The US regional broker-dealer took a 34% hit in its third quarterly net income (US$172m) compared to the same period a year prior.

The plummet can be attributed to the firm’s loan loss provision of US$81m compared to a US$5m benefit in 2019’s fiscal third quarter. Despite the decline, net income climbed by two percent from the previous quarter.

The firm also reported a five percent drop in Q3 net revenues of US$1.83 billion, largely driven by the impact of lower short-term interest rates on both net interest income the Raymond James deposit program fees from third-party banks.

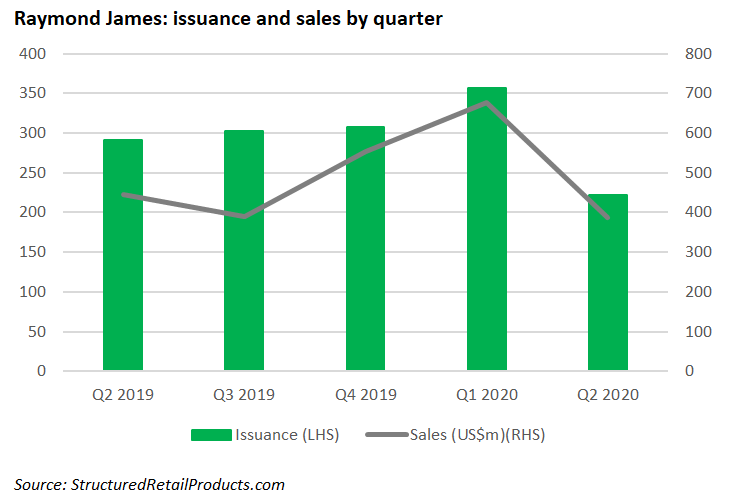

The firm remains a top 10 distributor of structured products in the US market in terms of issuance and sales having sold over 570 products worth US$1.06 billion, year-to-date. Raymond James issuance has been flat year-on-year (H1 2019: 574 products), but sales have gone up 10% (H1 2019: US$965m), according to SRP data.

During the quarter, the firm distributed 222 structured products valued at US$386.6m, a tumble from the same period a year prior when it distributed 291 products at a sales volume of US$445.5m.

In the firm’s Q2 period of this year (January to March), Raymond James distributed 356 products for US$677.3m.

SRP data shows that Raymond James has distributed over 3,500 live products listed domestically. The investments are wrapped as registered unlisted notes, certificates of deposit, unregistered notes, and structured annuities.

Major issuers include HSBC Bank, GS Finance, Credit Suisse, JP Morgan Chase Financial, Goldman Sachs, and Barclays Bank. Some underlyings are the S&P500, Russell 2000, Eurostoxx 50, DJ Industrial Average Index, and SPDR S&P Oil & Gas Exploration & Production ETF.

Net revenues also suffered an 11% sequential tumble due to lower asset management and related administrative fees.

The firm’s private client group reported a 35% decrease in its pre-tax income of US$91m though assets under management were boosted by six percent over June 2019, and 14% over March 2020 to total US$833.1 billion.

The growth in financial assets under management is due to the increase in equity markets as the S&P500 index appreciated 20% during the quarter.

However, capital markets reported stellar increases in pre-tax income of 158% at US$62m with brokerage revenues up by 60% at US$166m from Q3 19.

The record results were driven by higher debt underwriting revenues which more than offset lower mergers and acquisitions revenues.

Raymond James suffered a disastrous pre-tax revenue fall of 90% at US$14m from the previous year while net revenues slid by 17%.

Click here to view the second quarter earnings.