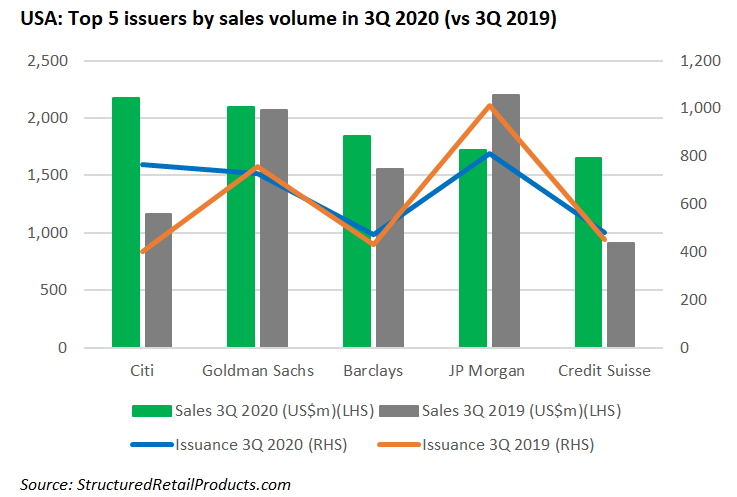

The US investment bank’s issuance has slightly dropped from its Q3 19 figure of 756 products though the current quarter’s sales volumes beats last year’s value of US$2.07 billion.

Goldman Sachs has seen its structured product issuance shoot up to 726 (US$2.1 billion) in the third quarter of 2020 from 595 products valued at US$1.56m during the previous quarter, SRP data shows.

The bank is the second most prolific issuer group in the US market behind Citi, reflecting a climb from its position of fifth place in Q2 20 and third place during the first quarter of 2020.

Other issuer groups presiding in the top 10 league table include Barclays (474/US$1.84 billion), JPMorgan (812/US$1.7 billion), Credit Suisse (480/US$1.65 billion), and Morgan Stanley (541/US$1.55 billion).

The bank led by chief executive officer and chairman David Solomon (pictured) has a total of 2,210 live products in the SRP database that are listed in the US market and wrapped as CDs (1,735/US$3.06 billion), registered unlisted notes (472/US$1.98 billion), exchange-traded notes (two/US$105.8m), and unregistered notes (one/US$6m).

Popular underlyings deployed in Q3 20 include the GS Momentum Builder Multi-Asset 5S ER Index, S&P500, Russell 2000, Motif Capital National Defense 7 ER Index, and Eurostoxx 50. The tranche investments fall under nine asset classes that include equity (single index, share basket, index basket, single share), hybrid, interest rate, commodities, FX rates and others.

Total net revenues stand at US$10.78 billion compared with US$13.3 billion in Q2 20, a 19% drop – this figure does represent a 30% rise from the bank’s Q3 19 figure of US$8.3 billion.

The bank’s investment banking segment reported net revenues of US$1.97 billion for the third quarter of 2020 reflecting a 26% plummet from its Q2 20 figure US$2.66 billion though a 7% increase from its Q3 19 value US$1.84 billion.

Global markets raked in net revenues of US$4.55 billion in Q3 20, a 29% increase from Q3 19 but a 37% fall from the previous quarter.

Risk-weighted assets (RWAs) stood at US$535m at the end of the quarter compared with US$563m in the second quarter of this year.

Total assets under supervision value US$2.04 billion compared with US$2.06 billion in Q2 20 and US$1.76 billion in Q3 19.

Net revenues in equities were US$2.05 billion, a 10% boost from Q3 19, due to significantly higher net revenues in equities intermediation that reflect greater earnings in derivatives, partially offset by lower net earnings in cash products.

Click here to view Goldman Sachs’ Q3 earnings.