The number of hybrid-linked structured products in the US market has seen a significant uptick in 2021.

The SRP database has recorded a spike in the volume of hybrid-linked structured products during 2021 with sales volumes across the US market amounting to US$3.3 billion across roughly 1,322 products to-date.

This is a 33% increase from US$2.5 billion (1584 products) in sales during 2020.

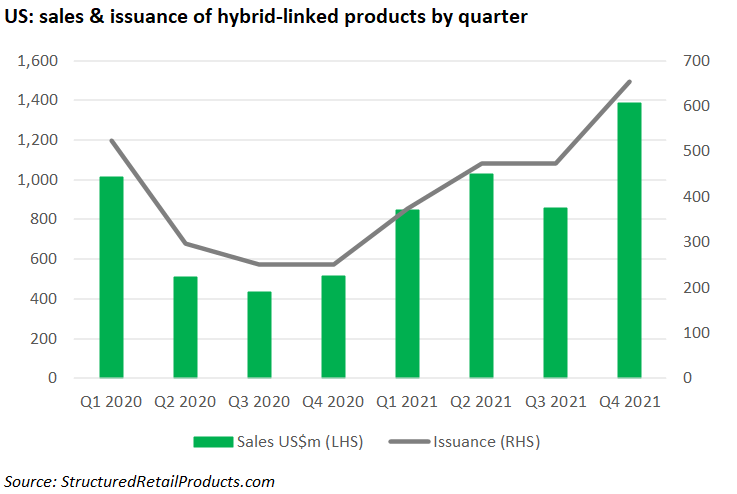

In the first quarter of 2021, a total of 375 structured products falling under the hybrid asset class were issued, valued at US$848m. This was a 28% decrease from the 523 products issued in the same quarter of 2020 where sales stood at US$1 billion.

Issuance then shot up to 474 products in the second quarter of 2021 while sales amounted to US$1 billion, a record figure for the year, compared with 298 products issued in the same period a year prior in which sales totalled US$511m.

Activity stagnated in the third quarter of 2021 where sales dropped to US$855m extending across 473 structured products. As of 31 December 2021, fourth quarter sales stand at US$1.4 billion for 653 products.

Over the past five years, sales and issuance of hybrid-linked structured products in the US market have fluctuated with 2016 recording US$1.5 billion in sales for 572 products. This then increased to US$2.3 billion across 1,142 products in 2017, and subsequently US$3.5 billion for 1,844 products in 2018. By the end of 2019, sales fell to around US$2.7 billion extending across 1,703 products.

The best-selling hybrid structure during 2021 to-date was the Uncapped Return Enhanced Notes - Worst of Option (48132RJW1). Selling for US$35.5m, the growth note was issued by J.P. Morgan Chase Financial and features a digital payoff type.

The product will reach maturity in five years and tracks the iShares PHLX Semiconductor ETF, Nasdaq 100, Nasdaq100 Technology Sector Index. If the final level of the worst performing underlying is at or above its initial level at maturity, the product will offer a capital return of 100% plus the greater of 25% and 149.5% of the rise in the worst performing underlying.

The top three US providers of hybrid structured products in 2021 are J.P. Morgan Chase Financial with 449 products worth US$855m, Citigroup Global Markets with a total of 380 products valued at US$701m, and GS Finance with 275 products with a sales volume of US$421m.

From a distribution standpoint, J.P. Morgan Chase Financial leads with 302 structured products valued at US$602m, followed by GS Finance with 159 products worth US$231m, Morgan Stanley Finance with 81 products worth US$327m, and Incapital with 158 products, selling for US$217m.

During 2021, the volume of hybrid-linked structured products tied to the emerging markets sector has increased by 88% from the previous year with sales standing at US$627m (300 products) from US$334m (149 products).

For instance, 289 structured products were tied to iShares MSCI Emerging Markets ETF in 2021 to-date with sales reaching US$590m, compared with 143 products tied to the same underlying in the prior year in which sales stood at US$329m.

Another popular sector among hybrid-linked products in 2021 was commodities with US$295m (137 products) worth of structured products being issued throughout the year. The best-selling structure under this category was the Callable Contingent Coupon Notes - Worst of Option (06748EX65).

Issued by Barclays Bank, the income note has a short tenor of just over a year and callable, reverse convertible, and worst of option payoff types. The product which sold US$12.5m tracks the VanEck Vectors Gold Miners ETF, Russell 2000, and S&P 500 underlyings.

The note offers a monthly coupon of 11.55% pa, if each underlying is greater than or equal to 65% of its respective initial level on the observation date.

SRP is the leading source of data intelligence on structured products globally, enabling you to plan for the future, gain market insights and compete strategically. Contact us to try a free a demo.

Image: Austin Park/Unsplash