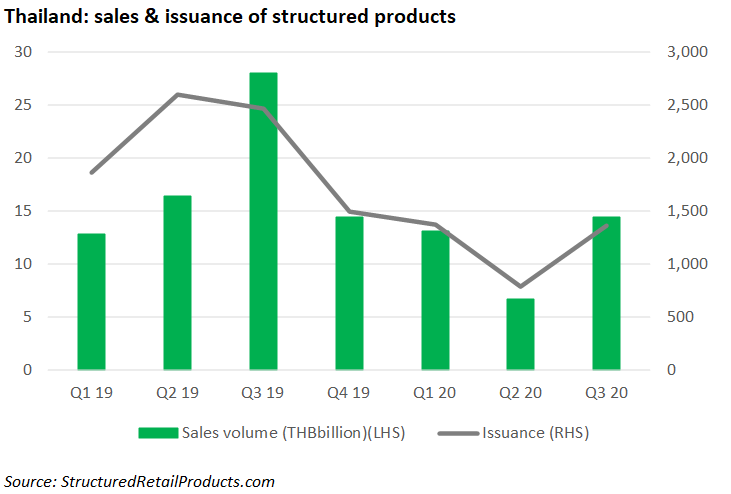

Thailand’s structured products market has seen a fall in activity with the main two providers delivering mixed performances.

The subsidiary of Kiatnakin Phatra Bank has kept a safe lead with 1,139 structured notes issued during the first nine months of 2020, despite a 2x plunge YoY amid an overall scaledown in Thailand. It was followed by CGS-CIMB Securities and Siam Commercial Bank.

This brings a total sales volume of THB6.6 billion, or a market share of 19.4%. In contrast, the broker-dealer recorded 3,405 notes worth THB17.5 billion, a market share of 30.6% during the same period in 2019.

With a tenor no longer than six months, the notes were sold to high-net-worth and institutional clients in Thailand, as required by regulations, with no capital protection.

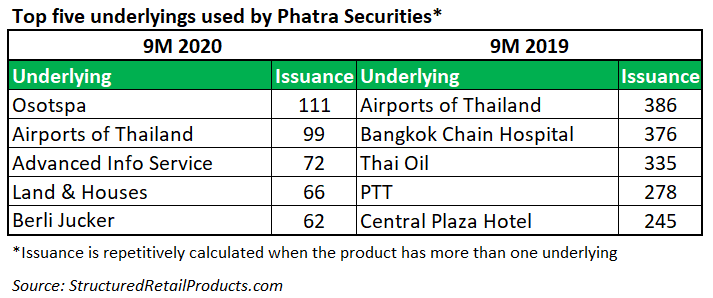

Food and beverage replaced healthcare as the most favoured underlying sector while the number of products linked to financial services rose to 12 from one, making it the eighth popular choice after oil and gas, healthcare, utilities, real estate and basic resources.

Kiatnakin Phatra Securities ("KKPS") posted a fees and services income of THB22m in the third quarter ended on 30 September, down 18.5% YoY, leading to that of THB68m in the nine months.

Expenses rose to THB44m from THB33m in the quarter YoY, bringing those to THB130m from THB94m in the nine months.

Siam Commercial Bank (SCB)

Unlike most issuers in Thailand, SCB posted an advanced volume with 582 products issued in 9M 20, up 135.6% YoY, a market share of 19.44% through a sales volume of THB6.6 billion.

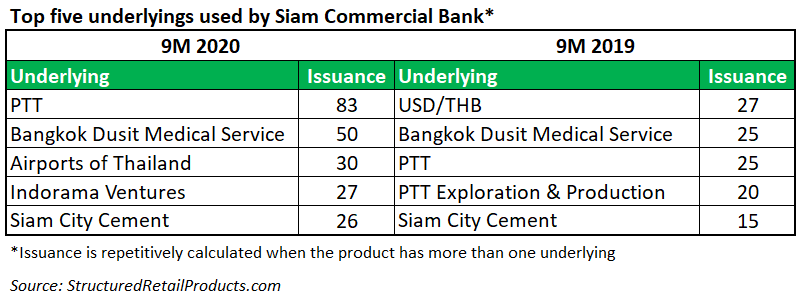

The top favoured underlying sectors remain the same for the largest commercial bank in country – oil and gas as well as basic resources. Travel and leisure made it to the third with 36 products linked to it while the number of products linked to G10 currencies dropped to three from 11 in 9M 19.

In addition, the bank issued 18 dual currency notes linked to USD/THB, down from 27 in 9M 19. The majority of them had an investment period of 30 days while two had a year. They were sold at US$14.8m-equivalent.

Net profit at SCB dropped by 68.9% to THB4.58 billion in the third quarter YoY, leading to a figure of THB22.1 billion in 9M 20, down 36.6% YoY.

CGS-CIMB Securities

The 50-50 joint venture between China Galaxy Securities and CIMB Group has issued 610 products for high-net-worth and institutional clients during the period from January to September, a slump from the 1,088 products YoY.

Airports of Thailand was the most popular underlying with 72 notes tied to it contributing US$25.8m-equivalent while 54 notes linked to Total Access Communication brought US$2.7m-equivalent.

Image: Tan Kaninthanond/Unsplash.