Market players in South Korea reflect on the stagnating issuance of equity-linked securities (ELS) linked to ESG indices since their debut in April.

As the most active issuer of ESG index-linked ELS, Shinhan Investment halted its weekly offerings in August having collected KRW11.2 billion (US$9.4m), according to the securities house. Nearly half of the sales amount came from equity-linked funds distributed by Korean banks to retail investors.

“As the volatility of other underlying indices increases, the competitiveness of ESG index-linked ELS has decreased,” a spokesman at Shinhan Investment told SRP.

The issuer has rolled out nearly 900 ELS since April with the S&P 500, Eurostoxx 50 and Hang Seng China Enterprises Index as the most used underlying assets, SRP data shows.

In South Korea, there are 63 live ESG-linked ELS tracking the performance of the S&P 500 ESG, Kospi 200, Eurostoxx 50, Eurostoxx 50 ESG or Nikkei 225 in the form of a single or basket structures, according to SRP data. Five additional ELS were withdrawn during their subscription period, including a structure linked to the Eurostoxx 50 Low Carbon EUR Price index.

All live products have a tenor of three years and offer no capital protection - the only offering with 80% capital protection was withdrawn by Shinhan Investment in April. At least 11 of the 63 live ELS are step-down autocallables with a worst-of option, SRP data shows.

Despite the efforts to promoting ESG-linked ELS through weekly launches, Shinhan Investment has seen little interest in the ESG theme from investors who are yield-orientated.

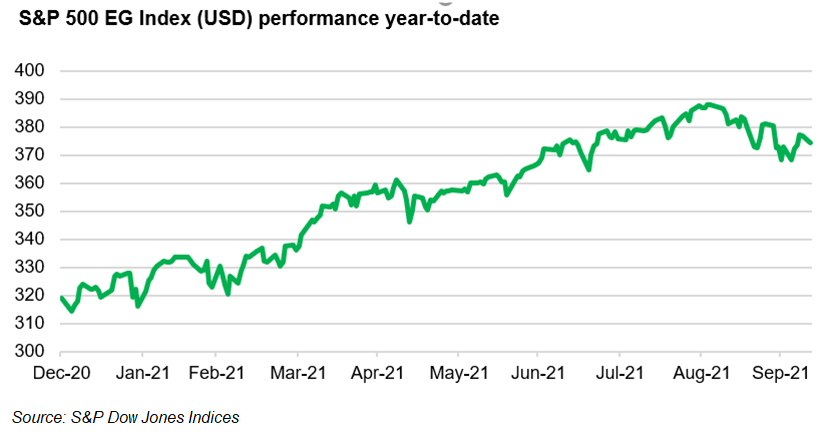

“So far, investors do not feel a big difference between an ESG index and a regular index due to the lack of outperformance between them,” said the spokesman. “Retail clients still look at ESG as the point of consumption but not as an investment.”

To raise interest, issuers and distributors may consider incentives for investors such as a preferential interest rate for loans for customers who invest in ESG index-linked ELS, according to the spokesman.

Gyun Jun (pictured), senior analyst and director of derivatives strategy at Samsung Securities, noted that ESG-linked ELS usually have a longer investment period, which is required for ESG indices to deliver outperformance of its non-ESG index counterparts.

“Most ELS in Korea have a short-term duration catering to the appetite of retail investors,” Jun told SRP, adding that institutional investors currently account for a larger volume of the ESG-linked ELS than retail.

Korean investors prefer direct investment for the environmental theme among the ESG components, which has stood out in the post-pandemic era, such as renewable energy, said Jun.

“ESG-linked exchange-traded funds (ETFs) or mutual funds have delivered better yields than structured products. The ESG-linked ELS market is still expected to grow in the long term.”

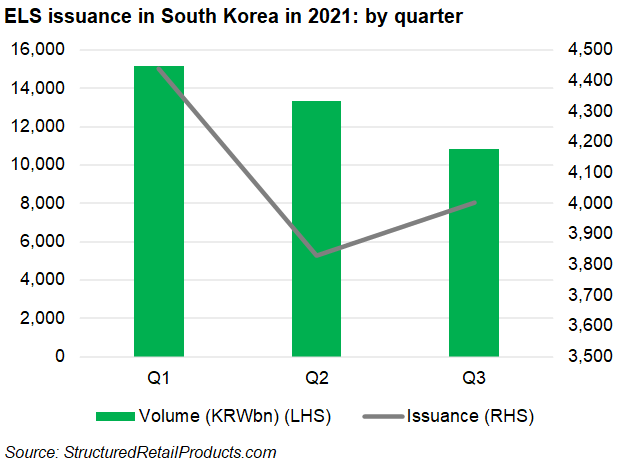

Looking at the entire ELS market, new issuance has been slashed in Q2 21 as the global stock market began to correct, according to Jun. “Investors are increasingly worried about the inflation and more correction of stock markets,” he said.

This has led to an increasing popularity of ‘hi-five’ or ‘shooting-up’ ELS structures, which offer partial capital guarantee with a digital or leveraged call options, especially on single stocks, according to Jun.