The US bank sees structured products sales in the US market increase by 87% Y-o-Y as it reports a ‘very strong’ performance from its institutional client group in Q3.

Citi has become the number one structured products issuer in the US market, according to SRP data.

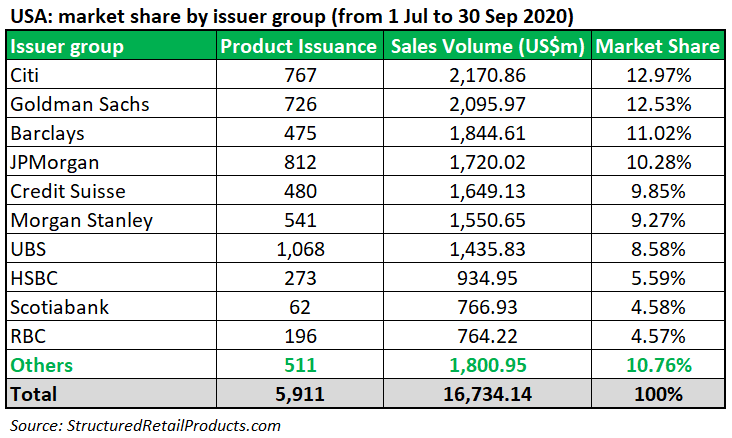

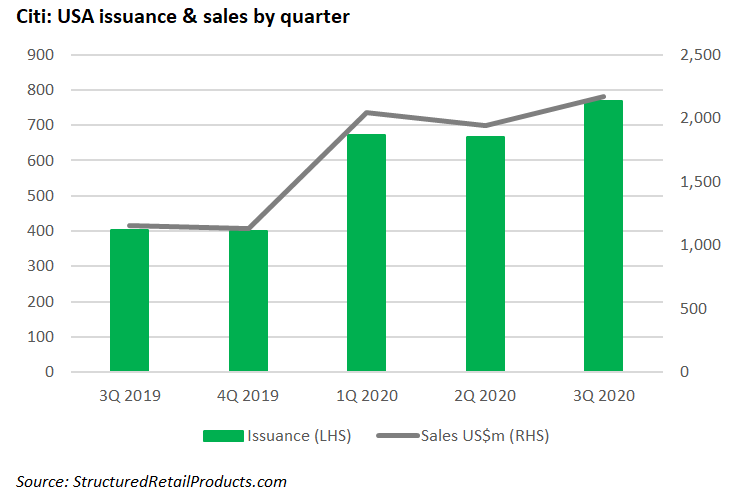

The bank collected a combined US$2.2 billion (from 767 products) via its Citigroup Global Markets issuance vehicle in the third quarter of 2020, up 87% in sales and up 91% in issuance from the prior year quarter. It is now the market leader in the US, with a market share of just under 13%. Goldman Sachs and Barclays with a share of 12.5% and 11%, respectively, came second and third.

In its third quarter 2020 results, Citigroup reported a 34% decrease in net income.

Revenues, at US$17.3 billion, decreased seven percent from the prior-year period, primarily reflecting lower revenues in global consumer banking (GCB) and corporate/other, partially offset by growth in fixed income markets, investment banking, equity markets and the private bank in the institutional clients group (ICG).

Citi’s structured products were sold via 11 different distributors, including, among others, First Trust Portfolios, Raymond James, Goldman Sachs Private Banking, Morgan Stanley Wealth Management, UBS Financial Services, FISN, Incapital and Wells Fargo.

The group’s best-selling product was a Trigger Callable Contingent Yield Note linked to a worst-of basket comprising the shares of Apple, Alibaba, Alphabet, Amazon, Facebook, and Microsoft that was distributed via UBS and sold US$40m.

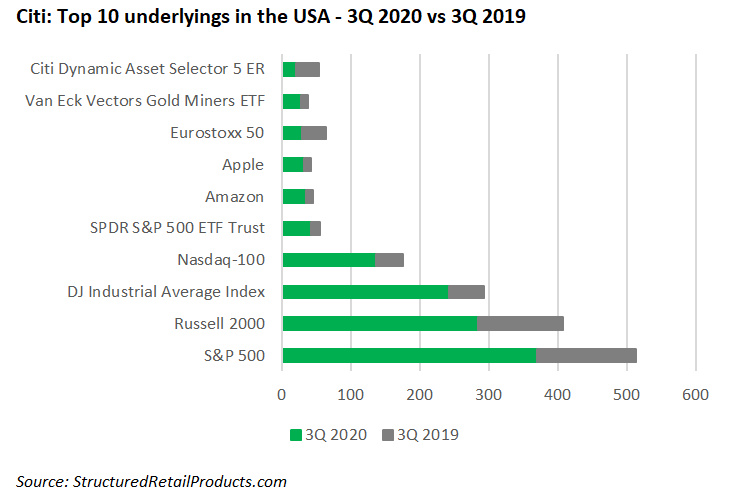

Market cap indices such as the S&P 500, Russell 2000 and DJ Industrial Average, were the most featured underlyings on Citi’s products, often seen together as part of a worst-of basket. Other sectors frequently used were industry, technology, and consumer services while 23 products were tied to it in-house developed Citi Dynamic Asset Selector 5 ER Index, which follows a rules-based, hypothetical investment methodology which dynamically allocates between the S&P 500 Futures ER and S&P 10Y US Treasury Note Futures ER Index.

Outside the US, Citi was active on the primary market in China, were it issued 29 products worth an estimated US$550m, Taiwan (US$170m from 50 products), Italy (US$10m from seven products), and also in the UK, France and Belgium.

The group also issued 5,730 flow certificates and more than 90,400 leverage certificates that were targeted at retail investors in Germany and which are listed on the stock exchanges of Frankfurt and Stuttgart.

ICG revenues of US$10.4 billion increased five percent.

Markets and securities services revenues of US$5.2 billion increased 16% while fixed income markets revenues of US$3.8 billion increased 18%, driven by strong performance across spread products and commodities.

Equity markets revenues of US$875m increased 15%, as solid performance in cash equities and derivatives was partially offset by lower revenues in prime finance. Securities services revenues of $631m decreased five percent on a reported basis and four percent in constant dollars, as higher deposit volumes were more than offset by lower spreads, according to the third quarter 2020 results.

‘Credit costs have stabilized; deposits continued to increase; revenues are up three percent year-to-date, and our institutional clients group again had very strong performance, especially in markets, investment banking and the private bank,’ said Michael Corbat (pictured), Citi CEO.

Click the link read the full third quarter 2020 results, presentation and financial supplement.