The US group reported record net income boosted by a strong performance in the institutional client group in a year that started better than expected, according to CEO Jane Fraser (pictured).

Citigroup has reported net income of US$7.9 billion on revenues of US$19.3 billion for the first quarter of 2021. This compared to net income of US$2.5 billion, on revenues of US$20.7 billion for Q1 2020. During the quarter the group sold more structured products in its domestic market than ever before, according to SRP data.

US

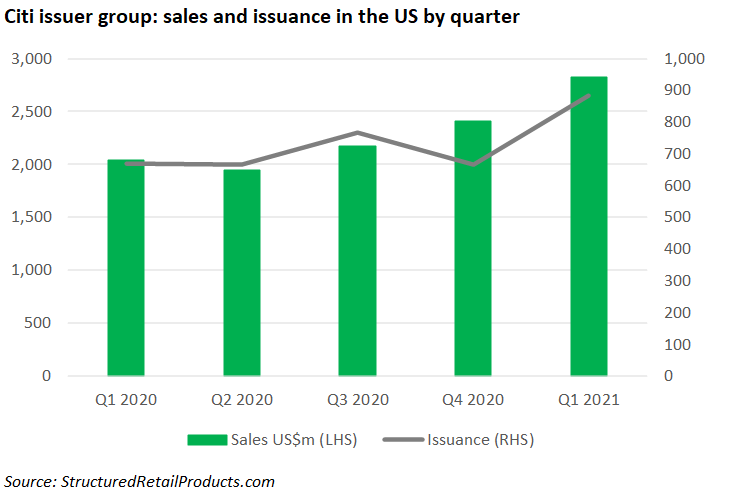

Citi registered record structured product sales in the US market in the first quarter of 2021. The group collected US$2.8 billion from 883 products in the period – its highest quarterly sales volume since the launch of the SRP US database in 2005. Volumes were up 38% year-on-year (YoY) and by 17% compared to Q4 2020, when it achieved sales of US$2.4 billion from 667 products.

The group’s US products are issued via the Citigroup Global Markets Holdings vehicle (formerly Salomon Smith Barney Holdings), which provides financial advisory, research and capital raising services in investment services, private client services and asset management.

Citi’s US products were available via nine different channels, of which UBS Financial Services saw the highest volumes (US$657.9m from 44 products), including US$50.8m for a Trigger Callable Contingent Yield Note on a worst of basket comprising S&P 500, Russell 2000 and Nasdaq 100 – the bank’s best-selling product in Q1.

Other active distributors for Citi’s products included Morgan Stanley Wealth Management (US$293.4m from 34 products), First Trust Portfolio’s (US$151.9m from 89 products), Raymond James (US$139.3m from 34 products), and Goldman Sachs Private Banking (US$73.4m from 18 products).

Europe & Apac

Outside its domestic market, Citi was also active, albeit on a much smaller scale, in both Europe and Asia.

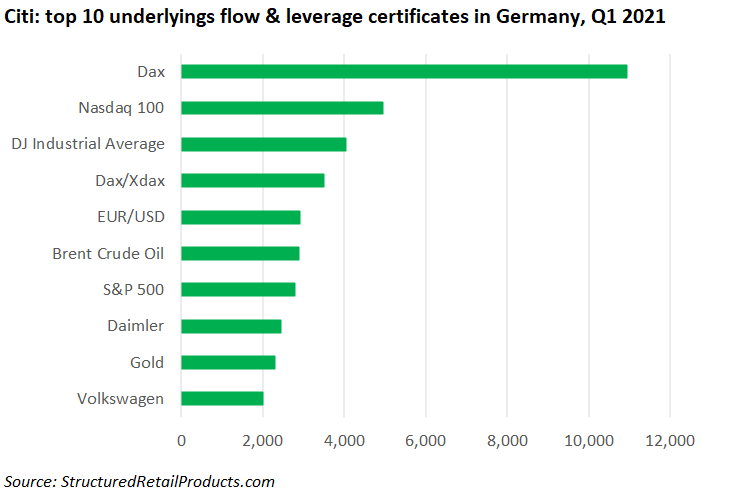

The main focus in Europe was not with the traditional primary market products, but with listed flow- and leverage certificates instead. This rings especially true in Germany, where the bank launched 11,950 (capped) bonus certificates and 82,535 turbo certificates in the quarter.

Underlyings for these products mainly focused on single stocks (55,738 products) and indices (29,931) while commodities (5,490) and FX rates (3,282) were also in demand.

In Italy, it issued 20 Phoenix autocalls and one autoswitch certificate. The latter has a three-year tenor and is tied to the shares of Airbnb and TUI. It pays a quarterly coupon of 4.25% providing both shares close at or above 70% of their initial level on any valuation date. However, if on any interest conditionality switch observation date (from 21 January 2022 onwards), the reference price of the worst performing underlying is at or above 100%, the coupon becomes fixed for the remainder of the tenor.

A further two structures were available in Sweden via Strukturinvest, while in the UK six products were sold via Walker Crips (four) and Hilbert Investment Solutions (two), respectively.

In Asia, the bank was the manufacturing company behind six products that were sold through the networks of local providers.

First quarter earnings

Revenues in the institutional clients group (ICG), at US$12.2 billion, were up 32% quarter-on-quarter (QoQ) but slightly down (two percent) from Q1 2020.

Markets and securities services revenues of US$6.7 billion increased by two percent year-on-year (YoY) and by 49% QoQ. Fixed income markets revenues of US$4.6 billion were down five percent versus a strong prior-year period, as higher revenues across spread products partially offset lower revenues in rates and currencies. Equity markets revenues of US$1.5 billion increased 26%, driven by strong performance in cash equities, derivatives and prime finance, reflecting solid client activity and favourable market conditions.

In global consumer banking (GCB), the group announced that as part of an ongoing strategic review it will focus its presence in Asia and Europe Middle East and Africa (Emea) on four wealth centres: Singapore, Hong Kong, the UAE and London.

‘We have decided that we are going to double down on wealth,’ said Fraser, adding that this positions the group to ‘capture the strong growth and attractive returns the wealth management business offers through these important hubs’.

As a result, Citi is exiting from its consumer franchises in thirteen markets including, among others Australia, China, India, Korea, Poland, Russia, and Taiwan. However, Citigroup’s ICG will continue to serve clients in these markets.

Click the link to read the Citi first quarter 2021 results, presentation and financial supplement.