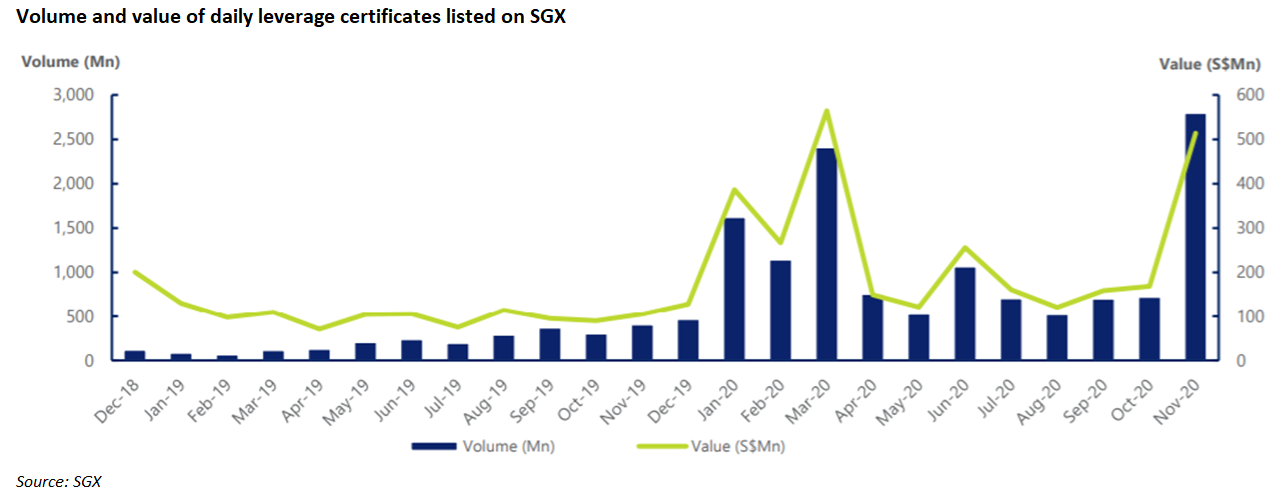

The turnover of daily leveraged certificates (DLCs) listed on the Singapore Exchange (SGX) has jumped by 390% to SG$514m in November year-on-year (YoY) as ‘markets bounced between positive news on vaccine developments and the pandemic's spread,’ according to a SGX report.

That figure, 94.4% of which is linked to stocks while the remaining to indices, is a 204% growth month-to-month (MoM). There was 121 DLCs on single stocks and 19 DLCs on the MSCI Singapore Free, Hang Seng Index or Hang Seng China Enterprises Index.

Single stock DLCs on Hong Kong SAR stocks accounted for 78% of the total turnover with Xiaomi, BYD, Alibaba and Tencent amongst the most popular stock underlying. The most actively traded stock DLC was the 5x Long Xiaomi DLC.

Weekly outstanding value in DLCs has grown more than sixfold since the launch of single stock DLCs in 2018, which reached a record high of SG$33m as of 27 November.

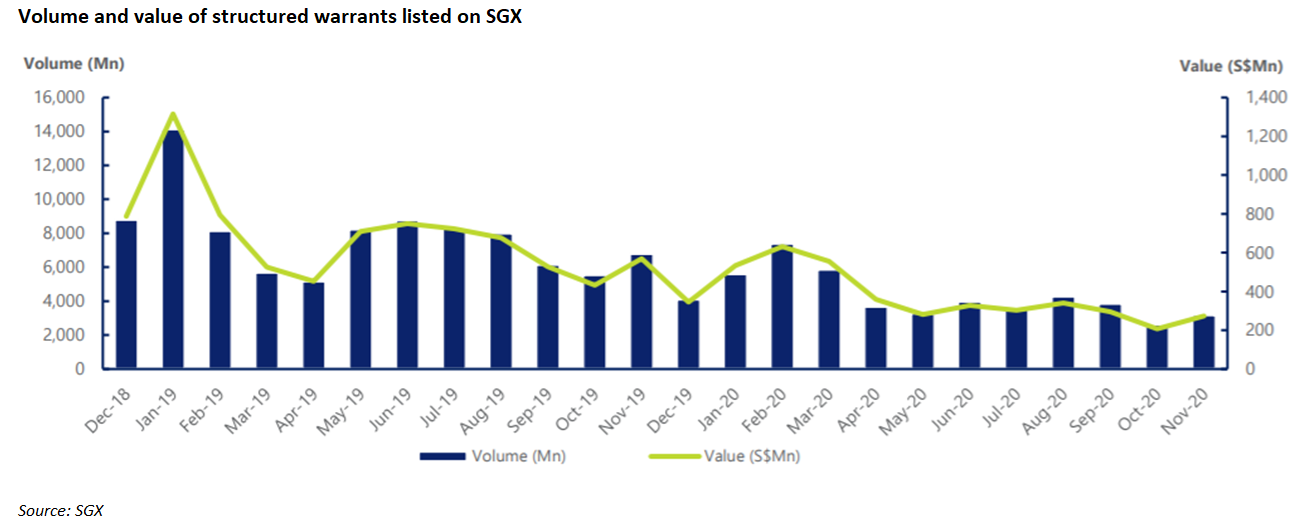

Structured warrants

In the meantime, the turnover of SGX-listed structured warrants in November was down 52% YoY to SG$274m, or up 32% MoM. Approximately 91.6% of the value came from the warrants linked to indices with the Hang Seng Index remaining dominant. There were 143 warrants outstanding as at the end of November.

This month saw Macquarie Bank list 42 new warrants on SGX, a hike from 26 in October. These included 11 longer-dated warrants tied to stocks and eight longer-dated ones tied to the Hang Seng Index, S&P 500, Nikkei 225 and Straits Times Index.

The longer-term warrants will expire between 25 February 2021 to 1 October 2021, and feature slower time value erosion and lower risk (lower effective gearing), according to Macquarie.

Additionally, the Australian bank has begun to trade one new warrant on iFast, UOL Group and City Developments (CDL) each since 30 November as it looks to expand its Singapore single stock shelf.

According to Macquarie iFAST shares have surged 247% year-to-date.

The three warrants will expire between 7 May 2021 to 1 July 2021 with an effective gearing between 2.7 and 5.3.