DBS Bank Limited (DBS) has announced the launch of the first two series of derivative warrants listed on the Hong Kong Exchanges & Clearing Limited (HKEX) following the approval of DBS as a listed structured products issuer by the Hong Kong exchange.

The Singapore bank has launched one series of call warrants and one series of put warrants linked to Tencent Holdings Limited stock, and plans to continue adding its product offerings this year, with additional derivative warrants that cover over 60 major underlying stocks listed in Hong Kong SAR, to respond to ‘rising market demand’.

DBS will also enter the callable bull bear contracts (CBBCs) segment to further expand its product offering for Hong Kong investors.

The launch is part of the bank’s plan to expand its wealth structured products franchise and derivative warrants business, according to Wei San Soong, head of equity derivatives, treasury & markets at DBS.

‘The synergy will allow us to ensure that we provide competitive prices to all our customers,’ he said, adding that the bank will continue ‘to dedicate significant effort in exploring a wide spectrum of financial products from local and global markets, and opening investment opportunities for investors’ broader market exposures’.

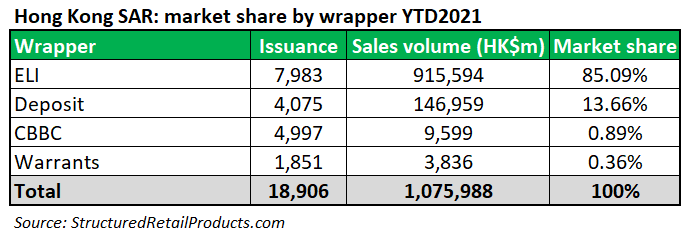

Warrants are the fourth most popular product wrap in the Hong Kong SAR market, according to SRP data. The most active providers in Hong Kong include HSBC, Bank of China, UBS, Société Générale and Credit Suisse.

Spectrum Markets adds equity stocks to turbo range

Spectrum Markets has expanded its range of turbo certificates linked to indices, foreign exchange and commodities with a selected number of equities from Europe and the US. The new turbo certificates are now tradable at the pan-European trading venue for securitised derivatives.

‘In addition to indices, which account for around 40-45% of general trading volume on the main market places in Europe, equity turbos are traded by a good third of market participants via leveraged products,’ said Eren Eraslan (right), head of product innovation at Spectrum Markets.

At launch, the platform offers turbo products linked to 70 of the most popular stocks in the US and Europe, which currently see high trading volume through securitised derivatives.

‘Usually, it is only a small number of stocks that account for about 90 percent of the trading volume,’ said Eraslan.

Currently the best represented sectors are IT (19 stocks), bank/finance (11 stocks) and commerce/e-commerce (eight stocks).

The selected stocks include well-known tech firms such as Alphabet, Amazon, and Tesla, alongside shares of other companies like LVMH Group, The Coca-Cola-Company, Astra Zeneca and Deutsche Bank. Investors will also be able to access niche innovators like plant-based meat substitute maker Beyond Meat, Dutch payments group Adyen, and Chinese electric vehicle company NIO.

Abu Dhabi exchange to launch derivatives market

Abu Dhabi Securities Exchange (ADX) has signed an agreement with Nasdaq to deliver marketplace technology solutions, including matching, real-time clearing and settlement technology.

The exchange is expanding asset classes and developing new offerings for both regional and international investors as it moves to launch a derivatives market this year.

‘By deepening our capital markets and increasing the range of products and services, we are supporting the UAE’s strategy for economic diversification, providing growth companies with favorable access to global capital and allowing investors to participate in the UAE’s ambitions,’ said Mohammed Ali Al Shorafa Al Hammadi, chairman of ADX.

The exchange plans to launch single stock futures and index futures in the fourth quarter of this year before expanding to a wider range of derivative products.

The derivatives market will be accompanied by introducing central counterparty clearing (CCP) to promote ‘clearing efficiency, stability and confidence in the market’.

The ADX One strategy, launched at the start of 2021, aims to bring a broader offering of products and services to market in partnership with global market institutions. As of August 2021, ADX has 78 companies listed on its main and Second Market.

Bloomberg completes BRAIS fixed income index rebrand

Bloomberg has rebranded the Bloomberg Barclays fixed income benchmark indices as the Bloomberg Fixed Income Indices.

The rebrand marks the end of the five-year transition period following Bloomberg’s acquisition of Barclays Risk Analytics and Index Solutions (BRAIS) in 2016.

The flagship fixed-income benchmarks including the US, Euro, Asia-Pacific, Global Aggregate, US Municipals, High-Yield, Emerging Market, Inflation, and Convertible indices, are all included in this rebrand, as well as all bespoke and customized fixed income indices. This also includes the Bloomberg Barclays MSCI Indices, which are now known as the Bloomberg MSCI ESG Fixed Income Indices.

Bloomberg acquired the indices from Barclays with the agreement that they be co-branded for five years. The bank retained its quantitative investment strategy (QIS) index business as well as the Barclays strategy indices which include the Roubini Barclays Country Insights Indices, a family of tradeable equity indices based on the Roubini Country Insights model launched in July 2014, and the Shiller Barclays CAPE indices, developed jointly by Barclays and Professor Robert Shiller of Yale University. The calculation and maintenance of Barclays' strategy indices was outsourced to Bloomberg as part of the agreement.

BMO, Rex Shares partner in leverage ETN FANG push

REX Shares has launched two new MicroSectors Exchange Traded Notes (ETNs) issued by Bank of Montreal (BMO) linked to the Solactive FANG Innovation Index.

The new MicroSectors Solactive FANG & Innovation 3x Leveraged ETN (BULZ) and MicroSectors Solactive FANG & Innovation -3x Inverse Leveraged ETN (BERZ) are available for trading on NYSE Arca.

Launched in June 2021, the Solactive FANG Innovation Index tracks large US-listed tech and internet/media companies and is designed to represent stocks building tomorrow's technology today.

The index includes eight core components (Apple, Amazon, Facebook, Alphabet, Microsoft Corporation, Netflix, NVIDIA Corporation, and Tesla) and the seven stocks with the largest market capitalisation and 12-month average daily value traded taken from the technology sector, including Advanced Micro Devices (AMD), Intel Corporation (INTC), Micron Technology (MU), PayPal Holdings (PYPL), salesforce.com (CRM), Square (SQ), and Zoom Video Communications (ZM). The index is equally weighted across all stocks, rebalances monthly and reconstitutes quarterly.

BMO and REX have collaborated on the development and issuance of ETNs since 2017, and currently provide over 14 ETN offerings.