The Chinese securities house delivered a stable issuance in H1 21 year-on-year (YoY) as the decrease in short-term notes was offset by an increase of long-dated structures.

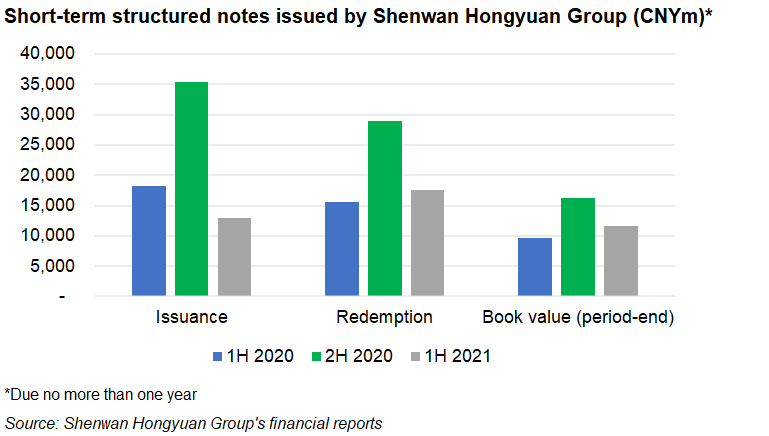

New issuance of short-term structured notes with a tenor of no more than one year raised CNY13 billion (US$2 billion) across 435 tranches, down 28.8% YoY, according to Shenwan Hongyuan (SWHY) Group’s H1 21 financial report.

In the meantime, there were 429 tranches redeemed at CNY17.5 billion, which led to a book value of CNY11.6 billion as of 30 June, down 20.3% YoY.

By the end of the first half, the structured notes issued used fixed rates or floating rates to accrue interest, in which the fixed rates ranged between 2.80% and 6.80% - a steady level compared with six months ago.

During 2020, the issuer has launched 1,407 tranches of structured notes and repaid 1,078 tranches.

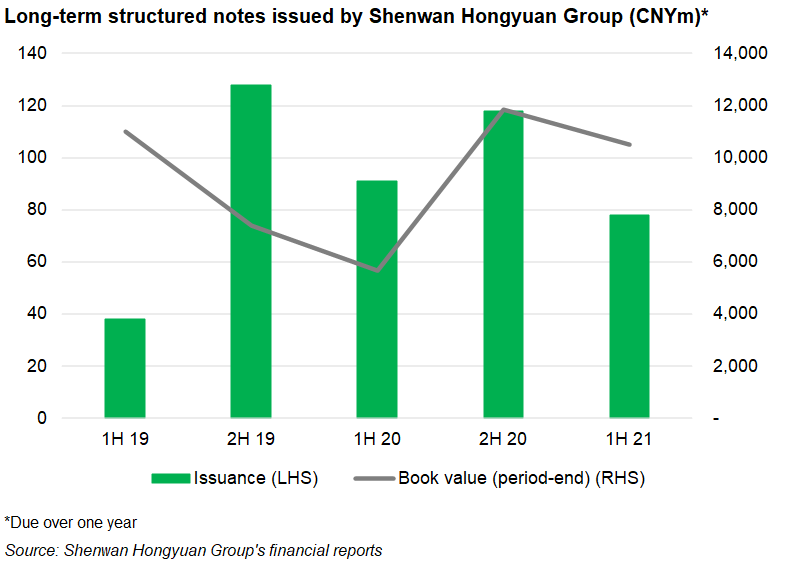

For long-term structured notes, which have an investment term of over one year, the issuance amount nearly doubled to CNY10.5 billion, although the number of tranches dropped to 78 from 91 during the same period YoY, stated the report.

The fixed rates to accrue the interest of new structures remained between 3.3% and 4.22% during the first half of the year

As one of the major financing channels for the parent group, SWHY Securities is the main issuance entity of structured notes and one of the most active broker-dealers in China.

The current structured notes liabilities were measured to fair value at CNY2.6 billion, more than triple compared to six months ago, when the figure was CNY366.3m for non-current structured notes liabilities, down 18%.