Marex Financial Products is making its Bitcoin Cash and Carry trade is available again as the Bitcoin futures curve is at its steepest in five months.

The non-banking issuer launched a new tranche of the trade ahead of the first Bitcoin ETF in the US. Marex Financial Products is still the only issuer offering institutional investors a certificate to capture the economics of this trade.

By buying the spot cheaply and selling the forward at a higher price, a Cash and Carry trade allows investors to benefit from the difference between the spot and futures price of Bitcoin, generating a fixed return irrespective of Bitcoin price movements.

Our role is to make it easy for clients to invest their money - Joost Burgerhout

“With Bitcoin prices nearing an all-time high and today’s launch of the first futures-based Bitcoin ETF in the US, the curve has become very attractive again for the cash and carry trade,” Joost Burgerhout (pictured), head of Marex Financial Products, told SRP. “As with our previous launches, demand for this innovative product is extremely high but we do not expect this opportunity to be around for long.”

The firm continues to see increasing demand from traditional private bank investors who want access to digital assets through notes or certificates.

“Our role is to make it easy for clients to invest their money,” said Burgerhout. “We are allowing non-digital-natives to participate in this crypto opportunity on their terms. This is an exciting area of our business that we are fast growing and have a major announcement coming soon.”

ProShares rolls out first US BTC-linked tracker fund

ETF provider ProShares has launched the first bitcoin-linked exchange-traded fund (ETF) in the New York Stock Exchange (NYSE Ticker: BITO).

The new ETF is targeted at investors seeking to gain exposure to bitcoin returns, through a brokerage account. It can be bought and sold like a stock and does not need for an account at a cryptocurrency exchange and for a crypto wallet.

‘We believe a multitude of investors have been eagerly awaiting the launch of a bitcoin-linked ETF after years of efforts to launch one,’ said ProShares CEO Michael L. Sapir, adding that the new ETF will open up exposure to bitcoin to a large segment of investors who have a brokerage account.

‘BITO will continue the legacy of ETFs that provide investors convenient, liquid access to an asset class.’

Sapir noted that 1993 is remembered for the first equity ETF, 2002 for the first bond ETF, and 2004 for the first gold ETF.

‘2021 will be remembered for the first cryptocurrency-linked ETF,’ he said.

The ProShares Bitcoin Strategy ETF will invest primarily in bitcoin futures contracts and does not directly invest in bitcoin. In July of this year, ProShares’ affiliate company, ProFunds, launched the first bitcoin-linked mutual fund in the US.

Valour BTC trackers listed on the Frankfurt Stock Exchange

DeFi Technologies has announced that its subsidiary Valour, an issuer of digital asset exchange-traded products (ETPs), has begun trading its Bitcoin Zero and Ethereum Zero products on the Boerse Frankfurt Zertifikate AG this week.

The listing of Valour's Cardano, Polkadot, and Solana ETPs will follow shortly, according to Russell Starr, DeFi Technologies CEO.

‘This new market is key as Valour expands its international presence and of particular interest given Germany's crypto-friendly regulatory environment,’ he said. ‘We believe as our products list on larger and more liquid global exchanges, Valour's underlying AUM should grow substantially.’

The listing in Germany marks the next step in Valour's growth plans and intention to push into new markets. Since Valour first launched its Bitcoin ETP in December 2020 on the Nordic Growth Exchange, it has introduced ETPs on Ethereum, Cardano, Polkadot, and Solana, and announced the appointment of a new chief operating officer, Frances Edwards, who arrived from Blackrock.

As of 14 October 2021, Valour had surpassed US$250m in assets under management (AUM) trading on the Nordic Growth Market Stock Exchange (NGM) – the firm has had an exceptional first 10 months of 2021, which its AUM growing more than 2560% since the beginning of the year.

Valour's Bitcoin Zero and Ethereum Zero products precisely track the price of BTC and ETH without charging management fees. For each ETP of Valour that is bought and sold on the NGM, Frankfurt Stock Exchange or other exchanges, Valour purchases or sells the equivalent amount of the underlying digital assets, meaning the ETPs are fully backed at all times.

