Belgian investors were spoiled for choice in 9M2021.

One hundred and four structured products worth a combined €1.1 billion had strike dates in the Belgian market during the first nine months of 2021. The products were linked to no fewer than 45 individual underlyings.

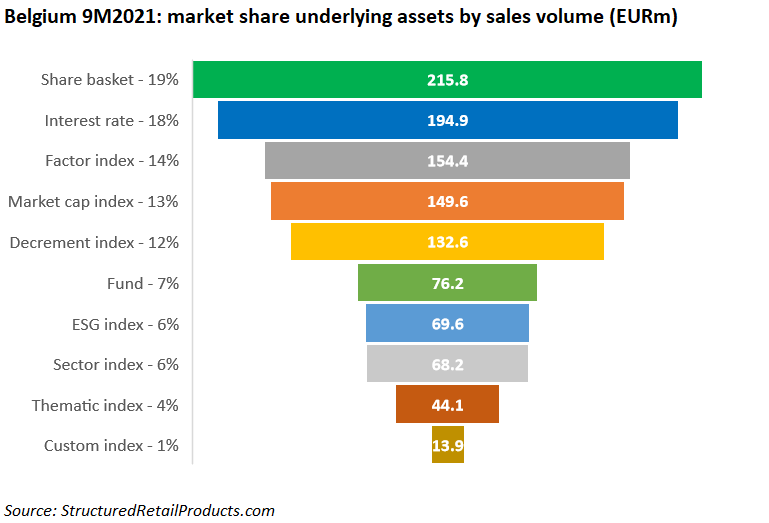

More than 65% of this years sales volumes came from structures linked to a single index, of which the Eurostoxx Select Dividend 30 (€83m) and Eurostoxx Banks (€68m) were the most popular. However, the highest market share was achieved by products tied to a share basket (€215m) followed by those that were linked to the interest rate (€195m).

Unlike in neighbouring France, where they were the number one underlying asset by some distance, decrement indices only achieved a 12% market share (€133m).

Check out the below table for the preferred underlying assets of the Belgian investor.