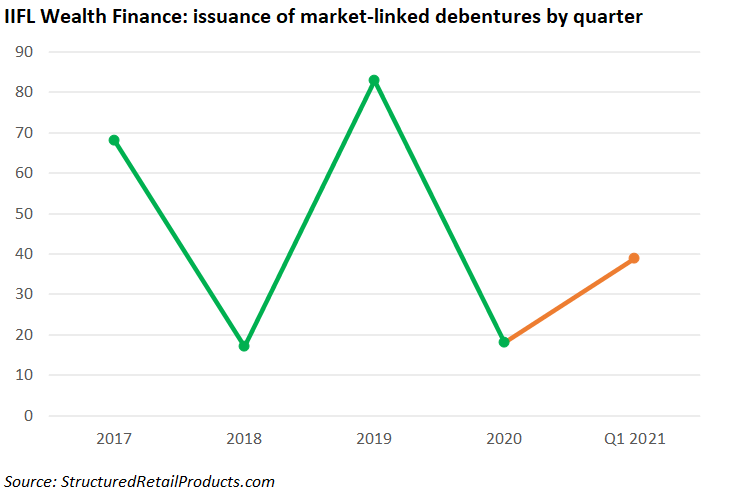

The subsidiary of IIFL Wealth Management has led the issuance of structured products in India, known as market-linked debenture (MLD), accounting for 81.8% of the market share in Q1 21.

The firm has marketed 39 MLDs during the first three months of the year followed by Edelweiss Financial Services (17), Edelweiss Finance & Investments (13) and ECap Equities (11), which doubled its issuance in 2020 and accounted for 47% of that in 2019, according to SRP data.

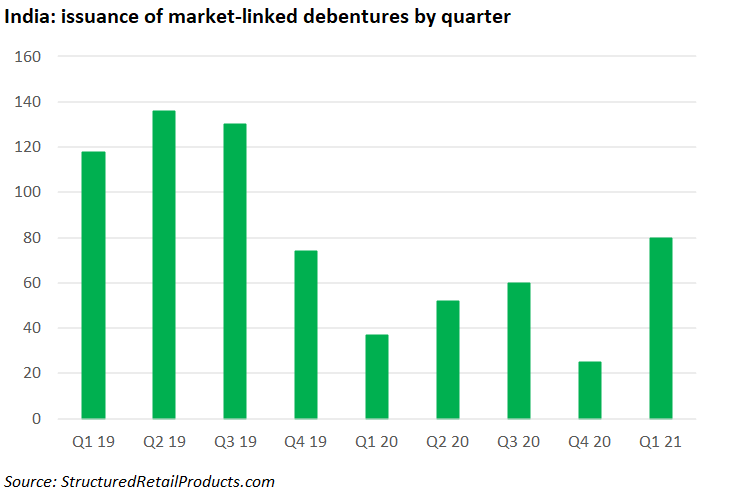

The 80 products issued in India in Q1 21 are all fully principal-protected, 70 of which are linked to 10-year India government bonds with a yield of 5.77% with the remaining linked to the Nifty 50 index. The two assets are the most common underlyings for MLD structures in India, which require a minimum investment of INR2.5m (US$35,000) when being traded through portfolio management services. The treasury bill currently offers a coupon of six percent.

Edelweiss Finance & Investments and Edelweiss Asset Reconstruction Company together issued 14 MLDs tracking the Nifty 10 yr Benchmark G-Sec (Clean Price) Index from January to July 2020, which together collected INR1.3 billion. The finance arm of Edelweiss was the most active issuer of MLDs in 2020 with 49 tranches after finishing 2019 in second place .

Eight out of the 14 products have an investment period of six years while one has a 10-year term, which is longer than the typical two to three year tenor for MLDs. These products usually require a lock-in period of at least 12 months.

The Edelweiss Private Banking H1G001A05 raised the highest sales volume during this period at INR507.5m. The six-year structured note based on a digital payoff will be redeemed early paying out a 13.59% coupon if the final level of the underlying index is above 50% of the initial level. If the underlying is at or below 10% of its initial level on any valuation date, the product will offer a coupon of 43.201%, or 6.132% pa.

India’s MDL market shrank sharply in 2020 with 174 products issued nationwide, down 62% year-on-year (YoY), according to SRP data. The first quarter of 2021 saw 80 products launched, down 38 from Q1 19.

Centrum Capital and Centrum Financial Services, which were among the top three issuers by number of products in 2020, have not been active in the MLD market this

The management segment of IIFL Wealth & Asset Management posted a pre-tax profit of INR1.08 billion in Q4 FY21 ended in March 2021, up 14.9% quarter-on-quarter bringing the firm’s full-year pre-tax profit to INR3.86 billion, up 41.9% YoY.

Click here to view IIFL Wealth & Asset Management’s earnings report for Q4 FY21.