The world’s largest hub for structured products has capitalised on the shortened listing cycle for these, introduced at the beginning of July to enhance market efficiency on product issuance and help increase product choice for investors.

Net profit at Hong Kong Exchanges and Clearing (HKEX) increased by 51.4% year-on-year (YoY) to HK$3.34 billion (US$430m) in the third quarter ended 30 September as revenue and other income surpassed the first two quarters.

Operating expenses in the quarter grew by 10.5% to HK$3.2 billion YoY. Net profit for 9M 20 stood at HK$8.57 billion, up 15.7% YoY.

The exchange reported that the listing cycle of structured products shortened from five to three trading days introduced in July was ‘another milestone for HKEX to accelerate growth in its structured products market’.

Equity and financial derivates

Revenue and other income in the equity and financial derivatives segment which houses the exchange’s structured products was up 6.9% to HK$2.51 billion in 9M 20 YoY, accounting for 17.8% of the total, while its EBITDA climbed by 4.2% to HK$2.01 billion.

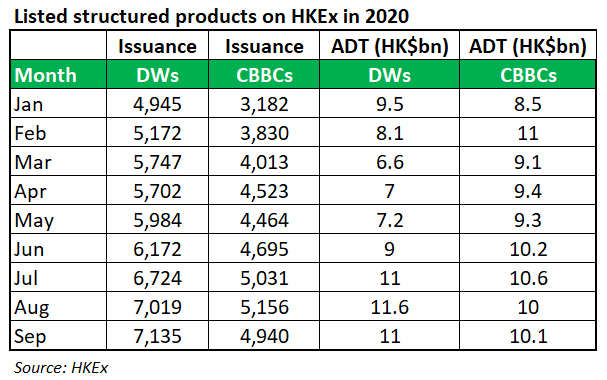

Trading fees and trading tariffs of derivative warrants (DWs), callable bull/bear contracts (CBBCs) and warrants were up 8.7% to HK$537m in 9M 20 YoY despite a slight drop in their average daily turnover (ATD).

The growth was supported by ‘higher trading fees received from new issues of DWs and CBBCs and an eight percent increase in the average daily number (ADN) of trades’.

The ATD fell by 4.1% to HK$18.9 billion while the ADN of trades rose by 8.4% to 348,000 during the first nine months of the year.

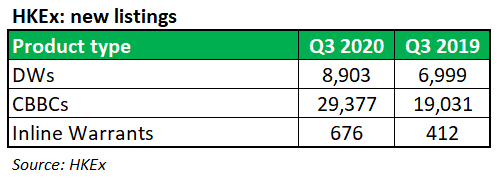

Stock exchange listing fees were up 38% due to ‘the increase in number of newly listed DWs and CBBCs’, which reached ‘a nine-month record high’ of 29,377 in 9M 20.

Derivatives trading fees of the futures exchange, the largest contributor in the segment, were down by 8.7% to HK$1 billion mainly due to ‘a lower proportion of higher fee contracts, including Hang Seng Index futures and options’ being traded in 9M 20.

Meanwhile, operating expenses grew by 19.4% to HK$418m because of ‘higher allocated costs of the listing division, reflecting the increase in listing fees from DWs and CBBCs compared with the decrease in listing fees from equities and license fees payable for MSCI contracts starting from Q3 2020’.

As a result, the segmental EBITDA reached HK$1.93 billion, up 4.2%, with an EBITDA margin of 80% in 9M 20.

MSCI Asian suite

HKEx launched 38 out of the 39 products under MSCI Asia and Emerging Market Index Futures and Options Suite, in Q3 20. Two JPY-denominated and an SGD-denominated contract, marked the first derivatives contracts on HKEX in the two currencies.

As of 30 September, the 38 products posted a total of 125,992 contracts traded since launch and 44,066 contracts in open interest, among which MSCI Taiwan (USD) Index Futures and MSCI Taiwan Net Total Return (USD) Index Futures were the most active.

MSCI Taiwan (USD) Index Options - the 39th in the suite - is set to be launched in Q4 20.

Additionally, HKEX has received certification from the US Commodity Futures Trading Commission, which will allow 28 MSCI futures contracts to be offered and sold to investors in the US.

Click here to view the HKEX’s Q3 20 report.