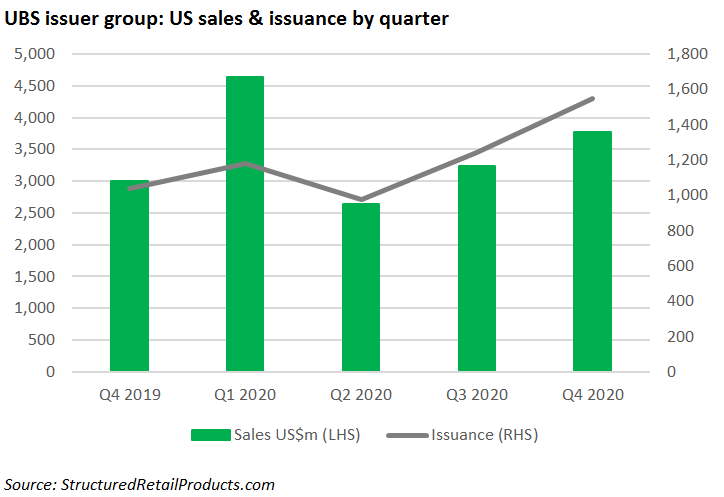

Swiss investment bank UBS has increased its structured product distribution in the US market by about 27% in Q4 20 from the prior year’s 1,547 products worth US$3.8 billion.

However, the bank’s structured product distribution fell from the first quarter of 2020 with 1,181 products valued at US$4.6 billion, making it the most prolific distributor at the beginning of the year.

UBS then slid to second place behind Morgan Stanley during the second quarter with 977 products worth US$2.6 billion and has not budged from its ranking since then.

In Q4 19, UBS distributed 1,041 structured products worth US$3 billion, trailing behind Morgan Stanley’s 575 products that were valued at US$3.2 billion. Bank of America was third, having distributed 165 products with a sales volume of US$2.9 billion.

SRP data shows that UBS as a distributor group has 7,962 live structured products in the US market. The most common underlying sectors are technology (US$2.9 billion), industrials & related services (US$2.7 billion), emerging markets (US$2.1 billion), retail (US$932m), and banks (US$548m).

The majority of the tranche investments are wrapped as registered unlisted notes, exchange-traded notes (ETNs), and CDs, while main issuers include UBS, Barclays, Morgan Stanley, Goldman Sachs, JPMorgan, and HSBC.

Profit before tax (PBT) in Q4 20 was US$2.1 billion, up 122% year-over-year, including net credit loss expenses of US$ 66m.

PBT in FY2020 was US$8.2 billion representing a 47% increase year-over-year, inclusive of net credit loss expenses of US$694m.

Risk-weighted assets stand at US$289 billion as of 31 December 2020, compared with US$259 billion in 2019.

Global markets revenue increased by 21% or US$248m, primarily driven by higher client activity levels, particularly across equity derivatives, cash equities and credit product lines.

“Our strong 2020 results clearly demonstrate the true strength of our franchise and the commitment of our employees. It was a challenging year for our clients, for our colleagues, and for our communities alike, which makes these results even more gratifying,” said chief executive officer Ralph Hamers (pictured).

Click here to view UBS’s Q4 20 earnings.