Brazilian investment bank XP Inc. has reported a 80% jump in retail revenues to BRL1.7 billion (US$310m) for the third quarter of 2020.

The increase was mostly been driven by an influx of structured notes (COE) issuance as well as equity-linked derivatives and fixed income.

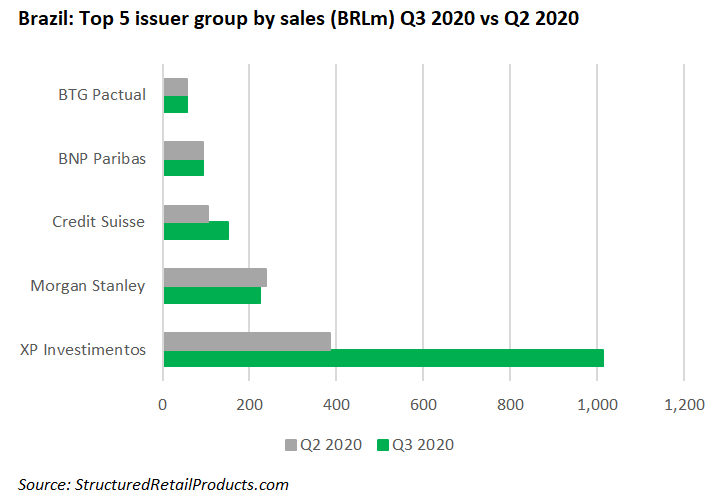

SRP data shows that the bank’s subsidiary XP Investimentos is the highest-ranking issuer group in the Brazilian market having issued a total of 78 structured products at BRL1.01 billion in Q3 20. Other leading firms include Morgan Stanley (19/BRL225m), Credit Suisse (13/BRL149.9m), BNP Paribas (six/BRL92.5m), and BTG Pactual (six/BRL55.7m).

XP Investimentos has 1,431 live products in the SRP database listed domestically, all of which are wrapped as COEs valuing US$1.96 billion. Popular underlyings include the Morgan Stanley Global Opportunity 9% Index (124/US$124.9m), GAM Star Credit Opportunities (EUR) (Acc) index (111/US$174.6m), Netflix (72/US$90m), and Credit Suisse Digital Health Fund Index (64/US$71.2m).

The majority of the investments fall under single index equities (434/657.3m), hybrids (374/US$411m), share basket equities (275/US$287m), credit (130/262.5m) and fund (129/US$213.8m).

The group’s overall gross revenues climbed 55% in Q3 20 to BRL2.2 billion from the third quarter of 2019.

Adjusted net income was up 119% in the third quarter totalling BRL570m, due to strong growth in retail revenues. Total assets under custody reached BRL563 billion on 30 September 2020 reflecting a 61% boost year-over-year while the increase can be attributed to BRL195 billion worth of cumulative net inflows and BRL18 billion of market appreciation.

Net inflows, adjusted by extraordinary equity inflows/outflows totalled BRL134 billion over the last 12 months, broken down to BRL11 billion each month. This figure has since increased to BRL13 billion for the third quarter of 2020.

The bank’s active clients have also grown by 72% in Q3 20 to 2,645 from 1,536 in the same period of 2019.

Total derivative financial instruments stood at BRL12.7 billion at the end of Q3 20, down compared to BRL15 billion recorded in the previous quarter of 2020.

As a result of higher equity trading volumes as well as increased fixed income secondary trading, institutional gross revenue is up by 38% in Q3 20 with a figure of BRL239m from BRL173m in the same period a year prior.

Click here to view XP’s third quarter earnings.