-year to €5.4 billion.

Provision for credit losses of €761m which is consistent with management expectations and was driven by speedbumps brought on by the Covid-19 pandemic.

Net profits totalled €61m in the second quarter contrasting with the net loss of €3.1 billion in the prior year quarter which included transformation-related effects of €3.4 billion.

Assets under management rose by €45 billion to €745 billion in the quarter though asset management revenues dropped by €549m, due to the non-recurrence of periodic performance fees that relate to an infrastructure fund.

Revenues in fixed income and currencies sales and trading saw a 39% jump to €2.1 billion in the second quarter.

Risk-weighted assets were four percent down from the first quarter and 38% down from Q2 19 totalling €43 billion.

“In a challenging environment we grew revenues and continued to reduce costs, and we’re fully on track to meet all our targets,” said chief executive officer, Christian Sewing (pictured).

Click here to view the second quarter earnings.