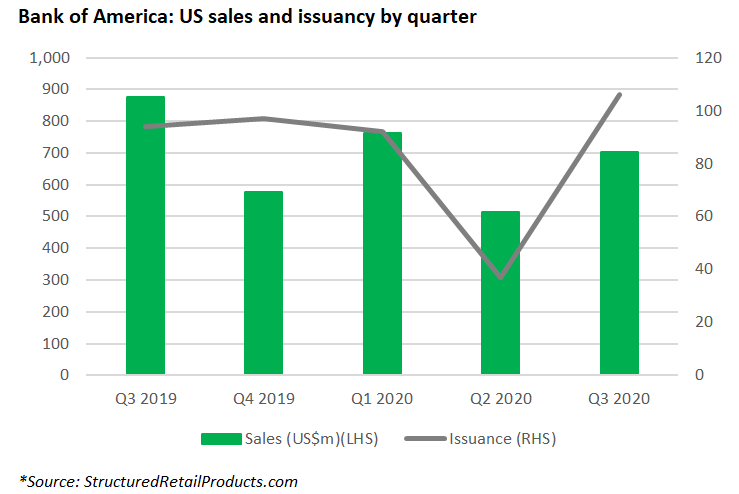

Bank of America’s structured product sales volume fell to US$701.62m in the third quarter of 2020 from US$874.2m during the same period a year prior, according to SRP data.

However, its issuance saw a 186% increase to 106 products, a significant uptick from the bank’s Q2 20 figure of 37 products and 12.7% compared to Q3 19 when the bank brought 94 products to market.

All in all, the US bank has issued 259 products worth US$2 billion and lost its spot in the US top 10 issuer ranking with sales falling significantly compared to the previous year. With two months before the end of the year, Bank of America is US$1 billion short compared to the US$3 billion sales volume achieved throughout 2019.

SRP’s database shows that the bank led by chief executive officer Brian Moynihan (pictured) has 95 live structured products listed in the US market mostly wrapped as registered unlisted notes (92) and CDs (three). Popular underlyings include the Constant Maturity Swap Rate, S&P500, DJ Industrial Average Index and Libor.

The products fall under six asset classes with equity (index basket, share basket, single index), hybrid, and interest rate, taking the lion’s share.

Bank of America reported net income of US$4.9 billion in Q3 20, a climb from the US$3.5 billion of Q2, though this reflects a decrease from US$5.8 billion in the third quarter of 2019.

Total revenues also tumbled around 10% to US$20.3 billion quarter-on-quarter.

Provision for credit losses totalled US$1.4 billion compared with US$5.1 billion in the previous quarter and US$0.8 billion in the third quarter of 2019.

Risk-weighted assets stood at US$1.46 trillion, remaining steady from Q2 20 though a slight drop from the value in Q3 19.

The bank’s global markets segment raked in a net income of US$857m with fixed income, currencies, and commodities (FICC) increasing three percent to US$2.1 billion and equities by six percent to US$1.2 billion. These were driven by a stronger performance in mortgage and foreign exchange products along with increased client activity in Asia.

Global banking reported a net income of US$926m while loans were down by one percent at US$373 billion and deposits shot up by 31% to US$471 billion.

Click here to view Bank of America’s third quarter earnings.