Structured products are increasingly used as an alternative to equities by investors in South Africa.

Although still relatively small in terms of retail flows in the market, the structured product industry in South Africa is growing slowly but steadily, according to panellists of the Under the bonnet of structured financial products discussion, which was broadcasted on South African news channel Business Day TV on 23 September.

Sometimes it almost feels like cheating - Melissa Dyer

“The problem with structured products is that they are not the traditional unit trusts or shares,” said Melissa Dyer (pictured), managing director at Harbour Wealth.

She urged financial advisers to upscale a little bit, because structured products are fantastic for building, monitoring and maintaining a financial plan for a client.

“Sometimes it almost feels like cheating,” said Dyer. “If you can give your client a capital guarantee, plus a geared upside, and you get this predetermined outcome, after fees, it helps in terms of an IFA when we are planning for our clients.”

In most cases, structured products return the nominal invested in combination with participating in the best part of equity, according to Brian McMillan, head of structured products at Investec Corporate and Institutional Banking.

“The ability of equity is to outperform interest rate markets. So you have the upside of equity markets and the capital protection of bonds,” he said.

Darryl Hannington, portfolio manager at Anchor Capital, agreed that for certain investors, structured products have the “sleep easy factor”.

“You know that you have a defined outcome, sometimes with capital protection, sometimes without, over a period of time. They are a great diversifier in a very difficult market to create diversification from traditional asset classes,” he said.

In today’s market, with all its uncertainty and volatility, many global wealth managers struggle to build a balanced portfolio.

“People are feeling a little bit nervous about equity market valuations and the difficulty facing wealth managers is that the traditional alternatives to equities are, let’s not call them un-investable, but pretty unattractive,” Hannington said.

Historically when investors are feeling uncomfortable about equity market valuations, they often de-risk by buying listed bonds. “In our view the yields you get from listed bonds offer are not very attractive at the moment,” said Hannington. "The benefit alternative assets like structured products give is diversification. To still participate in equity like returns, in sideways or even downward trending markets.”

Clients are being wooed all the time by some of those big family offices overseas - Darryl Hannington

One of the main drivers of advisers becoming more comfortable in offering structured products to their clients, is that most banks now provide an active secondary market.

“Over the last 20 years that structured products have been around, that is probably been the biggest change,” said McMillan, adding that most of Investec’s products are listed on the Johannesburg Stock Exchange.

Banking on technology

According to Dyer, IFAs are able to access structured products much more easily.

“We can include structured products into our clients’ portfolio, either via a stockbroking account, or via various platforms. For us at Harbour, we make use of technology where in a single clients portfolio, whether it be a living annuity or a retirement annuity, we can now use a structured product, a unit trust, an ETF, and that means at a financial adviser level, we control the liquidity because we can package and use cash flow strategy for our clients,” she said.

From a retirement perspective, according to Hannington, you can “ignore structured products at your own peril” when putting proposals forward for ultra-high-net-worth individuals and high-net-worth individuals, because the adoption of structured products from some of the large family offices, particularly in Europe, is becoming more and more prevalent.

“Our clients are being wooed all the time by some of those big family offices overseas,” said Hannington. “The use of structured products in a diversified portfolio is coming to the fore, and you need to understand what is out there and present to your clients what others do.”

Investec has changed its focus from the local Top 40 index, to the offshore market with the bank’s products mostly linked to the S&P 500, FTSE 100 or Eurostoxx 50. “We can link it in different currencies as well,” said McMillan. “We speak to our advisers, get feedback from them, and then we tailor that view to where we are in the market.”

The good old days of South African equity market returns of 15% plus seem like a distant memory, according to Hannington.

Because of the interest rate differential between South Africa and many of the developed markets structured products can provide investors with an interesting alternative. “These local structured products in Rand, referencing offshore indices, can offer very attractive, rand return profiles, in the region of 15 to 20% perhaps even higher if there is a level of gearing,” Hannington concluded.

There are more than 6,000 live products worth an estimated ZAR26.7 billion (US$1.9 billion) listed on the SRP South Africa database.

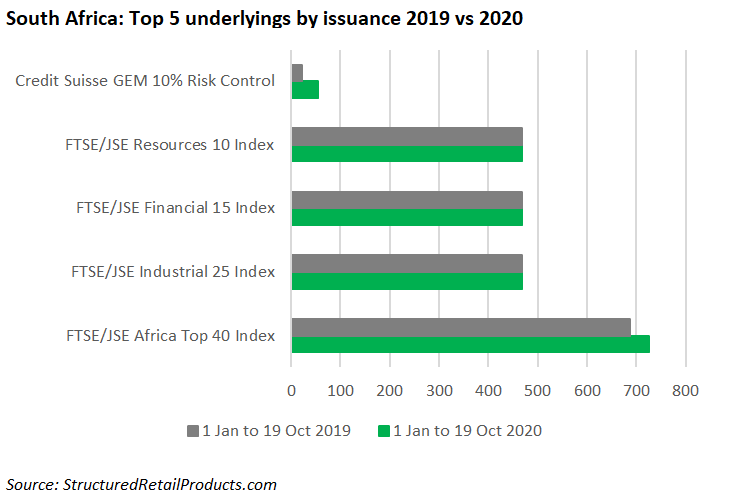

Year to date, 2,223 products – from seven different issuers, including Absa, Investec, Standard Bank, and UBS – have strike dates, the vast majority of which (2,208 products) are tied to a single index.

The best-selling structure of the year so far is a five-year FTSE 100-linked autocall from Investment Bank that is listed in Johannesburg and sold ZAR73m in January. If the index closes at or above its initial level on the annual valuation date, the product is redeemed early, returning 100% of the nominal invested, plus a coupon of 17% for each year elapsed.