The Swiss bank delivered its best third quarter in a decade as market volatility leads to higher client activity in equity derivatives.

UBS has reported a profit before tax (PBT) of US$2.6 billion for the third quarter of 2020, up 92% year-over-year (YoY).

The investment bank (IB) registered a PBT of US$632m, up 268% from the prior year quarter.

Revenues for the global markets business increased 26% to US$ 1.6 billion, delivering the ‘best third quarter’ since the acceleration of UBS’s strategy in 2012, primarily driven by higher client activity levels – resulting from market volatility – particularly across equity derivatives, credit, foreign exchange and cash equities.

Global markets 3Q 2020 revenues exclude US$215m gain on the sale of intellectual property rights associated with the Bloomberg Commodity Index family, which has 90 live structured products – almost exclusively in the US market and worth approximately US$475m – linked to it, according to SRP data.

UBS issued 1,688 structured products (excluding leverage and flow products) between 1 July and 30 September 2020, up 20% from the same period last year.

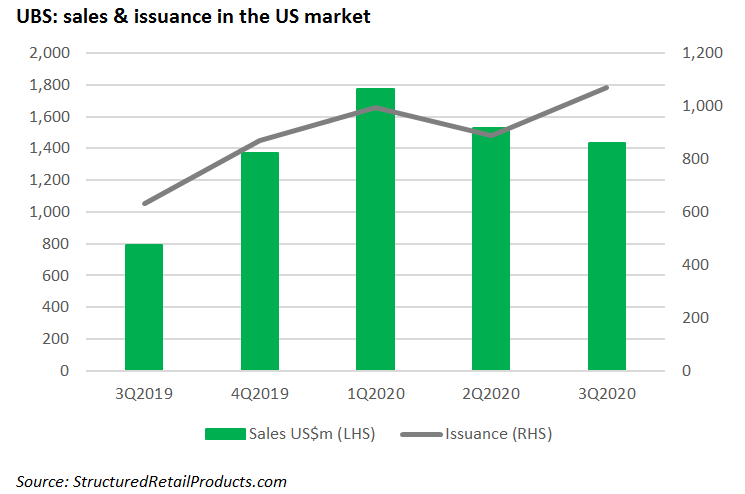

More than 60% of the bank’s primary market products were issued in the USA where it collected US$1.4 billion from 1,068 structures, which translates to an 8.58% share of the market. US sales were up more than 80% on 3Q 2019 when it accumulated US$794m from 632 products.

Some 883 of the US products featured the autocall payoff, with the majority tied to single stocks. The share of Apple, seen in 77 products, was the most frequently used, followed by Amazon (66), Microsoft (47) and Bank of America (33).

Equity derivatives had a better quarter for us in the Americas after a fairly weak second quarter

The bank’s bestselling product in Q3, however, was linked to an index. The 1.5-year Trigger Callable Yield Note (90281M607), which pays monthly interest of five percent per year, was linked to the S&P 500 and sold US$34m during the subscription period.

‘We did see a very good investment banking quarter in the Americas, and that did help in particular to have a higher level of contribution from that region,’ said Kirt Gardner (pictured), UBS chief financial officer, on the bank’s earnings call. ‘Equity derivatives had a better quarter for us in the Americas after a fairly weak second quarter.’

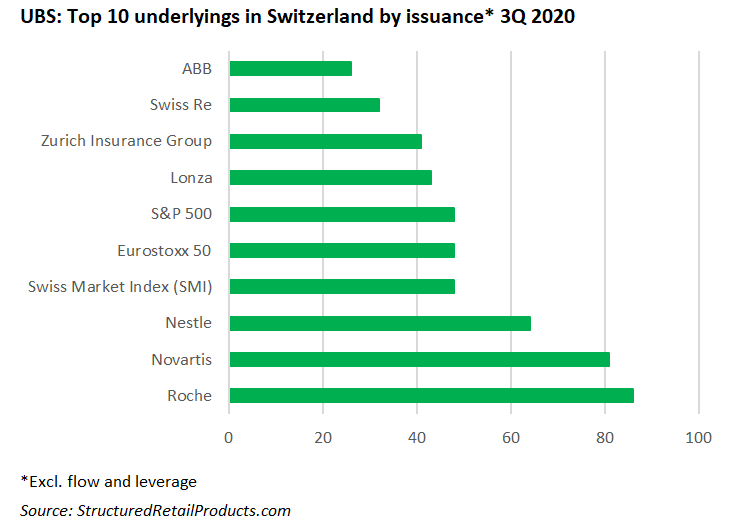

The main market for tranche products outside the USA, was Switzerland, were the bank issued 422 products worth an estimated US$612m, according to the SRP database (3Q 2019: US$442m from 301 products).

All Swiss products were reverse convertibles, which are often linked to a ‘worst of’ basket comprising mostly domestic shares, of which Roche, Novartis, and Nestle were the most popular (used in 86, 81 and 64 products, respectively).

Other markets where the bank was active during the quarter, included Germany, where it issued 13,617 turbos and 3,834 flow certificates while in Hong Kong SAR it sold 231 warrants and 1,183 callable bull bear certificates (CBBC).

In asset management, invested assets were up six percent quarter-over-quarter to a record US$ 980 billion on positive market performance and foreign currency translation effects, as well as positive net new money of US$6 billion (US$ 17.9 billion excluding money market flows).

During the quarter, UBS announced a strategic alliance with Banco do Brasil, establishing an investment banking partnership that will provide investment banking services and institutional securities brokerage in Brazil and selected countries in South America. Upon completion of this transaction, UBS’s common equity tier 1 capital decreased by US$147m and there was no effect on profit or loss.

As of 30 September 2020, the bank’s balance sheet included debt securities worth US$19 billion (end-December 2019: US$14.1 billion).

Click the link to read the UBS third quarter 2020 results, full report and presentation.