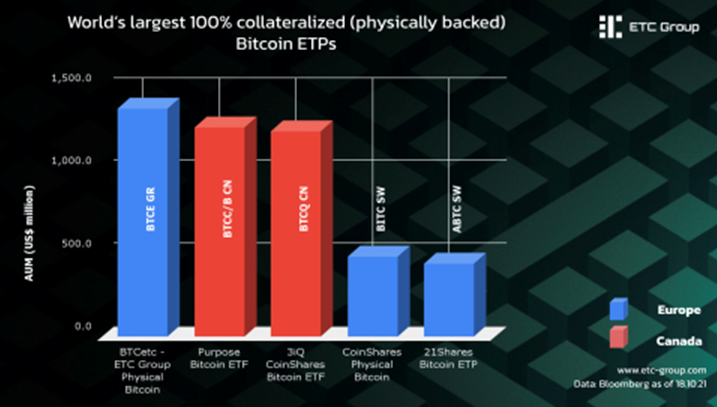

Europe overtakes Canada as the holder of the world’s largest and most traded physical BTC ETP

ETC Group’s total assets under management (AUM) reached US$1.5 billion, with its bitcoin ETP (BTCE), now the world’s largest physically backed single cryptocurrency ETP with over US$1.3 billion AUM.

The announcement comes only 16 months after the launch of ETC Group’s first product, BTCetc - ETC Group Physical Bitcoin (BTCE), on Deutsche Börse’s Xetra exchange. Research released this month by CryptoCompare also shows that BTCE is the most traded listed crypto ETP with average daily trading volumes of US$26.3 million, more than seven times its nearest competitor.

ETC Group has pioneered the digital asset management industry by providing institutional quality, 100% physically backed, high liquidity digital asset backed securities. With a Germany domiciled issuer, its Bitcoin product BTCE was the first crypto product to be centrally cleared when it listed on XETRA.

ETC Group was also the first company to make its leading Bitcoin ETC carbon neutral, and the first issuer to list a Crypto ETP on a UK stock exchange. Recently, BTCE became the underlying product of Europe’s first Futures contracts announced by Eurex, Europe’s largest derivatives exchange.

ETC Group now lists Bitcoin, Ethereum, Litecoin and Bitcoin Cash ETCs across multiple exchanges in Europe, and is planning to expand its suite of products to meet investor demand for digital asset-backed investments on Europe’s financial markets.

FOMO effect once again ripples through crypto world

The FOMO effect is once again rippling through the crypto world, bouncing the price of Bitcoin near all-time highs, according to Hargreaves Lansdown.

The announcement was released as Bitcoin gained US$2,000 dollars in just two hours earlier today as it surged back up towards yesterday’s record level above $66,930.

According to the UK manager, speculators are fearful of missing out on future price gains, amid expectation that the green light given this week to the Bitcoin futures ETF in the US ‘will swing open the saloon doors to more entrants into the crypto Wild West’.

‘The move does seem to have added more legitimacy to Bitcoin, despite the fact that trading in futures contracts and speculating where the price will go next may be even more risky and expensive than trading right now in crypto currency on an exchange,’ it said.

Given that the UK’s Financial Conduct Authority banned crypto EFTs as of January this year, the firm does not expect to see any moves in the UK any time soon.

‘The FCA has been nervous about the number of retail investors risking their money in the crypto sphere for some time. It’s now worried the volatile nature of the coins and tokens could blow up in the face of the financial sector with more institutions piling in,’ stated the firm.

‘We do expect fresh regulation to limit banks and hedge funds exposure to crypto to be introduced, which could be along the lines of the Basel Committee recommendations for financial institutions to be forced to set aside a buffer of up to 100% of money invested in crypto assets to protect against future losses.’

HL will not be able to offer these new ETFs as these are US domiciled ETFs. These don’t produce the correct key information document (KID) that are required for ETFs to be sold in Europe anymore.

This became a requirement in 2018 with the introduction of Packaged Retail Investment and Insurance Products (Priips) regulation, where prior to this the KID was not needed.