The Thai arm of Malaysia’s CIMB Group has also seen a steady demand for credit-linked bills of exchange (CLNs).

CIMB Thai Bank has raised its structured note volume by 35.5% to THB4.38 billion (US$141m) in H1 21 year-on-year, holding the third place in the issuer league table with 47 products brought to market.

The bank’s volume could have translated into a higher market share which stood at 8.25% in H1 21 due to the irruption of dark horse Krungthai Bank, SRP data shows.

The structured notes designated at fair value through profit or loss were stable at THB8.15 billion as at June-end compared with six months ago, which represented a 2.7x increase from a year ago, according to the bank’s H1 21 financial report.

These were callable range accrual notes referenced to the three-month Thai Baht Interest Rate Fixing (THBFIX), which will mature in two to five years.

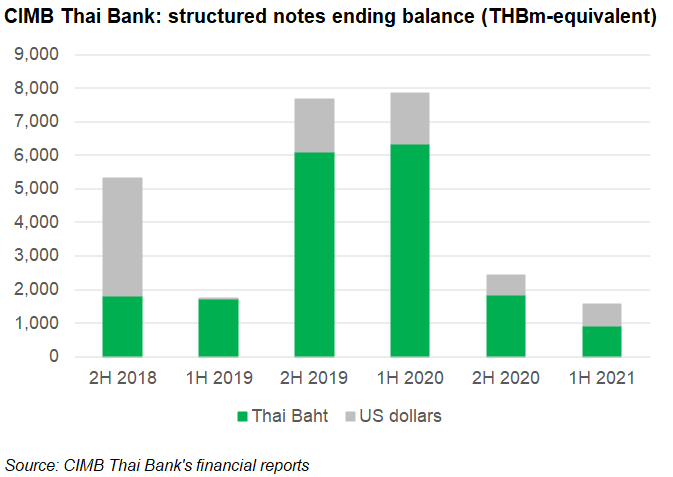

As of 30 June, the outstanding balance of structured notes, locally known as structured debentures, fell by 35.8% to THB1.57 billion compared to six months ago, the report shows.

Credit-linked notes remained the largest contributor with a US$20m balance – an unchanged level from six months ago. The notes have a tenor of three years with the coupon and redemption amounts set to be paid at maturity.

Mutual fund-linked notes at THB815m with tenors of between one and three years were also in focus. The bank recorded a US$0.6m and US$9m balance for such notes as at 30 June and 31 December 2020, respectively.

The balance of mutual fund-linked notes with one year maturities has been dwindling since it hit a record high of US$12m at the end of 2019.

In addition, the bank headed by new CEO Paul Wong Chee Kin (pictured), had THB116m in Maxi X-Change Single Barrier Bullish notes with a tenor of one to two months - a hike from the THB45m six months ago.

Among the 47 new products issued by the bank during the last six months, there was one reverse convertible note tracking Thai stock Advanced Info Service which sold THB20.4m. The note matured on 30 June after striking on 31 May, SRP data shows. The remaining were linked to interest rates or FX rates.

In H1 21, interest expenses for structured notes plunged to THB10m from THB74m, according to the bank.

Bills of exchange

CIMB Thai Bank is an active issuer of structured bills of exchange, which are not protected by the Deposit Protection Agency and, like structured notes, are only accessible to high-net-worth individuals and institutional investors.

As of 30 June, the accreting bills embedded with interest rate swaps were measured to fair value at THB17.7 billion, translating to a 23.8% decline from six months ago. These bear an interest rate of 1.78% to 5.18% pa, and have an investment term of between three and 23 years. To hedge the interest rate risk of these products, the Thai commercial bank buys interest rate swaps (IRS) with other counterparties.

The issuer had an outstanding balance of credit-linked bills of exchange (CLNs) of THB5.29 billion - this was a stable level compared with six months ago.

By currency, the THB1.8 billion CLNs bear an interested rate of 3.75% to 4.01% pa. with an investment period of 10 years while the US$109m CLNs carry a floating rate of six-month Libor+ 1.6597% to six-month Libor+ 2.3925% pa.

For both types, their investors will receive all coupon amounts on the respective payment dates and the redemption amount upon maturity, subject to the credit risk.

Interest expenses for structured bills of exchange during the last six months fell to THB29m from THB51m.

Click in the link to view CIMB Thai Bank’s H1 21 financial report..